Annual Financial Report for the period from 1st of January to the 31st of December 2012

121

For the fiscal year 2011, the Group companies which were subject to tax audit by statutory auditors or audit

firm, under para.5 Article 82 of Law 2238/1994, received a Tax Compliance Certificate free of disputes. In order

to consider that the fiscal year was inspected by the tax authorities, must be applied as specified in paragraph

1a of Article 6 of POL 1159/2011.

For fiscal year 2012, the tax audit which is being carried out by the auditors are not expected to result in a

significant variation in tax liabilities incorporated in the financial statements.

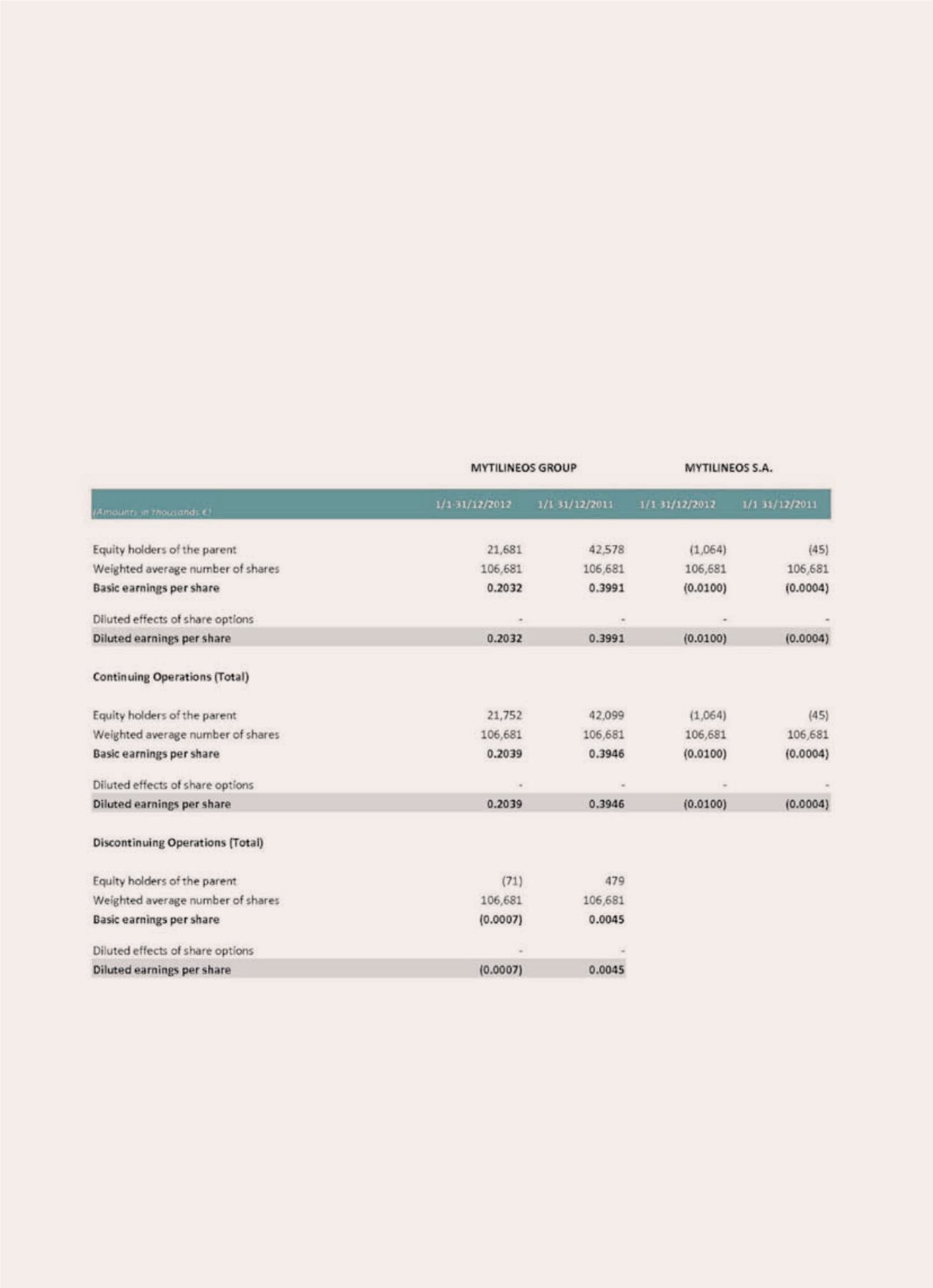

