14

15

Semi-annual Board of Directors Management Report

shape a concrete opinion on the effectiveness of the

corporate systems, procedures and policies.

ii. The company’s statutory external auditors do not

offer other non auditing services to the company.

IV.SignificantRelatedPartyTransactions

The commercial transactions of the Group and

the Company with related parties during the first

semester of 2016, were realized under the common

commercial terms. The Group or any of its related

parties has not entered in any transactions that were

not in an arm’s length basis, and do not intent to

participate in such transactions in the future. No

transaction was under any special terms.

The tables bellow present the intercompany sales

and transactions, among the Parent Company and

its subsidiaries and associates and the executives

as at 30 June 2016.

also recognise opportunities in the EPC side of operations due to any of said, re-

vised or new, rules, regulations and legislation associated to the climate change.

Non realization of expected long-term benefits from productivity and

cost-reduction initiatives

The Group has undertaken, and may continue to undertake, productivity and

cost-reduction initiatives to improve performance and reduce its overall produc-

tion cost. There are always possibilities that these initiatives cannot all be com-

pleted or that estimated cost savings from such initiatives will not be realized in

total and in time for reasons that may not entirely lie on the Group’s control.

Political and regulatory issues

The Group’s activities that are associated with energy remain significantly regu-

lated in Greece and exposed to political, legal and regulatory framework issues.

Developments in this environment that could indicate delays in the substantial

deregulation of the energy market can be expected to have an impact on the

Group’s operations, forward - looking results and fair value of Energy Assets or

Assets for the operation of which significant amount of Energy is required.

In addition to that, the Group may also be affected by unfavourable develop-

ments regarding political and regulatory issues associated to its EPC activity held

in countries outside the Greek territory.

IT Security

Our business processes are supported by several software packages and data

processing systems. Nevertheless, we cannot fully rule out a lack of availability of

IT infrastructure or a breach in the security of our data.

We mitigate these risks by applying high security standards as well as taking

measures in order to achieve and assure availability, integrity, confidentiality

and traceability. In addition and in order to mitigate security related risks, we

regularly invest in hardware and software upgrades, execute periodic internal

and external IT audits by international consultant groups, and generally apply a

continuous improvement approach.

EPC related risks

The Group through its subsidiary METKA, is contractually exposed to risks re-

lated to the design, engineering, procurement, construction and deliver of ready-

to-operate energy facilities for an agreed price. Said risks involve mainly cost

overruns associated with:

• unanticipated increases in the costs of raw materials and equipment,

• equipment or mechanical failures,

• unforeseen construction conditions,

• delays caused by adverse weather conditions

• performance failure or defaults by suppliers or subcontractors

• additional works required as the customer changes its instructions or is

unable to provide on time and on schedule the required information relating to

the design or engineering of the project

Recent events in Turkey are expected to increase uncertainty levels in the wider

region, directly influencing economic sentiment and business and investment

decisions. Subsidiary METKA is closely monitoring developments in Turkey, tak-

ing all the necessary measures to avert potential risks.

Unexpected events

Unexpected events, including natural disasters, war or terrorist activities, un-

planned outages, supply disruptions, or failure of equipment or processes to

meet specifications may increase the cost of doing business or otherwise impact

the Group’s financial performance. Further, existing insurance arrangements

• the preparation of the financial statements and any other docu-

ments containing important disclosures of the company,

• the reliability, the credentials and the independency of Statutory Ex-

ternal Auditors.

• Cases of conflict of interest between the company and its BOD

members or Managers,

• the transactions and corporate affairs of the company with its affili-

ates and other entities in which the company’s BOD members hold

more that 10% interest or in which there is a holding interest by share-

holders of the company representing more than 10% of its share capi-

tal.

• the remuneration of the BOD members and the managers of the

company.

i. The BOD reviews on a constant basis the Corporate Strategy and

the main Enterprise Risks associated to this Strategy, especially being

active in a cyclical and dynamic environment. Additionally, it regularly

reviews the reports of the Audit Committee, therefore being able to

may not provide protection for all of the costs that

may arise from such events.

Pendency of proceedings

The Group, mainly via its subsidiaries, has been in-

volved in a number of cases against third parties, ei-

ther as complainant or as respondent. The outcome

of such cases may involve expenses or revenues

that can significantly affect the results as well as the

financial position of both the subsidiaries and the

Group alike.

b. Risk Management organization and

execution

The Group has defined risk as an occurrence of un-

certain or unplanned conditions that may affect its

overall operations, business activity, financial perfor-

mance as well as its strategy execution and goals

achievement.

A specific Risk Management approach is held in all

areas of activity where certain risks have been identi-

fied as follows:

(i) assessment of risk factors

(ii) design of the risk management policy

(iii) execution and evaluation of the risk policy

The Group has not established yet a concrete Risk

Management Organizational structure. However, its

line management is engaged in a continuous pro-

cess of identifying and primary assessing risks in

order to facilitate the Executive Committees of each

business sector and the BOD of each legal entity

in the design and approval of specific risk manage-

ment procedures and policies.

The Group is executing periodic internal audits to

ensure the proper and effective application of risk

identification and assessment processes and risk

management policies.

