According to 4/507/28.04.2009 resolution ofGreek Capital Committee,

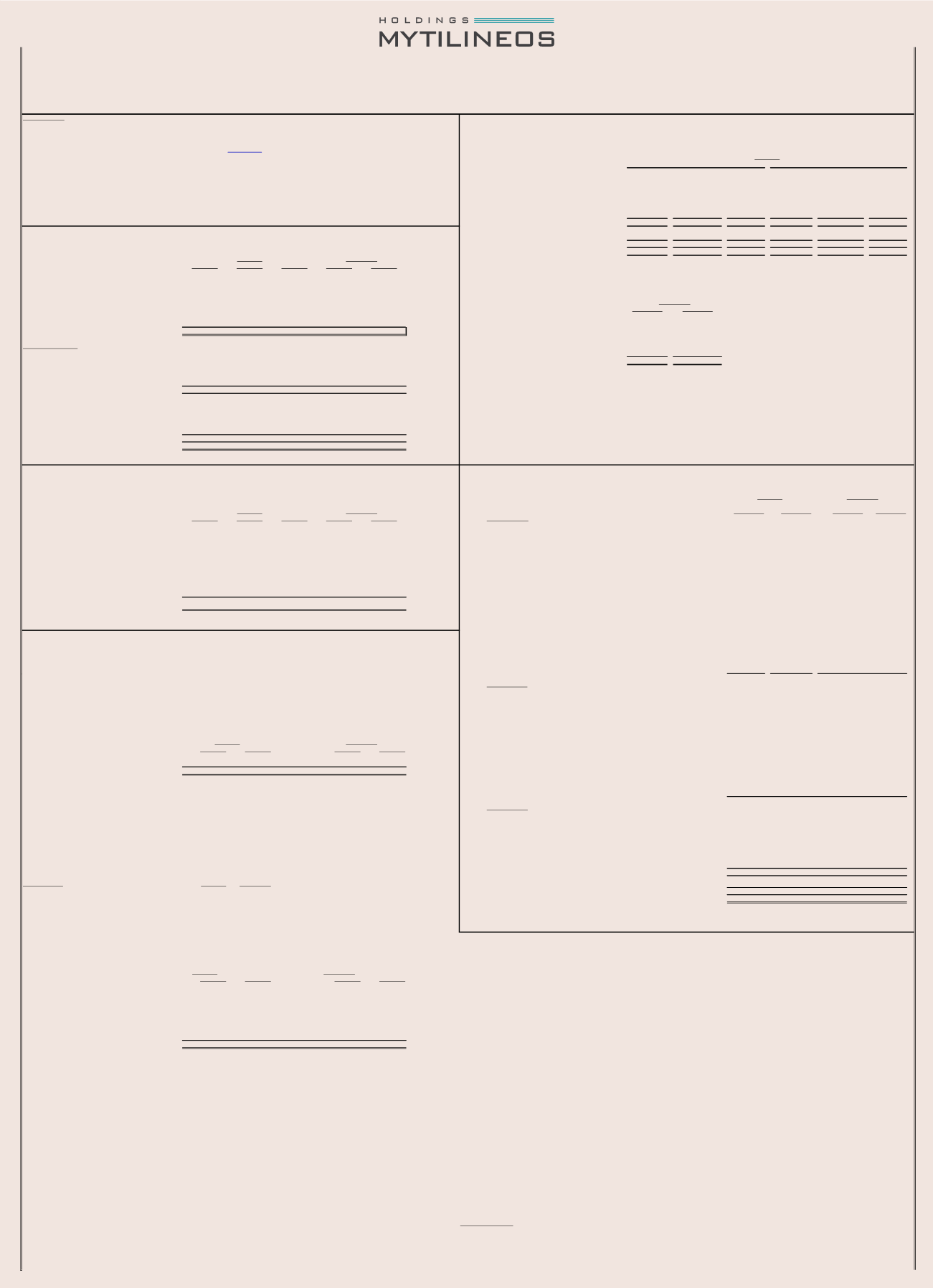

COMPANYPROFILE

SupervisingAuthority:

Amounts in 000's €

Companywebsite:

BoardofDirectors:

Continuing

Operations

Discontinuing

Operations

Total

Continuing

Operations

Discontinuing

Operations

Total

Sales Turnover

1.402.954

6.339

1.409.293

1.453.636

5.771

1.459.407

Dateofapprovalof theFinancialStatementsby theBoardofDirectors:

24March 2014

Gross profit / (loss)

200.040

2.184

202.224

138.484

2.902

141.386

TheCertifiedAuditor:

Vassilis Kazas, Thanassis Xynas

Profit / (Loss) before tax, financial and investment results

166.642

(179)

166.463

104.152

(57)

104.095

AuditingCompany:

GRANT THORNTON

Profit/ (Loss)before tax

80.378

(202)

80.176

55.397

(71)

55.326

TypeofAuditor'sopinion:

Unqualified opinion - emphasis ofmatter

Less taxes

(13.058)

-

(13.058)

(10.000)

-

(10.000)

Profit/ (Loss)after tax (A)

67.320

(202)

67.118

45.398

(71)

45.327

Equity holders of the parent Company

22.707

(202)

22.505

19.131

(71)

19.060

Minority Interests

44.613

-

44.613

26.267

-

26.267

Amounts in 000's €

Other comprehensive incomeafter tax (B)

(84.053)

-

(84.053)

23.488

-

23.488

Total comprehensive incomeafter tax (A)+ (B)

(16.733)

(202)

(16.935)

68.886

(71)

68.815

Owners of the Company

(61.169)

(202)

(61.371)

29.008

(71)

28.937

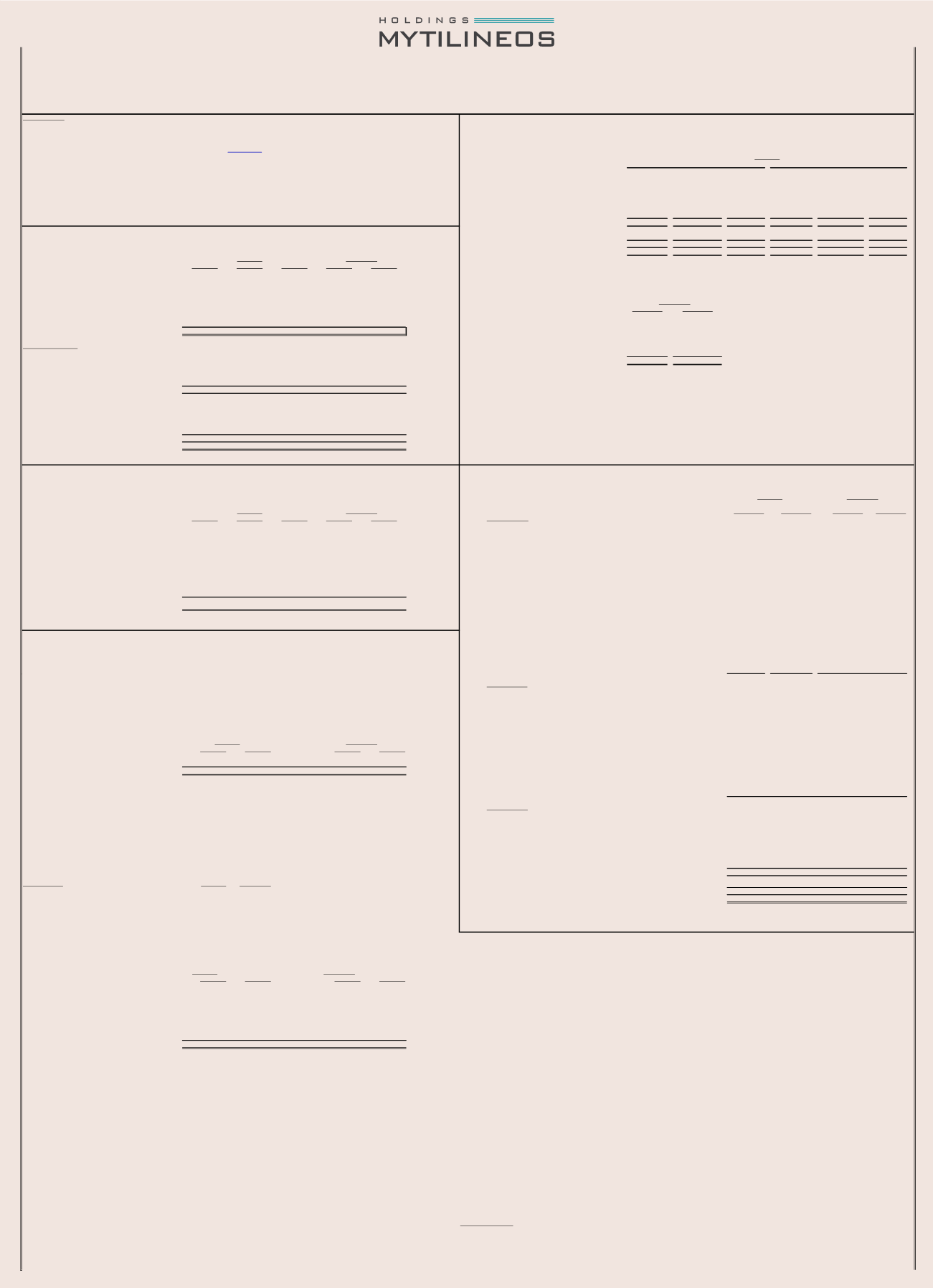

31/12/2013

31/12/2012

31/12/2011

31/12/2013

31/12/2012

Minority Interests

44.436

-

44.436

39.878

-

39.878

Net profit after tax per share (in Euro/share)

0,20

(0,0018)

0,1992

0,1793

(0,0007)

0,1786

Tangible Assets

1.081.673

1.097.529

1.121.359

10.204

10.285

Profit / (Loss) before tax, financial,

231.961

1.613

233.574

165.423

1.947

167.370

Intangible Assets

244.706

244.772

240.246

99

229

investment results, depreciation and amortization

Other non current assets

347.181

324.146

300.123

847.466

924.185

Inventories

128.425

151.074

174.560

- -

Trade Receivables

575.079

658.247

448.810

385

498

1/1-31/12/13

1/1-31/12/12

Other Current Assets

287.222

248.638

435.499

16.484

18.236

Non current assets available for sale

-

-

-

-

-

Sales Turnover

16.918

16.040

TotalAssets

2.664.287

2.724.406

2.720.598

874.638

953.433

Gross profit / (loss)

29

28

Profit / (Loss) before tax, financial and investment results

1.436

2.723

EQUITYANDLIABILITIES

Profit/ (Loss)before tax

(15.908)

8.418

Share Capital

125.335

125.335

127.545

125.100

125.100

Less taxes

2.406

7.420

Treasury stock reserve

-

(104.566)

(104.566)

-

(104.566)

Profit/ (Loss)after tax (A)

(13.502)

(997)

Retained earnings and other reserves

738.956

779.245

740.822

379.468

456.078

Equity holders of the parent Company

(13.502)

(997)

Equityattributable toparent'sShareholders (a)

864.291

800.014

763.801

504.568

476.611

Minority Interests

-

-

Minority Interests (b)

233.404

176.202

151.876

-

-

Other comprehensive incomeafter tax (B)

(63.108)

(67)

TotalEquity (c)= (a)+ (b)

1.097.695

976.216

915.677

504.568

476.611

Total comprehensive incomeafter tax (A)+ (B)

(76.610)

(1.064)

Long term Borrowings

435.115

22.635

334.588

159.308

-

Owners of the Company

(76.610)

(1.064)

Provisions and other long term liabilities

356.396

305.401

357.519

75.618

39.039

Minority Interests

-

-

Short term borrowings

256.311

838.777

508.141

3.329

330.982

Net profit after tax per share (in Euro/share)

(0)

(0)

Other short term liabilities

518.769

581.378

604.673

131.815

106.800

Profit / (Loss) before tax, financial,

Non current liabilities available for sale

-

-

-

-

-

investment results, depreciation and amortization

1.896

3.169

Total Liabilities (d)

1.566.592

1.748.191

1.804.921

370.070

476.821

TOTALEQUITYANDLIABILITIES (c)+ (d)

2.664.287

2.724.407

2.720.598

874.638

953.433

CASHFLOWSTATEMENT

Amounts in 000's €

Amounts in 000's €

1/1-31/12/13

1/1-31/12/12

1/1-31/12/13 1/1-31/12/12

31/12/2013

31/12/2012

31/12/2011

31/12/2013

31/12/2012

Operatingactivities

Equityat thebeginningof theperiod (01.01.2013,01.01.2012and

01.01.2011 respectively)

