Annual Financial Report for the period from1st of January to the 31st of December 2013

139

effect, in accordance with the intergovernmental agreement, from 1/7/2013.

The Group has calculated the positive impact of said discount for 2013 that amounts to approximately € 12mio

for its total gas consumption during the period from 1/7/2013 to 31/12/2013. More specifically, the impact on

Group’s Results and Equity is as follows:

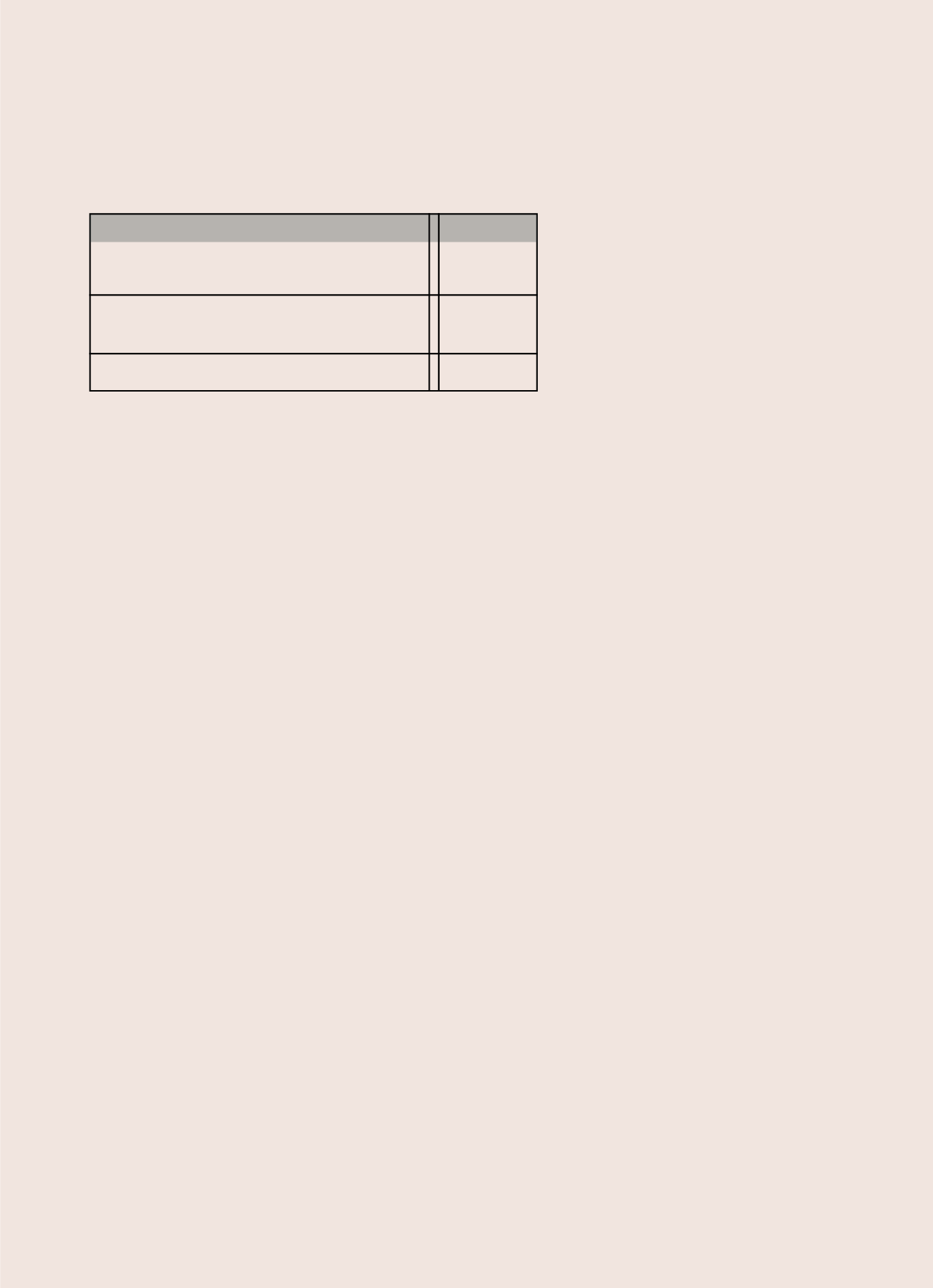

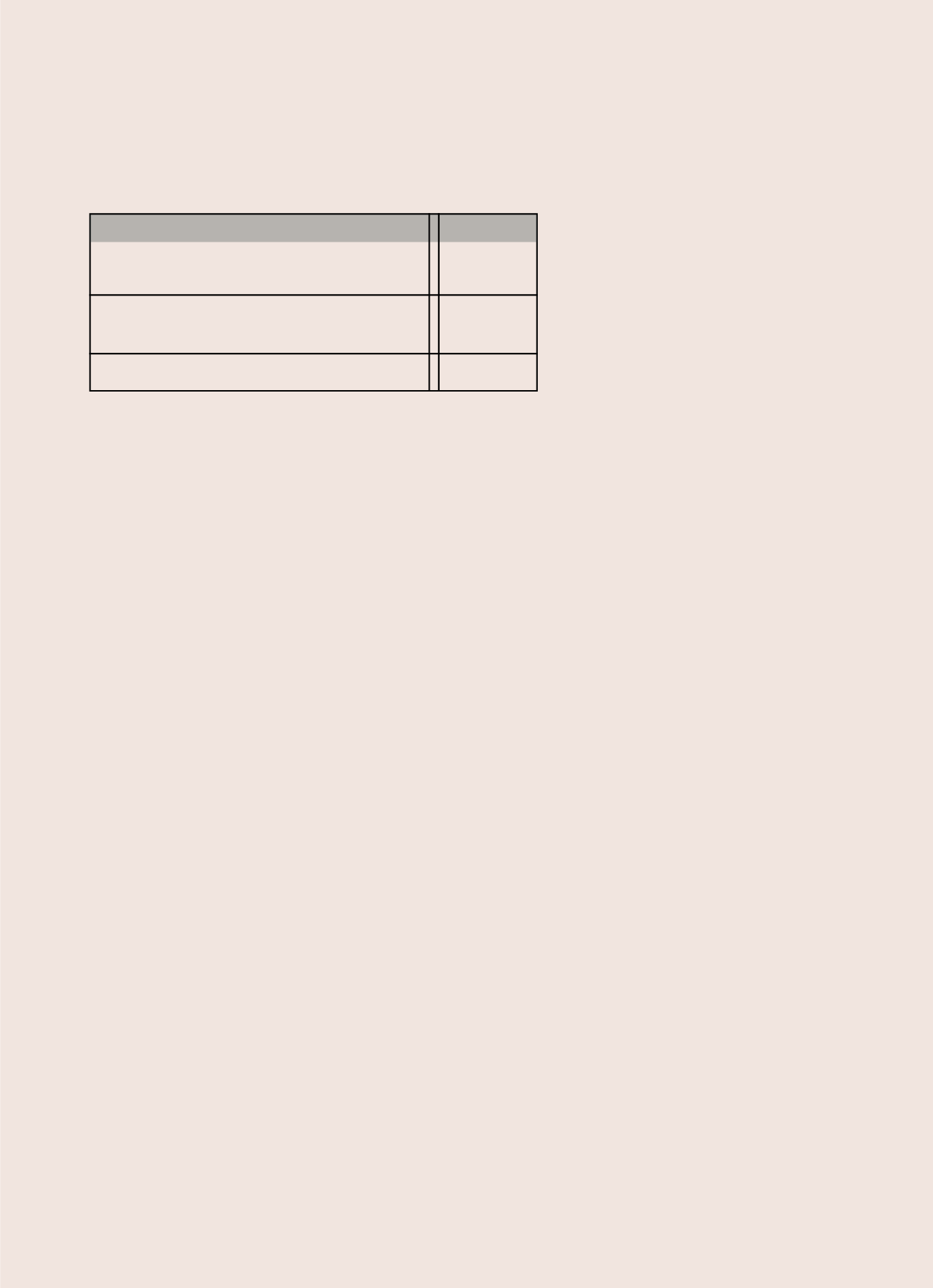

Amounts in mio€

Impact on Group’s Operating Result

12,00

Impact on Group’s Earnings after

8,08

tax and minorities

Equity attributable to Parent’s shareholders

8,08

The final positive impact will be recorded in the Group’s results in 2014 when the retroactive pricing from DEPA

is effected. The period of said retroactive pricing will be from 1/7/2013 until the last date invoiced with the

previous (before the discount) price.

Draft Law ‘ Arrangements for the reorganization of the special account referred to in article 40 of L. 2773/1999

and other provisions»

The draft law proposed arrangements in order to ensure the viability of the renewable energy sources

(RES) support mechanism, aimed at the consolidation of the special account referred to in article 40 of law

2773/1999. In addition, the recommended settings are intended to help reduce the cost of electricity for final

consumers and the national economy. More specifically, the present draft law consists of three main axes:

(a) price adjustment to converge, as far as possible, the benefits from the RES support mechanism at around

the same level for all categories of producers, therefore being an adjustment that aims, as far as possible,

