108

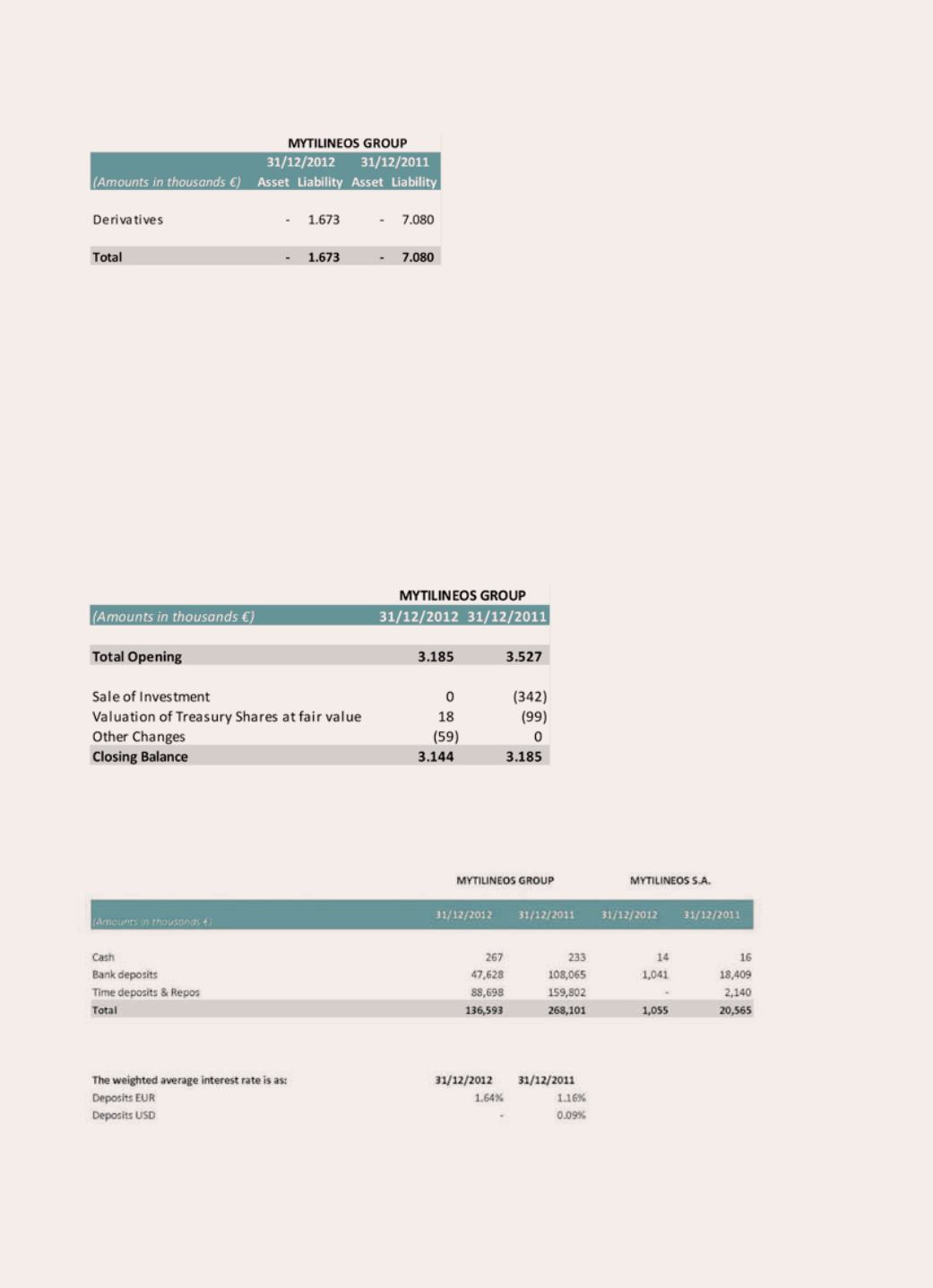

6.10 Derivatives financial instruments

All derivatives open positions have been mark to market. Fair values of the “interest rate swaps”, are con-

firmed by the financial institutions that the Group has as counterparties.