960.338

900.806

844.253

476.611

477.676

Profit before tax (continuing operations)

80.378

55.397

(15.908)

(8.418)

IAS8Adjustment

15.878

14.871

13.256

-

-

Profit before tax (discontinuing operations)

(202)

(71)

-

-

Total comprehensive income for the period after tax (continuing/ discontinuing

operations)

(16.935)

68.815

68.291

(76.610)

(1.064)

Adjustments for:

-

-

-

-

Increase / (Decrease) in Share Capital

(6)

11.814

(83)

-

-

Depreciation

67.112

63.276

460

445

Dividends paid

(6.020)

(17.849)

(12.124)

-

-

Impairments

13.609

226

29.235

23.066

Impact from acquisition of share in subsidiaries

-

-

-

-

-

Provisions

(5.777)

(9.789)

-

-

Treasury shares purchased

104.566

-

-

104.566

-

Exchange differences

881

(454)

1.017

(461)

Othermovements from subsidiaries

(250)

(2.241)

2.085

-

-

OtherOperating Results

(200)

5.800

-

-

Changes in Equity from Sale of Subsidiary

40.124

-

-

-

-

Results (income, expenses, gains and losses) of insting activities

(23.045)

(3.381)

(29.045)

(25.547)

Equityat theendof theperiod (31.12.2013,31.12.2012and31.12.2011

respectively)

1.097.695

976.216

915.678

504.568

476.611

Interest expense

62.335

44.999

17.056

13.623

Adjustments related toworking capitalaccountsor

tooperatingactivities

(Increase)/Decrease in stocks

23.374

32.946

-

-

(Increase)/Decrease in trade receivables

(4.834)

(101.778)

4.139

1.500

Increase / (Decrease) in liabilities (excluding banks)

15.618

(31.863)

58.015

(649)

Less:

1. Companies included in the consolidated financial statementswith the corresponding participation of interest aswell as themethod of consolidation for the period 1/1-31/12/2013

Interest expense paid

(63.705)

(49.932)

(18.917)

(14.899)

are being presented in note 3.10 of the Annual Financial Statements.

Income tax paid

(4.662)

(4.187)

-

-

Cash flows from discontinuing operating activities

1.859

1.932

-

-

Cash flows fromoperatingactivities (a)

162.742

3.120

46.051

(11.340)

Investingactivities

(Acquisition ) / Sale of subsidiaries (less cash)

40.071

(40.000)

40.245

(19.711)

Purchases of tangible and intandible assets

(57.967)

(95.522)

(249)

(189)

Acquisition of associates

-

(345)

-

-

Sale of tangible and intangible assets

1.575

438

1

1

4.Group’s assets are pledged for an amount of 323,7m as bank debt collateral.

Purchase of financial assets held-for-sale

-

-

-

-

Return of capital from Subsidiary

-

-

-

20.290

5. The number of employees andworkers at the end of the reporting period is as follows:

Sale of financial assets held-for-sale

69

52

-

-

Sale of financial assets at fair value through profit and loss

1.306

5.095

193

-

Employees

31/12/2013

31/12/2012

31/12/2013

31/12/2012

Purchase of financial assets at fair value through profit and loss

(100)

(6.677)

(100)

(200)

Workers

1.565

1.521

60

59

Grants received

7.025

0

-

-

191

315

-

-

Interest received

414

6.456

1.838

7.303

1.756

1.836

60

59

Loans to / from related parties

-

-

49.898

27.071

Dividends received

59

83

5.474

16.421

Cash flows from discontinuing investing activities

1

1

-

-

6. Capital Expenditure for 2013:Group €57.967 thousand and Company €249 thousand.

Other cash flows from investing activities

(22)

-

-

-

Cash flows from investingactivities (b)

(7.566) 0

(130.418) 0

97.298 0

50.986

7. Earnings per share has been calculated on the basis of net profits over theweighted average number of shares.

Financingactivities

Proceed from issue of capital

-

11.960

-

-

Sale / (purchase) of treasury shares

25.248

-

25.248

-

Tax payments

(216)

(36)

-

-

Proceeds from borrowings

291.909

26.267

-

32.797

Loan repayments

(201.069)

(147.984)

(166.378)

(93.000)

Dividends paid

(8.358)

(17.105)

-

-

Payment of finance lease liabilities

-

(6)

-

-

10. Related party transactions and balances for the reported period, according to I.A.S. 24 are as follows:

Cash flow discontinuing financing activities

-

-

-

-

Cash flows from continuing financingactivities (c)

107.515

(126.905)

(141.130)

(60.203)

Amounts in000's€

THEGROUP THECOMPANY

Net (decrease) / increase in cashand cash

equivalentsof theperiod (a)+ (b)+ (c)

262.690

(254.203)

2.219

(20.557)

Revenues

-

29.299

Cashand cashequivalentsatbeginningofperiod

(172.565)

84.232

(2.105)

18.406

Expenses

-

26.505

Net cashat theendof theperiod

90.127

(169.970)

114

(2.151)

Receivables

-

552

Liabilities

-

163.377

Keymanagement personnel compensations

13.756

2.963

Receivables from keymanagement personnel

-

-

Payables to keymananagement personnel

-

49

THEGROUP

THECOMPANY

31/12/2013

31/12/2012

31/12/2013

31/12/2012

Net profit(loss) for the period

67.118

45.327

(13.502)

(997)

Exchange differences on translation of foreign operations

(611)

7.895

-

-

Financial assets held-for-sale

13.371

-

15.929

-

Cash Flow hedging reserve

87

8.354

-

-

Income tax relating to components of other comprehensive income

(3)

-

-

-

Profit/(Loss) from treasury shares sale

(79.073)

-

(79.058)

-

StockOption Plan

(5.882)

7.239

21

(67)

Changes in reserves from diff. tax rate alteration

(11.942)

-

-

-

Total comprehen ive income for theperi dafter tax (continuing/

discontinuingoperations)

(16.935)

68.815

(76.610)

(1.064)

Maroussi,24March2014

THE PRESIDENTOF THE BOARD& CHIEF EXECUTIVEOFFICER

THE CHIEF EXECUTIVEDIRECTORGROUP FINANCE

EVANGELOSMYTILINEOS

I.D.No ΑΒ649316/2006

IOANNISKALAFATAS

16.MYTILINEOSGroup subsidiary ALUMINIUM S.A. has signedwith Swiss-basedmultinationalGlencore a contract for the sale of 75.000 tons of aluminium in billets. These quantitieswill be exported to the Europeanmarket from

January 2013 to June 2014.

