120

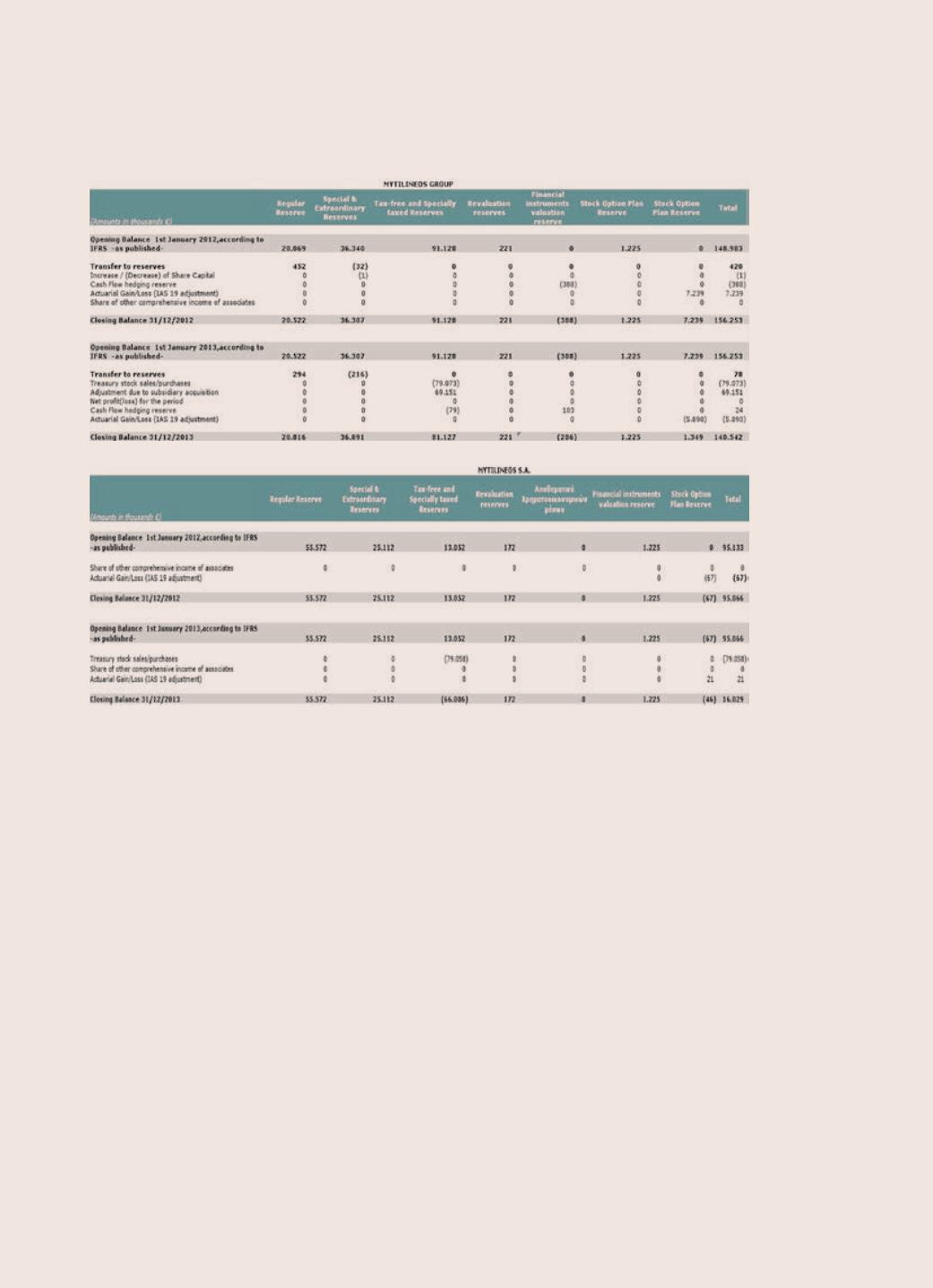

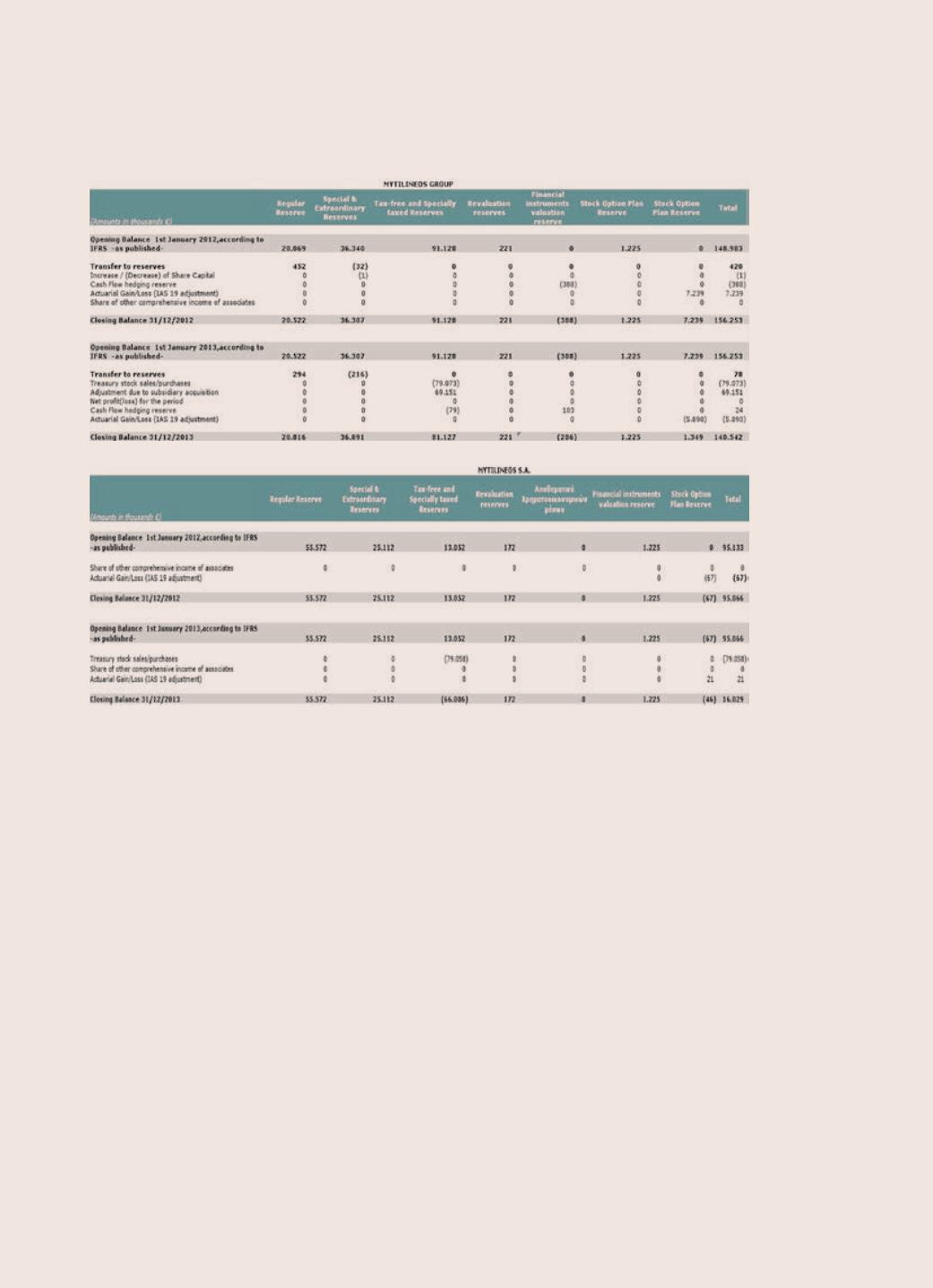

6.15 Reserves

Reserves in the financial statements are analyzed as follows:

The majority of the above reserves relates to Parent Company and Greek subsidiaries. Under Greek corporate

law, corporations are required to transfer a minimum of 5% of their annual net profit as reflected in their

statutory books to a legal reserve, until such reserve equals one-third of the outstanding share capital. The

above reserve cannot be distributed throughout the life of the company.

Tax free reserves represent non distributed profits that are exempt from income tax based on special provisions

of development laws (under the condition that adequate profits exist for their allowance). These reserves

mainly relate to investments and are not distributed.

Specially taxed reserves represent interest income and income from disposal of listed in the Stock Exchange

and non listed companies and are tax free or tax has been withheld at source. Except for any tax prepayments,

these reserves are exempted from taxes, provided they are not distributed to shareholders.