The Group manages the exposure to currency risk through the use of currency forwards and options and thus

by “locking” at exchange rates that provide sufficient cash flows and profit margins. Furthermore, the Group

manages the exposure to commodity risk through the use of: a) commodity futures that hedge the risk from

the change at fair value of commodities and b) commodity swaps that hedge fluctuations in cash flows from

the volatility in aluminum prices.

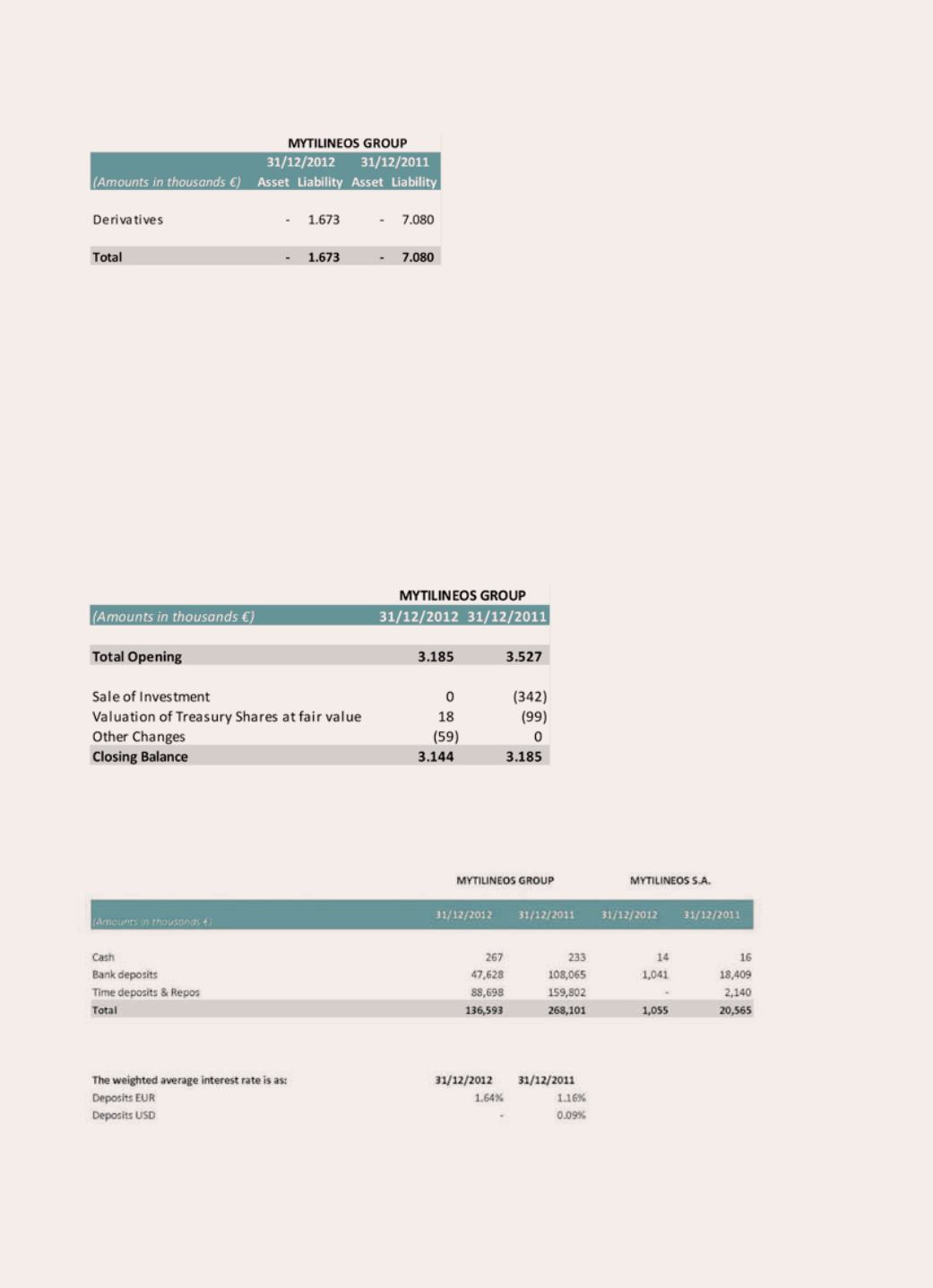

6.11 Financial Assets available for sale

6.12 Cash and cash equivalents

Group’s cash management involves deposits in Euro or foreigner currency and in overnight Libor-Euribor

interest rates.