17. TheMinistry of Environment, Energy& Climate Change issued a decision on 17/1/2013 for licensing the commercial service of the electric power / heat cogeneration plant of 'Aluminum'. As of 28/11/2012, the plant in question

was already in commissioning status asDistributedHigh Performance Electric Power /Heat Cogeneration Plant (trial operation ofDistributedHPEPHC) by themarket operator, after having signed a supplementary transaction

contract, and estimating and billing accordingly the electric power infused to the grid.

26. There are other contingent liabilities against theGroup, amounting to 12,7m€, forwhich no provision is formed on the results since the outcome of these is deemed uncertain.Moreover there areGroups’ claims against third parties

amounting to 75,38m€.

27. The emphasis ofmatter of the auditors relate to note 6.34 of the Financial Statements. In particular, on 25.7.2011, theGreekGovernment, via theMinistry of Environment, Energy& Climate Change, disclosed toGroup’s subsidiary

company ALUMINUM S.A., the decision of the European Commision, rendering incompatiblewith the community regulations on state assistance the pricing for electric energy sale imposed on ALUMINIUM S.A. by the PPC, for the period

between January 2007 andMarch 2008.On 6.10.2011ALUMINUM S.A. appealed before the EuropeanUnion’sGeneral Court requesting annulment of the abovementioned decision. PPC is trying to enforce the aforementioned European

Commision decision through a payment order issued, againstwhich ALUMINUM S.A.will appeal any proceduralmeasure tried by PPC aiming to the enforcement of the payment order and shall target the issuance of a new injunction decision

(enforcement suspension).Group’smanagement estimates that the probability of a future outflow of economic resources for the settlement of this contingent liability of € 20,3million (€ 17,4million plus interest), is remote.

THE VICE-PRESIDENTOF THE BOARD

THEGROUP FINANCIAL CONTROLLER

IOANNISMYTILINEOS

I.D.No ΑΕ044243/2007

ANASTASIOSDELIGEORIS

13. TheManagement's position, regarding the decision of the European Commission requesting the recovery of an amount of 17,4mil euros from the subsidiary ALUMINIUM S.A. on the basis thatwas a state aid, has not altered

(please refer to note 6.34 of the annual financial statements.).

24. InNovember 2013,Mytilineos announced that it had successfully completed an offering of 3.217.288 existing shares (the “Shares”) inMetka SA (“Metka”) generating total proceeds of c. EUR40,2million, byway of an international private

placement to institutional investors as part of an accelerated bookbuilding process (the “Transaction”). Following the Transaction,Mytilineos holds 50.0%+ 1 Share ofMetka’s share capital.

14.MYTILINEOSGroup subsidiary,METKA S.A., announced the following new contracts:

a) InMay 2013 the signing of a new contractwith Société Algérienne de Production de l’Electricité (SPE Spa is part of the SonelgazGroup, themajor Algerian electricity utility), in consortiumwithGeneral Electric.The total contract

value forMETKA is EUR 72mio plusDZD 2.127mio (total approx. EUR 92,8million) and the contracted schedule is 29,5months.

b) In July 2013METKA announced the signing of a contractwithMinistry of Electricity in Iraq for the combined cycle power plant at Al-Anbar.The total contract value amounts to $1,050million and its time schedule is 32months

following the opening of the irrevocable Letter of Credit.

25. Possible differences in total are due to rounding.

15. In September,METKA announced the successful completion of theOMV Samsun 870MW combined cycle power plant project in Turkey.

12. InNovember 2013, the arbitration procedure regarding the contract for the supply of electricity to theGroup’s subsidiary ALUMINIUM S.A. by the PPC S.A. has been completed. The difference to ensue for ALUMINIUM S.A. and

forMYTILINEOSGroup, is reflected in the interim summary financial statements for the period from 1 January to 30 September 2013 and are calculated at €35,2million (seeNote 3.11)

23.The ExtraordinaryGeneralMeeting of the Shareholders of the subsidiary company “PROTERGIA THERMOELECTRIC AGHIOUNIKOLAOU S.A.” decided, on 21/11/2013, the absorption of the electricity production segment of the natural gas

operating power plants ofMytilineos’Group subsidiary company named “PROTERGIA S.A.” according to lawΝ.2190/1920 aswell as articles 1-5 of lawΝ.2166/1993. The abovementioned demerger and Segment contributionwas approved

under the 24018/13-06/12/2013 22999/13 ruling of the AthensNorthDistrict (ΑΔΑ ΒΛΓΠ7Λ7-Ζ31) official.

THEGROUP

THECOMPANY

8.MYTILINEOSHOLDINGS S.A. on 18October 2013, pursuant to its BoD resolution on 17October 2013, sold 4,972,383 treasury shares at the price of €5.13 per share for a total consideration of €25,508,325. Following the above

mentioned transactionMYTILINEOSHOLDINGS S.A. does not hold any treasury stock. As of 18October 2013, the interest held by Fairfax inMYTILINEOSGroup stands at 5.02%,making Fairfax the third largestMYTILINEOSGroup

shareholder.

9. TheGroup, based on the terms of paragraph 51 of IAS 16, proceeded to the revaluation of the useful life of its basic productive units. (note 3.8.2 of the annual fincancial statement)

11. In the Statement of Changes in Equity, the amounts included in the line "Total comprehensive income for the period after tax (continuing/ discontinuing operations)"

for the year end 31December 2013 and 2012 are presented in the table below:

18. In August,MYTILINEOSHOLDINGS S.A. concluded an agreement for the refinancing of the Company’s current loan obligations, in the amount of €243million,with a term of three (3) yearswith an optional extension for an additional two

(2) years (five (5) years in total).

