Annual Financial Report for the period from1st of January to the 31st of December 2013

37

delivered from the month of entry into force of said Law and onwards, shall be suspended. The General

Secretariat of Public Revenues is hereby authorized to determine by decision the details regarding the tax

treatment of the transaction described in paragraph 1 and the present.

3. For RES and HeCoGen projects that issue the credit note pursuant to para. 1 the excise tax of L. 4093/2012,

as amended and in force, is recalculated on the reduced, after the credit note discount, proceeds from the

sale of energy for the reference year 2013.

The Group has calculated the possible impact on consolidated Results and Consolidated Equity, whether the

provisions of the above article of the draft law are to be implemented. Said impact is as follows:

Amounts in mio€

Impact on Group’s Operatg Result

2,88

Impact on Group’s Earngs after

2,64

tax and morities

Impact on Group’s Equity:

2,64

The group monitors the developments regarding this draft law and will recognize the appropriate impact on the

results of the year 2014. Said impact is to be crystalized after the voting of the final text of the Law, following

the assessment of comments obtained during the process of public consultation of the draft law, comments

which were in total negative.

Solvency Risk

The solvency risk is linked to the need to sufficiently finance the Group’s activity and growth. The relevant

solvency requirements are the subject of management through the meticulous monitoring of debts of long

term financial liabilities and also of payments made on a daily basis.

On 31/12/2013, the positive balance between Group’s Working Capital and Short-Term Liabilities secures the

adequate funding of the Parent Company.

The Group ensures the provision of adequate credit facilities available so as to cover short term business

requirements. In addition, funds for long term solvency needs shall be ensured through an adequate amount

of borrowed capital and the ability of selling long term financial assets.

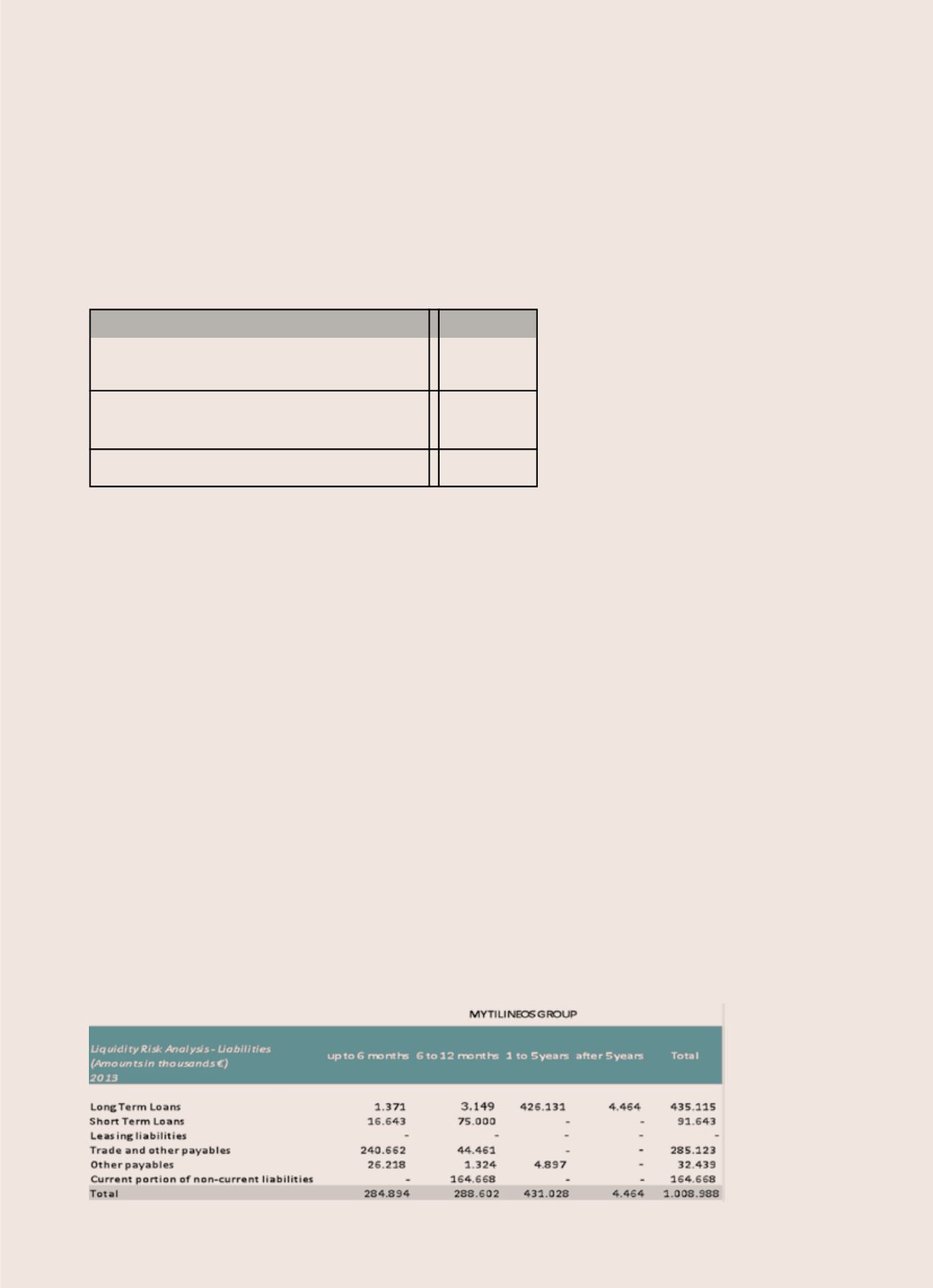

The tables below summarize the maturity profile of the Group’s liabilities as at 31.12.2013 and 31.12.2012

respectively: