120

The Group tests goodwill annually for any loss in value. To determine the recoverable amount value in use is

used. The value in use was based on management estimates. Determining the value in use was based on the

method of discounted cash flows. From the impairment test which was held in the assets of the subsidiary

PROTERGIA AE, due to the negative change of macroeconomic and financial parameters, an impairment loss

amounting € 10,8 million addition was revealed, Also, an impairment loss amounting € 12,2 million from the

impairment test performed in the assets of the subsidiary THORIKI SA, due to the negative change in macro-

economic and financial parameters, was held. This amount appears in the “Other financial results.”

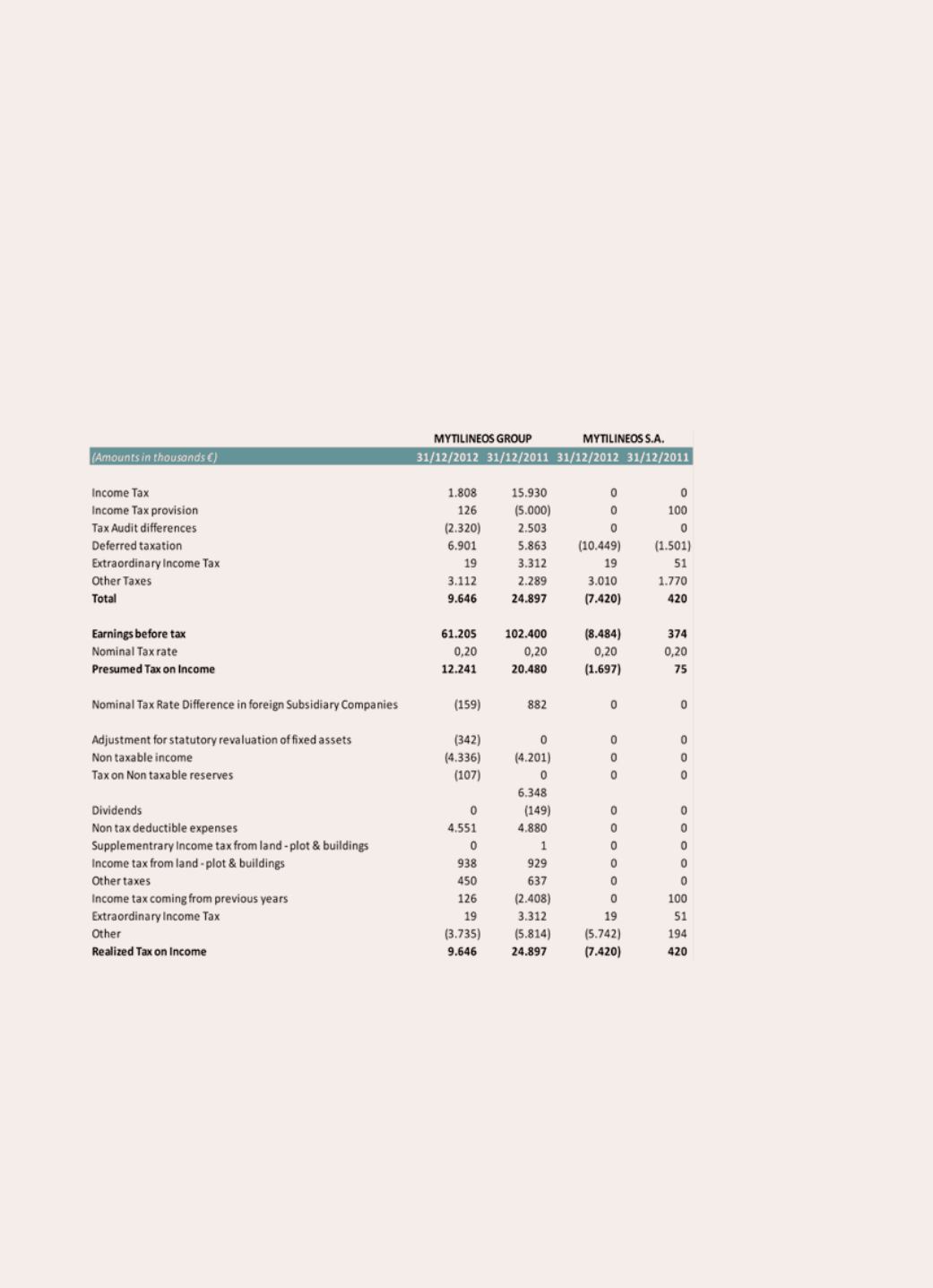

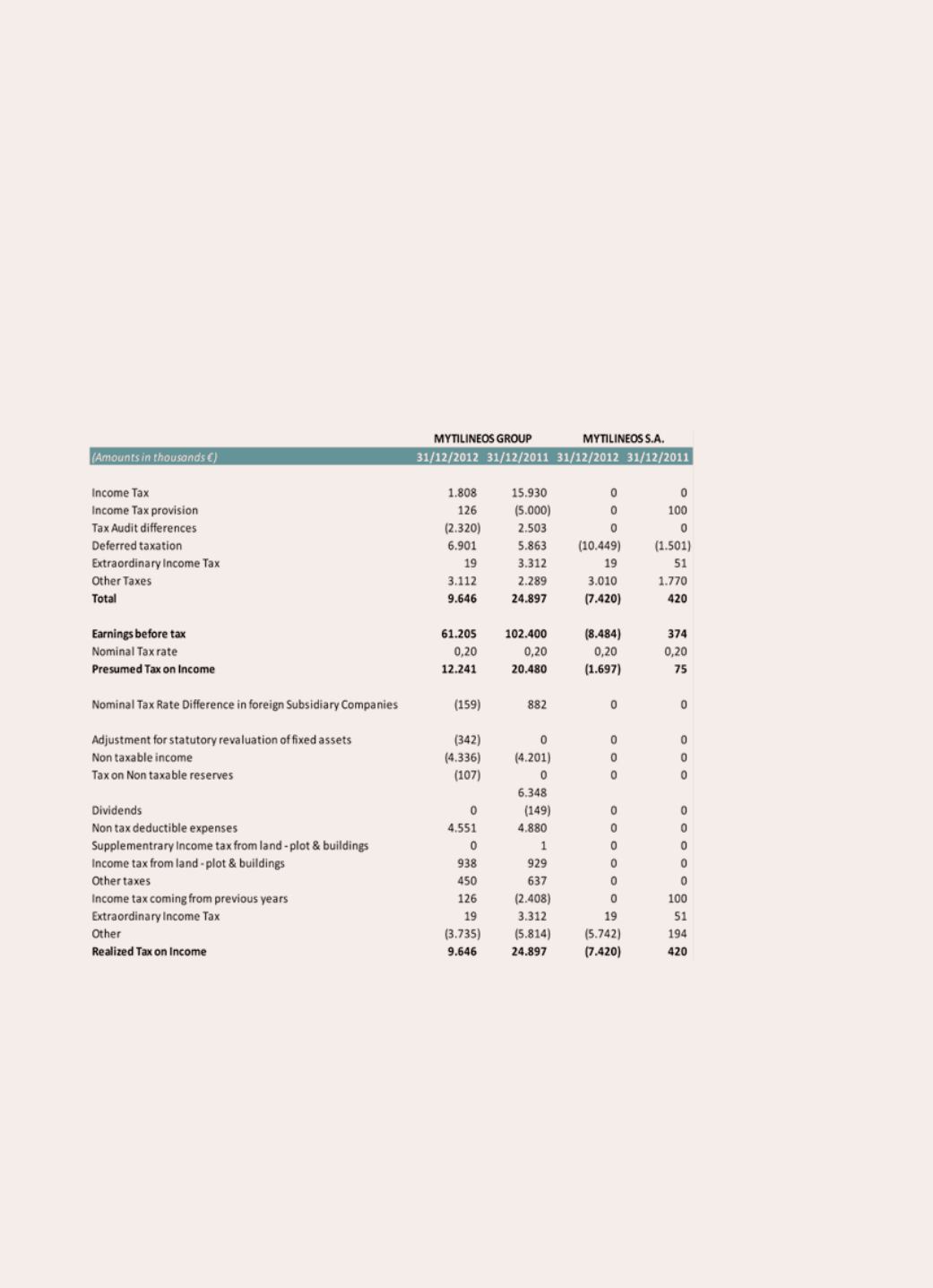

6.27 Income tax

Income tax for the Group and Company differs from the theoretical amount that would result using the nominal

tax rate prevailing at year end over the accounting profits. The reconciliation of this difference is analyzed as

follows:

Starting with the year 2011 and in accordance with paragraph 5 of Article 82 of Law 2238/1994, the Group

companies whose financial statements are audited by mandatory statutory auditor or audit firm, under the

provisions of Law 2190/1920, are subject to a tax audit by statutory auditors or audit firms and receives annual

Tax Compliance Certificate. In order to consider that the fiscal year was inspected by the tax authorities, must

be applied as specified in paragraph 1a of Article 6 of POL 1159/2011.