19. InNovember 2013, 100% group subsidiaries ALUMINIUM S.A. and PROTERGIA THERMAL – AGIOSNIKOLAOS PRODUCTION AND TRADEOF ELECTRICAL POWER S.A, awholly-owned subsidiary of PROTERGIA PRODUCTION AND TRADE

OF ELETRICAL POWER S.A. has issued a €145million syndicated debenture loan and a corresponding €104 syndicated debenture loan accordingly. Both these loans have been issued for a term of three (3) yearswith an option for extension

for an additional period of two (2) years, up to a total of five (5) years.

20. In September 2013, theGroup’s subsidiary company PROTERGIA S.A. submitted a request towithdraw theNo.D5/HL/C/F28/4/10202/01-06-2001 electricity production license for the 436,6MW combined cycle natural gas fired power

plant in the First Industrial Zone in Volos.

21.During the preparation of financial report for 31.12.2013, the Company’smanagement has assessed that said developmentwill lead to a loss event regarding its Investment in ELVO. As a result, on 31.12.2013 the amount of €13,4mil. for

theGroup and €15,9mil for the Company, are recognized, according to paragraphs 67 and 68 of IAS 39, in the income statement as impairment loss. (please refer to note 3.8.2 of the financial statements.).

22. The FinancialResults for the period 1/1-31/12/2012 have been restated according to the revised IAS 19 and theGroup changed accounting policy for cost recognition «Electrolysis pots relining», of the subsidiary Aluminium S.A. according

to the relevant requirements of IAS 16 (note 3.8.2 of the fincancial statement)

THECOMPANY

THEGROUP

THECOMPANY

ADDITIONALDATAAND INFORMATION

2. The fiscal years that are unaudited by the tax authorities for the Company and theGroup's subsidiaries are presented in detail in note 6.34 of the annual financial statements. For the fiscal year 2012, theGroup companieswhose

financial statementswere audited bymandatory statutory auditor or audit firm, under the provisions in paragraph 5 of Article 82 of Law 2238/1994, received a Tax Compliance Certificate. For the fiscal year 2013, tax audit is being

conducted by auditors and is not expected to result significant differentiation. In order to consider that the fiscal yearwas inspected by the tax authorities,must be applied as specified in paragraph 1a of Article 6 of POL 1159/2011.

Tax audit for the Parent CompanyMYTILINEOSHOLDINGS S.A. is being carried out by the relevant financial authorities, for the financial years 2007-2010.

THEGROUP

3. The basic accounting policies in the consolidated balance sheet of 31December 2012 have not been altered.

STATEMENTOF FINANCIALPOSITION

THEGROUP

THECOMPANY

THECOMPANY

STATEMENTOFCHANGES INEQUITY

EVANGELOSMYTILINEOS - President & CEO, IOANNISMYTILINEOS - Vice President non-executive,GEORGE KONTOUZOGLOU - ExecutiveDirector-executivemember, SOFIADASKALAKI - non-

executive,WADE BURTON - non-executive,NIKOLAOS KARAMOUZIS - independent non-executive, APOSTOLOSGEORGIADIS - independent non-executive, CHRISTOS ZEREFOS, independent non-

executive,MICHALISHANDRIS - independent non-executive

1/1-31/12/13

1/1-31/12/12

Company'sNo23103/06/Β/90/26 in the registerofSocietesAnonymes

5-7PatroklouStr.Maroussi

FIGURESAND INFORMATIONFORTHEFISCALYEAROF1 JANUARY2013UNTIL31December2013

The figures presented below aim to give summary information about the financial position and results ofMYTILINEOS S.A. and its subsidiaries.

The readerwho aims to form a full opinion on the company's financial position and results,must access the company'swebsitewhere the financial statements prepared according to

the International FinancialReporting Standards and the Auditor'sReport,when this is required, are published. Indicatively, the reader can visit the company'sweb site,where the above financial statements are posted.

INCOMESTATEMENT

HellenicMinistry ofDevelopment, Competitiveness, Infrastructure, Transport

andNetworks inGreece,General Secretariat of Commerce,GeneralDirectorate

of Inland Commerce, Directorate of Societes Anonymes and Credit

THEGROUP

According to 4/507/28.04.2009 resolution ofGreek Capital Co ittee,

COMPANYPROFILE

SupervisingAuthority:

Amounts in 000's €

Companywebsite:

BoardofDirectors:

Continuing

Operations

Discontinuing

Operations

Total

Continuing

Operations

Discontinuing

Operations

Total

Sales Turnover

1.402.954

6.339

1.409.293

1.453.636

5.771

1.459.407

Dateofapprovalof theFinancialStatementsby theBoardofDirectors:

24March 2014

Gross profit / (loss)

200.040

2.184

202.224

138.484

2.902

141.386

TheCertifiedAuditor:

Vassilis Kazas, Thanassis Xynas

Profit / (Loss) before tax, financial and investment results

166.642

(179)

166.463

104.152

(57)

104.095

AuditingCompany:

GRANT THORNTON

Profit/ (Loss)before tax

80.378

(202)

80.176

55.397

(71)

55.326

TypeofAuditor'sopinion:

Unqualified opinion - emphasis ofmatter

Less taxes

(13.058)

-

(13.058)

(10.000)

-

(10.000)

Profit/ (Loss)after tax (A)

67.320

(202)

67.118

45.398

(71)

45.327

Equity holders of the parent Company

22.707

(202)

22.505

19.131

(71)

19.060

Minority Interests

44.613

-

44.613

26.267

-

26.267

Amounts in 000's €

Other comprehensive incomeafter tax (B)

(84.053)

-

(84.053)

23.488

-

23.488

Total comprehensive incomeafter tax (A)+ (B)

(16.733)

(202)

(16.935)

68.886

(71)

68.815

Owners of the Company

(61.169)

(202)

(61.371)

29.008

(71)

28.937

31/12/2013

31/12/2012

31/12/2011

31/12/2013

31/12/2012

Minority Interests

44.436

-

44.436

39.878

-

39.878

Net profit after tax per share (in Euro/share)

0,20

(0,0018)

0,1992

0,1793

(0,0007)

0,1786

Tangible Assets

1.081.673

1.097.529

1.121.359

10.204

10.285

Profit / (Loss) before tax, financial,

231.961

1.613

233.574

165.423

1.947

167.370

Intangible Assets

244.706

244.772

240.246

99

229

investment results, depreciation and amortization

Other non current assets

347.181

324.146

300.123

847.466

924.185

Inventories

128.425

151.074

174.560

- -

Trade Receivables

575.079

658.247

448.810

385

498

1/1-31/12/13

1/1-31/12/12

Other Current Assets

287.222

248.638

435.499

16.484

18.236

Non current assets available for sale

-

-

-

-

-

Sales Turnover

16.918

16.040

TotalAssets

2.664.287

2.724.406

2.720.598

874.638

953.433

Gross profit / (loss)