C. Internal Audit System

In addition to the points discussed elsewhere in this

Statement including those discussed for the respon-

sibilities of the Audit Committee, the Internal Audit

of the company is an independent organizational

structure with direct report line to the BOD. As part of

its responsibilities it evaluates and improves the risk

management and internal audit systems and veri-

fies the conformation of the company with the poli-

cies and procedures either suggested by the Rule of

Operations or imposed by the legal and regulatory

framework.

On a constant basis the internal audit system pro-

vides for the monitoring of:

• the effectiveness of the accounting and financial

systems of the company, the audit mechanisms, the

quality assurance, the health and safety, the envi-

ronmental treatments and the management of en-

terprise risks,

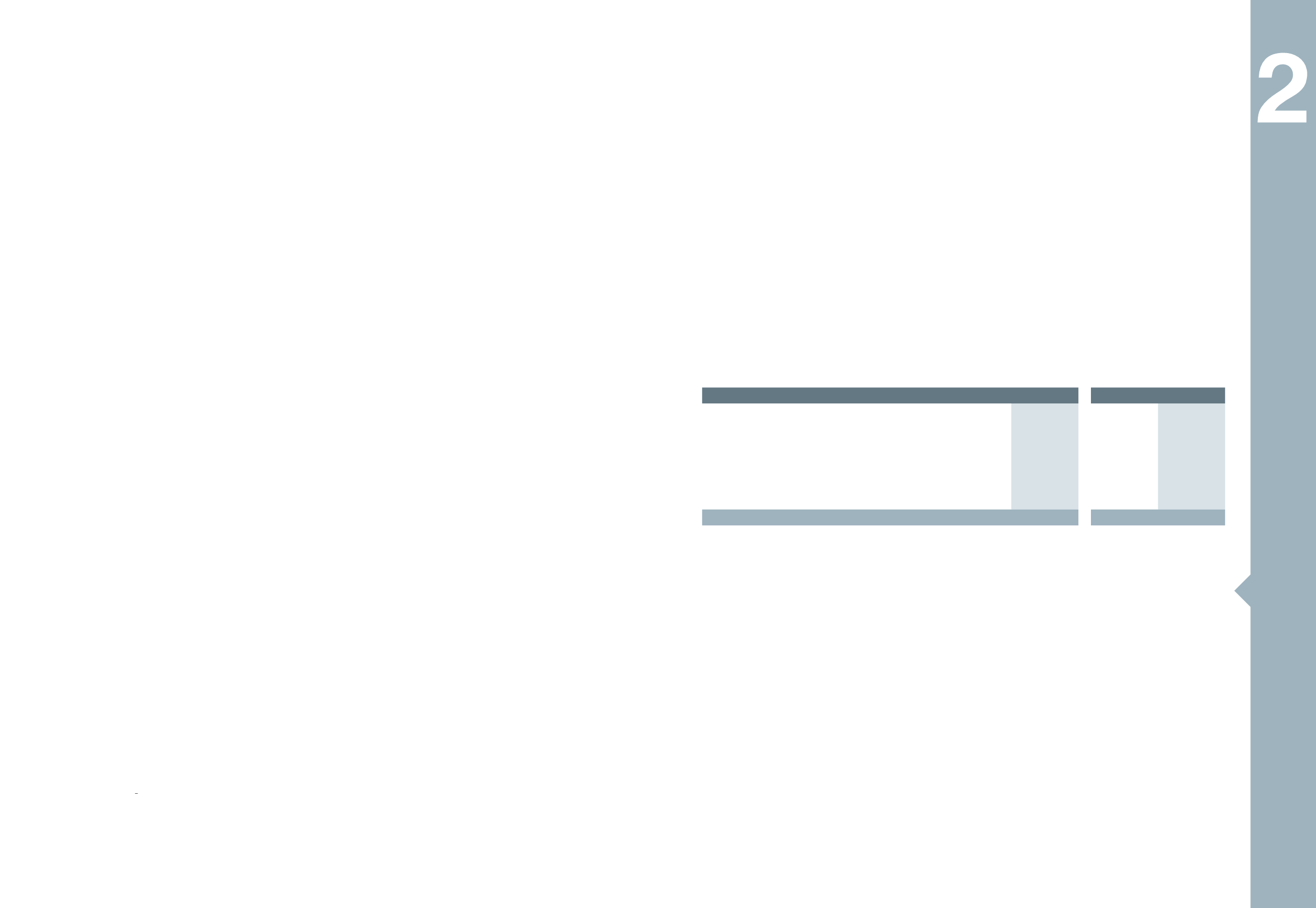

Benefits to executives at Group and Parent level

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

30/06/2016 30/06/2015

30/06/2016 30/06/2015

Short term employee benefits

- Wages and Salaries and BOD Fees

8.245

10.653

1.233

1.632

- Insurance service cost

317

306

132

129

8.562

10.959

1.365

1.761

Pension Benefits:

- Defined benefits scheme

-

2

-

-

- Defined contribution scheme

15

3

-

-

Total

8.578

10.964

1.365

1.761