on similar yields between the several types of investment, b) investor protection taking into account existing

financing agreements and c) new tariffs to compensate producers

of electricity from RES and through RES and high efficiency Cogeneration Plants (HeCoGen), compatible with

the requirements of the national electrical system, which will contribute to reduction of energy costs while at

the same time ensuring reasonable returns.

The said draft law was posted on 3 March 2014 and opened to public consultation which was concluded on

March 13, 2014.

In particular, Article 3 of the said draft law includes the following:

1. Within two (2) months from the entry into force of this law, the RES/HeCoGen producers shall issue a credit

note to provide discount:

a. 35% regarding energy from photovoltaic plants (except in cases of the «special program of development of

photovoltaic systems in buildings») and

b. 10% regarding energy from other RES and HeCoGens,

in both cases (a) and (b) calculated on the total value of energy sold in 2013.

2. On expiry of the period referred to in paragraph 1 and until issuance and delivery of the credit note

referred to in this paragraph, the obligation of LAGIE for the Interconnected System and DEDDIE for the Non

Interconnected System, to pay to RES and HeCoGens producers the price for the volume of electricity delivered

from the month of entry into force of said Law and onwards, shall be suspended. The General Secretariat of

Public Revenues is hereby authorized to determine by decision the details regarding the tax treatment of the

transaction described in paragraph 1 and the present.

3. For RES and HeCoGen projects that issue the credit note pursuant to para. 1 the excise tax of L. 4093/2012,