29

28

Profit / (Loss) before tax, financial and investment results

1.436

2.723

EQUITYANDLIABILITIES

Profit/ (Loss)before tax

(15.908)

8.418

Share Capital

125.335

125.335

127.545

125.100

125.100

Less taxes

2.406

7.420

Treasury stock reserve

-

(104.566)

(104.566)

-

(104.566)

Profit/ (Loss)after tax (A)

(13.502)

(997)

Retained earnings and other reserves

738.956

779.245

740.822

379.468

456.078

Equity holders of the parent Company

(13.502)

(997)

Equityattributable toparent'sShareholders (a)

864.291

800.014

763.801

504.568

476.611

Minority Interests

-

-

Minority Interests (b)

233.404

176.202

151.876

-

-

Other comprehensive incomeafter tax (B)

(63.108)

(67)

TotalEquity (c)= (a)+ (b)

1.097.695

976.216

915.677

504.568

476.611

Total co prehensive inco eafter tax (A)+ (B)

(76.610)

(1.064)

Long term Borrowings

435.115

22.635

334.588

159.308

-

Owners of the Company

(76.610)

(1.064)

Provisions and other long term liabilities

356.396

305.401

57. 19

75.61

39.039

Minority Interests

-

-

Short term borrowings

2 . 11

838.777

508.141

3.329

3 0.982

Net profit after tax per share (in Euro/share)

(0)

(0)

Other short term liabilities

518.769

581.3 8

6 4.673

131.815

106.800

Profit / (Loss) before tax, financial,

Non current liabilities available for sale

-

-

-

-

-

investment results, depreciation and amortization

1.896

3.169

T tal Liabilities (d)

1.566.592

1.748.191

1.804.921

370.070

476.821

OTA EQUITYANDLIABILITIES (c)+ (d)

26 4287

2 24407

2720598

8 4638

953433

CASHFLOWSTATEMENT

Amounts in 000's €

Amountsin 000's €

1/1-31/12/13

1/1-31/12/12

1/1-31/12/13 1/1-31/12/12

31/12/2013

31/12/2012

31/12/2011

31/12/2013

31/12/2012

Operatingactivities

Equityat thebeginningof theperiod (01.01.2013,01.01.2012and

01.01.2011 respectively)

960.338

900.806

844.253

476.611

477.676

Profit before tax (continuing operations)

80.378

55.397

(15.908)

(8.418)

IAS8Adjustment

1587

14 71

13 6

-

-

i

disco ti uing operations)

(202)

(71)

-

-

Total comprehensive income for the period after tax (continuing/ discontinuing

operations)

(16.935)

68.815

68.291

(76.610)

(1.064)

Adjustments for:

-

-

-

-

Increase / (Decrease) in Share Capital

(6

11. 4

(83)

-

-

Depreciation

67.112

63.276

460

445

Dividends paid

(6.020)

(17.849)

(12.124)

-

-

Im airments

13.609

2

29.235

23.066

Impact from acquisition of share in subsidiaries

-

-

-

-

-

Provisions

(5.777)

(9.789)

-

-

Treasury shares purchased

104.566

-

-

104.566

-

Exchange differences

881

(454)

1.017

(461)

Othermovements from subsidiaries

(250)

(2.241)

2.085

-

-

OtherOperating Results

(200)

5.800

-

-

Changes in Equity fro Sale of Subsidiary

40.124

-

-

-

-

Results (income, expenses, gains and losses) of insting activities

(23.045)

(3.381)

(29.045)

(25.547)

Equityat theendof theperiod (31.12.2013,31.12.2012and31.12.2011

respectively)

1.097.695

976.216

915.678

504.568

476.611

Interest expense

62.335

44.999

17.056

13.623

Adjustments related toworking capitalaccountsor

tooperatingactivities

(Increase)/Decrease in stocks

23.374

32.946

-

-

(Increase)/ ecrease in trade receivables

(4.834)

(101.778)

4.139

1.500

Increase / (Decrease) in liabilities (excluding banks)

15.618

(31.863)

58.015

(649)

Less:

1. Companies included in the consolidated financial statementswith the corresponding participation of interest aswell as themethod of consolidation for the period 1/1-31/12/2013

Interest expense paid

(63.705)

(49.932)

(18.917)

(14.899)

are being presented in note 3.10 of the Annual Financial Statements.

Income tax paid

(4.662)

(4.187)

-

-

Cash flows from discontinuing operating activities

1.859

1.932

-

-

Cash flows fromoperatingactivities (a)

162.742

3.120

46.051

(11.340)

Investingactivities

(Acquisition ) / Sale of subsidiaries (less cash)

40.071

(40.000)

40.245

(19.711)

Purchases of tangible and intandible assets

(57.967)

(95.522)

(249)

(189)

Acquisition of associates

-

(345)

-

-

Sale of tangible and intangible assets

1.575

438

1

1

4.Group’s assets are pledged for an amount of 323,7m as bank debt collateral.

Purchase of financial assets held-for-sale

-

-

-

-

Return of capital from Subsidiary

-

-

-

20.290

5. The number of employees andworkers at the end of the reporting period is as follows:

Sale of financial assets held-for-sale

69

52

-

-

Sale of financial assets at fair value through profit and loss

1.306

5.095

193

-

Employees

31/12/2013

31/12/2012

31/12/2013

31/12/2012

Purchase of financial assets at fair value through profit and loss

(100)

(6.677)

(100)

(200)

Workers

1.565

1.521

60

59

Grants received

7.025

0

-

-

191

315

-

-

Interest received

414

6.456

1.838

7.303

1.756

1.836

60

59

Loans to / from related parties

-

-

49.898

27.071

Dividends received

59

83

5.474

16.421

Cash flows from discontinuing investing activities

1

1

-

-

6. Capital Expenditure for 2013:Group €57.967 thousand and Company €249 thousand.

Other cash flows from investing activities

(22)

-

-

-

Cash flows from investingactivities (b)