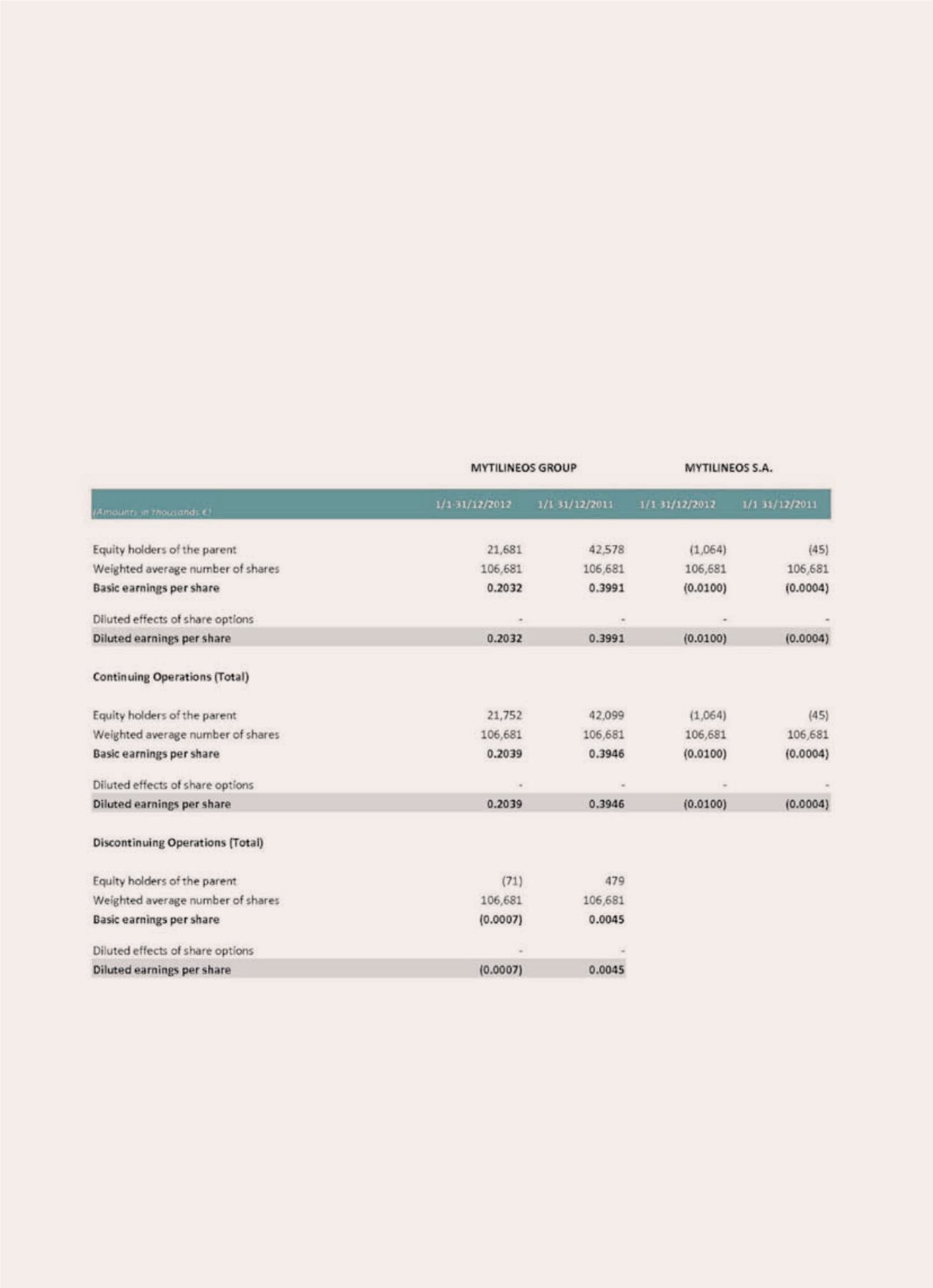

6.28 Earnings per share

Basic earnings per share are calculated by dividing net profit for the year attributable to shareholders by the

weighted average number of ordinary shares in issue during the year, excluding ordinary shares purchased by

the Company and held as treasury shares.

The diluted earnings per share are calculated adjusting the weighted average number of ordinary shares

outstanding to assume conversion of all dilutive potential ordinary shares. The Company has one category of

dilutive potential ordinary shares: stock options. As at 31.12.2012 the Group and the Company have no diluted

earnings per share from stock options.