30

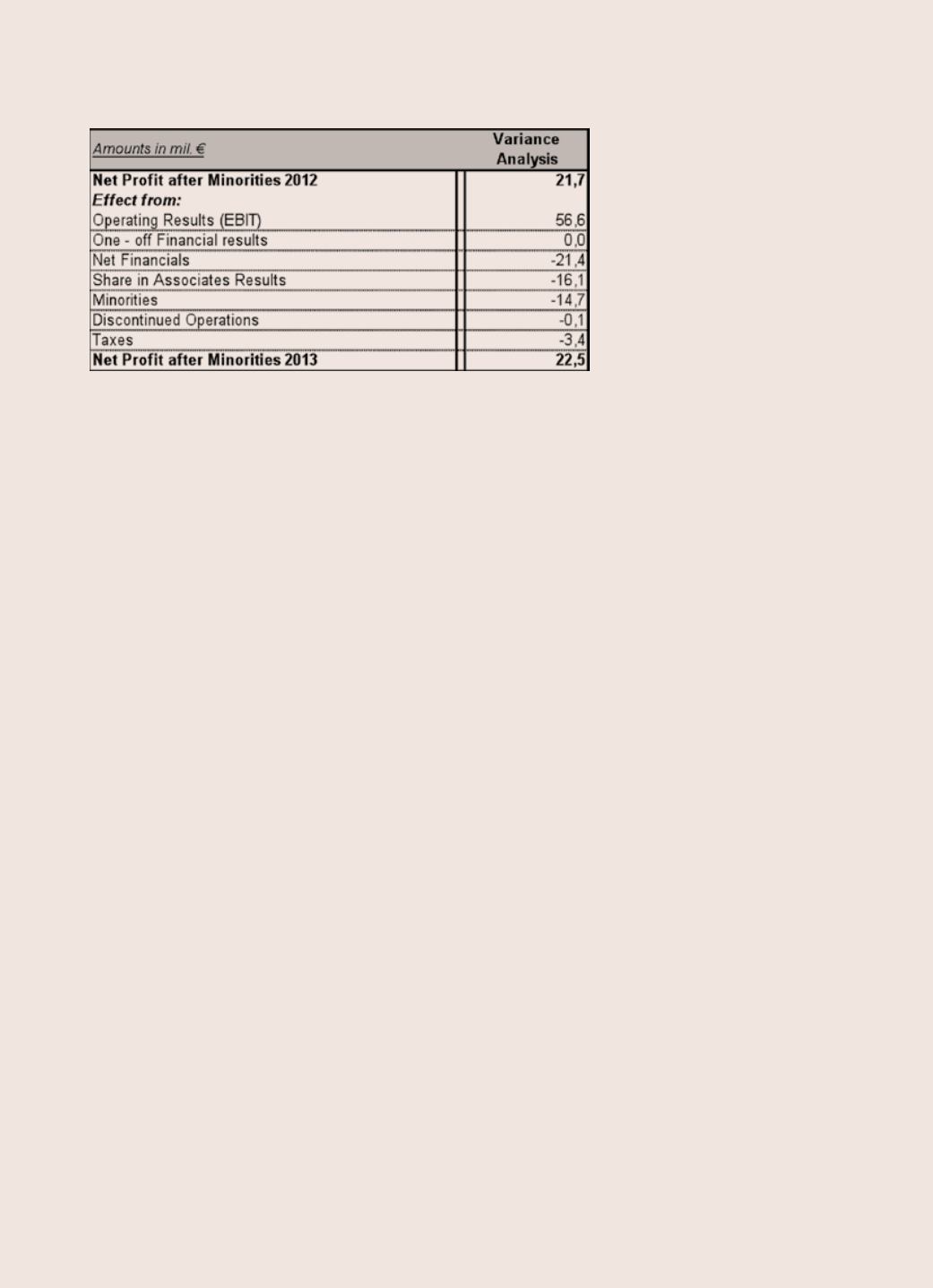

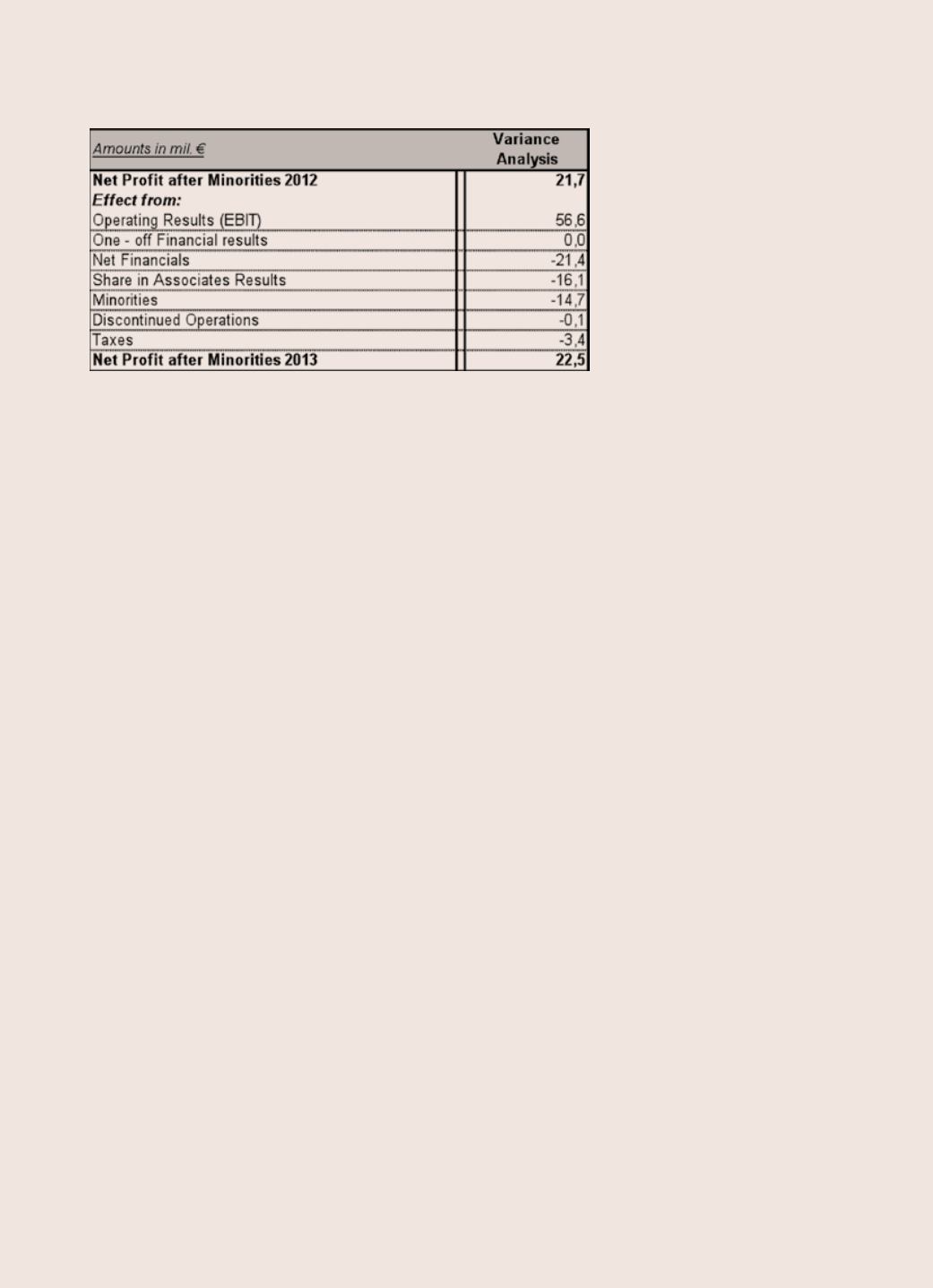

C. Net Profit after minorities

The Group’s policy is to monitor its performance on a month to month basis thus tracking on time and effectively

the deviations from its goals and undertaking necessary actions. The group evaluates its financial performance

using the following generally accepted Key Performance Indicators (KPI’s).

-EBITDA (Operating Earnings Before Interest, Taxes, Depreciation & Amortization):

The Group defines the

«Group EBITDA» quantity as profits/losses before tax, itemized for financial and investment results; for total

depreciation (of tangible and intangible fixed assets) as well as for the influence of specific factors, i.e. shares

in the operational results of liaised bodies where these are engaged in business in any of the business sectors

of the Group, as well as the influence of write-offs made in transactions with the above mentioned liaised

bodies.

- ROCE (Return on Capital Employed):

This index is derived by dividing profit before tax and financial results

to the total capital employed by the Group, these being the sum of the Net Position; the sum of loans; and

long - term forecasts.

- ROE (Return on Equity):

This index is derived by dividing profit after tax by the Group’s Net Position.

- EVA (Economic Value Added):

This metric is derived by multiplying the total capital employed with the

difference (ROCE – Capital Expenditure) and constitutes the amount by which the financial value if the company

increases. To calculate the capital expenditure, the Group uses theWACC formula – «Weighted Cost of Capital».