(7.566) 0

(130.418) 0

97.298 0

50.986

7. Earnings per share has been calculated on the basis of net profits over theweighted average number of shares.

Financingactivities

Proceed from issue of capital

-

11.960

-

-

Sale / (purchase) of treasury shares

25.248

-

25.248

-

Tax payments

(216)

(36)

-

-

Proceeds from borrowings

291.909

26.267

-

32.797

Loan repayments

(201.069)

(147.984)

(166.378)

(93.000)

Dividends paid

(8.358)

(17.105)

-

-

Payment of finance lease liabilities

-

(6)

-

-

10. Related party transactions and balances for the reported period, according to I.A.S. 24 are as follows:

Cash flow discontinuing financing activities

-

-

-

-

Cash flows from continuing financingactivities (c)

107.515

(126.905)

(141.130)

(60.203)

Amounts in000's€

THEGROUP THECOMPANY

Net (decrease) / increase in cashand cash

equivalentsof theperiod (a)+ (b)+ (c)

262.690

254.2 3

2.219

2 .557

Revenues

-

29.299

Cashand c hequivalentsatbegin ingofperiod

(172.565)

84.232

(2.105)

18.406

Expenses

-

26.505

Net c shat theendof theperiod

90.127

(169.970)

114

(2.151)

Receivables

-

552

Liabilities

-

163.377

Keymanagement personnel compensations

13.756

2.963

Receivables from keymanagement personnel

-

-

Payables to keymananagement personnel

-

49

THEGROUP

THECOMPANY

31/12/2013

31/12/2012

31/12/2013

31/12/2012

Net profit(loss) for the period

67.118

45.327

(13.502)

(997)

Exchange differences on translation of foreign operations

(6 1)

7.895

-

-

Financial as ets held-for-sale

13371

-

15.9 9

-

Cas Flow hedgi g reserve

87

8354

Income t x r lating to components of other comprehensive income

(3)

-

Profit/(Loss) from tr asury shares sale

(79.073)

-

(79.058)

StockOption Plan

(5.882

7.239

21

(67)

Changes in reserves from diff. taxr te alteration

11942

-

Total c mprehen ive incom for theperi dafter tax (continuing/

discontinuingoperations)

(16.935

68.815

(76.610)

(1.064

Maroussi,24March2014

THE PRESIDENTOF THE BOARD& CHIEF EXECUTIVEOFFICER

THE CHIEF EXECUTIVEDIRECTORGROUP FINANCE

EVANGELOSMYTILINEOS

I.D.No ΑΒ649316/2006

IOANNISKALAFATAS

16.MYTILINEOSGroup subsidiary ALUMINIUM S.A. has signedwith Swiss-basedmultinationalGlencore a contract for the sale of 75.000 tons of aluminium in billets. These quantitieswill be exported to the Europeanmarket from

January 2013 to June 2014.

17. TheMinistry of Environment, Energy& Climate Change issued a decision on 17/1/2013 for licensing the commercial service of the electric power / heat cogeneration plant of 'Aluminum'. As of 28/11/2012, the plant in question

was already in commissioning status asDistributedHigh Performance Electric Power /Heat Cogeneration Plant (trial operation ofDistributedHPEPHC) by themarket operator, after having signed a supplementary transaction

contract, and estimating and billing accordingly the electric power infused to the grid.

26. There are other contingent liabilities against theGroup, amounting to 12,7m€, forwhich no provision is formed on the results since the outcome of these is deemed uncertain.Moreover there areGroups’ claims against third parties

amounting to 75,38m€.

27. The emphasis of atter of the auditors relate to note 6.34 of the Financial Statements. In particular, on 25.7.2011, theGreekGovernment, via theMinistry of Environment, Energy& Climate Change, disclosed toGroup’s subsidiary

company ALUMINUM S.A., the decision of the European Commision, rendering incompatiblewith the community regulations on state assistance the pricing for electric energy sale imposed on ALUMINIUM S.A. by the PPC, for the period

between January 2007 andMarch 2008.On 6.10.2011ALUMINUM S.A. appealed before the EuropeanUnion’sGeneral Court requesting annulment of the abovementioned decision. PPC is trying to enforce the aforementioned European

Commision decision through a payment order issued, againstwhich ALUMINUM S.A.will appeal any proceduralmeasure tried by PPC aiming to the enforcement of the payment order and shall target the issuance of a new injunction decision

(enforcement suspension).Group’smanagement estimates that the probability of a future outflow of economic resources for the settlement of this contingent liability of € 20,3million (€ 17,4million plus interest), is remote.

THE VICE-PRESIDENTOF THE BOARD

THEGROUP FINANCIAL CONTROLLER

IOANNISMYTILINEOS

I.D.No ΑΕ044243/2007

ANASTASIOSDELIGEORIS

13. TheManagement's position, regarding th decision of the European Commi si n requ sting the recovery of an amount of 17,4mil euros from the subsidiary ALUMINIUMS.A. on the basis thatwas a state aid, has not altered

(please refer to note 6.34 of the annual financial statements.).

24. InNovember 2013,Mytilineos announced that it had successfully completed an offering of 3.217.288 existing shares (the “Shares”) inMetka SA (“Metka”) generating total proceeds of c. EUR40,2million, byway of an international private

placement to institutional investors as part of an accelerated bookbuilding process (the “Transaction”). Following the Transaction,Mytilineos holds 50.0%+ 1 Share ofMetka’s share capital.

14.MYTILINEOSGroup subsidiary,METKA S.A., announced the following new contracts:

a) InMay 2013 the signing of a new contractwith Société Algérienne de Production de l’Electricité (SPE Spa is part of the SonelgazGroup, themajor Algerian electricity utility), in consortiumwithGeneral Electric.The total contract

value forMETKA is EUR 72mio plusDZD 2.127mio (total approx. EUR 92,8million) and the contracted schedule is 29,5months.

b) In July 2013METKA announced the signing of a contractwithMinistry of Electricity in Iraq for the combined cycle power plant at Al-Anbar.The total contract value amounts to $1,050million and its time schedule is 32months

following the opening of the irrevocable Letter of Credit.

25. Possible differences in total are due to r unding.

15. In September,METKA announced the successful completion of theOMV Samsun 870MW combined cycle power plant project in Turkey.

