Annual Financial Report for the period from1st of January to the 31st of December 2013

129

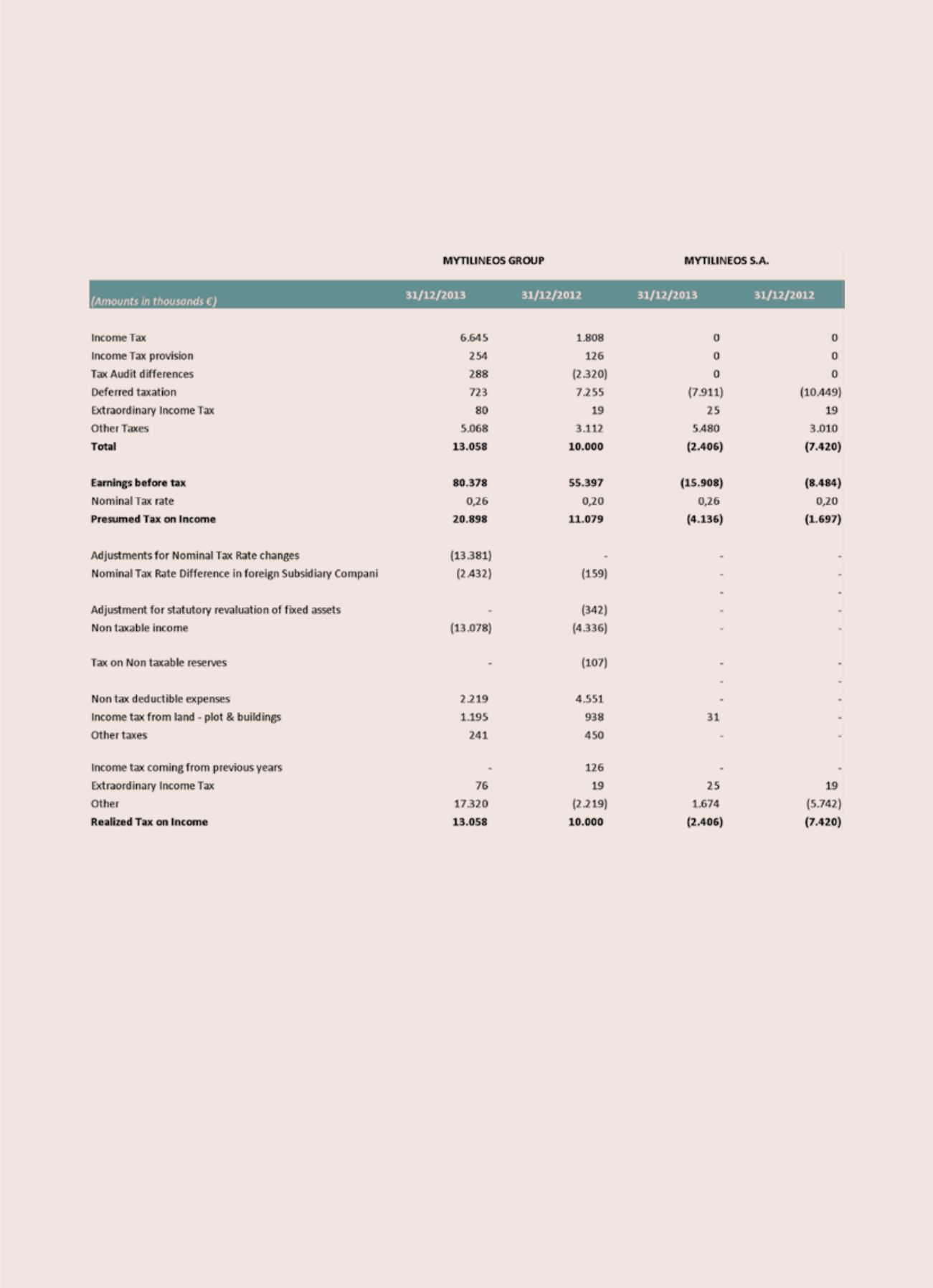

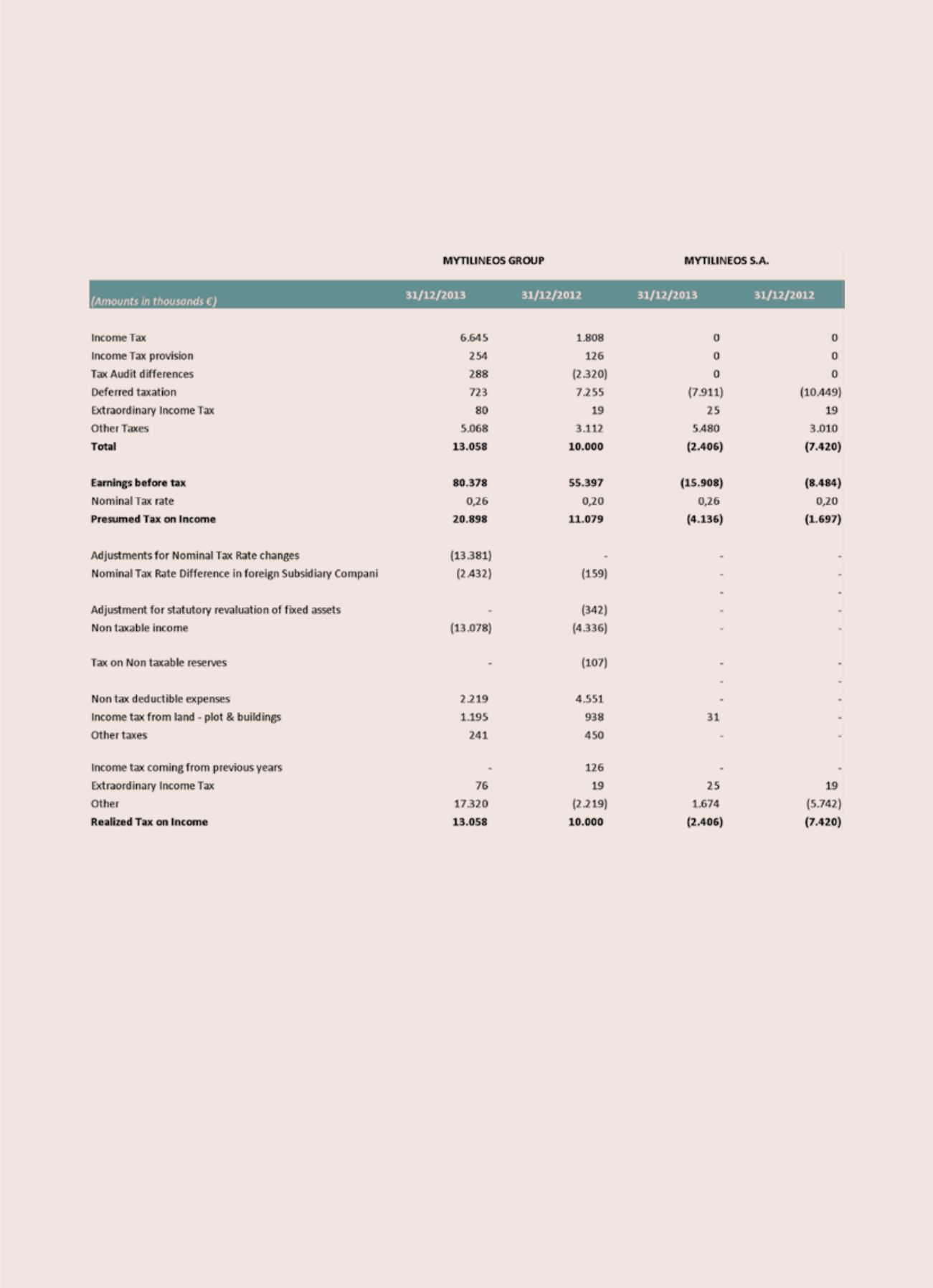

6.27 Income tax

Income tax for the Group and Company differs from the theoretical amount that would result using the nominal

tax rate prevailing at year end over the accounting profits. The reconciliation of this difference is analyzed as

follows:

Starting with the year 2011 and in accordance with paragraph 5 of Article 82 of Law 2238/1994, the Group

companies whose financial statements are audited by mandatory statutory auditor or audit firm, under the

provisions of Law 2190/1920, are subject to a tax audit by statutory auditors or audit firms and receives annual

Tax Compliance Certificate. In order to consider that the fiscal year was inspected by the tax authorities, must

be applied as specified in paragraph 1a of Article 6 of POL 1159/2011.

For the fiscal year 2012, the Group companies which were subject to tax audit by statutory auditors or audit

firm, under para.5 Article 82 of Law 2238/1994, received a Tax Compliance Certificate free of disputes.

For fiscal year 2013, the tax audit which is being carried out by the auditors are not expected to result in a

significant variation in tax liabilities incorporated in the financial statements. To conclude with, tax audit for

the Parent Company Mytilineos S.A. is being carried out by the relevant financial authorities, for the financial

years 2007-2010.