12. InNovember 2013, the arbitration procedure regarding the contract for the supply of electricity to theGroup’s subsidiary ALUMINIUM S.A. by the PPC S.A. has been completed. The difference to ensue for ALUMINIUM S.A. and

forMYTILINEOSGroup, is reflected in the interim summary financial statements for the period from 1 January to 30 September 2013 and are calculated at €35,2million (seeNote 3.11)

3The Extr ordinaryGeneralMeeting of the Shareholders ofth sub idiarycompa y “PROTERGIA THERMOELECTRIC AGHIOUNIKOLAOU S.A.” de ided, n 21/11/2013,the absorption ofthe electricity production segment of the n tural gas

operating powe plants ofMytilineos’Group subsidiary company named “PROTERGIA S.A.” according to lawΝ.2190/1920 aswell as articles 1-5 of lawΝ.2166/1993. The abovementioned demerger and Segment contributionwas approved

under the 24018/13-06/12/2013 22999/13 ruling of the AthensNorthDistrict (ΑΔΑ ΒΛΓΠ7Λ7-Ζ31) official.

THEGROUP

THECOMPANY

8.MYTILINEOSHOLDINGS S.A. on 18October 2013, pursuant to its BoD resolution on 17October 2013, sold 4,972,383 treasury shares at the price of €5.13 per share for a total consideration of €25,508,325. Following the above

mentioned transactionMYTILINEOSHOLDINGS S.A. does not hold any treasury stock. As of 18October 2013, the interest held by Fairfax inMYTILINEOSGroup stands at 5.02%,making Fairfax the third largestMYTILINEOSGroup

shareholder.

9. TheGroup, based on the terms of paragraph 51 of IAS 16, proceeded to the revaluation of the useful life of its basic productive units. (note 3.8.2 of the annual fincancial statement)

11. In the Statement of Changes in Equity, the amounts included in the line "Total comprehensive income for the period after tax (continuing/ discontinuing operations)"

for the year end 31December 2013 and 2012 are presented in the table below:

18. In August,MYTILINEOSHOLDINGS S.A. concluded an agreement for the refinancing of the Company’s current loan obligations, in the amount of €243million,with a term of three (3) yearswith an optional extension for an additional two

(2) years (five (5) years in total).

19. InNovember 2013, 100% group subsidiaries ALUMINIUM S.A. and PROTERGIA THERMAL – AGIOSNIKOLAOS PRODUCTION AND TRADEOF ELECTRICAL POWER S.A, awholly-owned subsidiary of PROTERGIA PRODUCTION AND TRADE

OF ELETRICAL POWER S.A. has issued a €145million syndicated debenture loan and a corresponding €104 syndicated debenture loan accordingly. Both these loans have been issued for a term of three (3) yearswith an option for extension

for an additional period of two (2) years, up to a total of five (5) years.

20. I September 2013, theGroup’s subsidiarycompanyPROTERGIA S.A. submitted a request towithdraw theNo.D5/HL/C/F28/4/10202/01-06-2001 electricity production license for the 436,6MW combined cycle natural gas fired power

plant in the First Industrial Zone in Volos.

21.During the preparation of financial report for 31.12.2013, the Company’smanagement has assessed that said developmentwill lead to a loss event regarding its Investment in ELVO. As a result, on 31.12.2013 the amount of €13,4mil. for

theGroup and €15,9mil for the Company, are recognized, according to paragraphs 67 and 68 of IAS 39, in the income statement as impairment loss. (please refer to note 3.8.2 of the financial statements.).

22.The Fin cialResults f r t period 1/1-31/12/2012 have been restated ccording to the revised IAS 19and theGroup changed accounting policyfor cost cognition «Electr lysis pots relning», of the subsidiary Aluminium S.A. according

to the relevant requirements of IAS 16 (note 3.8.2 of the fincancial statement)

THECOMPANY

THEGROUP

THECOMPANY

ADDITIONALDATAAND INFORMATION

2. The fiscal years that are unaudited by the tax authorities for the Company and theGroup's subsidiaries are presented in detail in note 6.34 of the annual financial statements. For the fiscal year 2012, theGroup companieswhose

financial statementswere audited bymandatory statutory auditor or audit firm, under the provisions in paragraph 5 of Article 82 of Law 2238/1994, received a Tax Compliance Certificate. For the fiscal year 2013, tax audit is being

conducted by auditors and is not expected to result significant differentiation. In order to consider that the fiscal yearwas inspected by the tax authorities,must be applied as specified in paragraph 1a of Article 6 of POL 1159/2011.

Tax audit for the Parent CompanyMYTILINEOSHOLDINGS S.A. is being carried out by the relevant financial authorities, for the financial years 2007-2010.

THEGROUP

3. The basic accounting policies in the consolidated balance sheet of 31December 2012 have not been altered.

STATEMENTOF FINANCIALPOSITION

THEGROUP

THECOMPANY

THECOMPANY

STATEMENTOFCHANGES INEQUITY

EVANGELOSMYTILINEOS - President & CEO, IOANNISMYTILINEOS - Vice President non-executive,GEORGE KONTOUZOGLOU - ExecutiveDirector-executivemember, SOFIADASKALAKI - non-

executive,WADE BURTON - non-executive,NIKOLAOS KARAMOUZIS - independent non-executive, APOSTOLOSGEORGIADIS - independent non-executive, CHRISTOS ZEREFOS, independent non-

executive,MICHALISHANDRIS - independent non-executive

1/1-31/12/13

1/1-31/12/12

's

i t r ist r f ci t s

s

- tr l tr.

r ssi

FI ES

I F

TI F T EFIS L E F1 J

2013

TIL31 ece ber2013

The figures presented below ai to give su ary infor ation about the financial position and results of YTILINEOS S.A. and its subsidiaries.

The readerwho ai s to for a full opinion on the co pany's financial position and results, ust access the co pany'swebsitewhere the financial state ents prepared according to

the International FinancialReporting Standards and the Auditor'sReport,when this is required, are published. Indicatively, the reader can visit the company'sweb site,where the above financial statements are posted.

INCOMESTATEMENT

HellenicMinistry ofDevelopment, Competitiveness, Infrastructure, Transport

andNetworks inGreece,General Secretariat of Commerce,GeneralDirectorate

of Inland Commerce, Directorate of Societes Anonymes and Credit

THEGROUP