Annual Financial Report for the period from1st of January to the 31st of December 2013

89

based on the IAS 8 principles where an entity shall change an accounting policy only if the change results in the

financial statements providing reliable and more relevant information about the effects of transactions, other

events or conditions on the entity’s financial position, financial performance or cash flows.

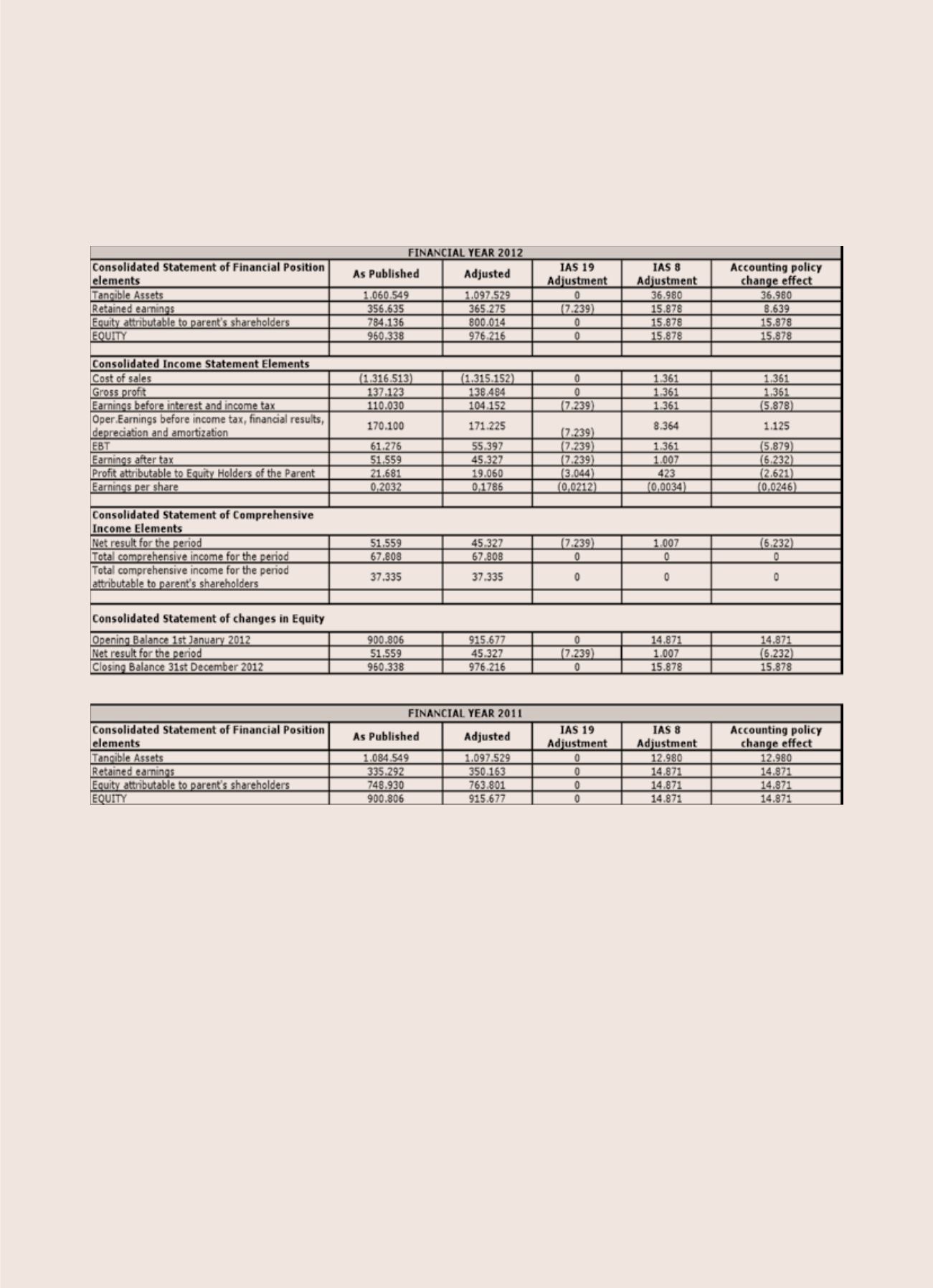

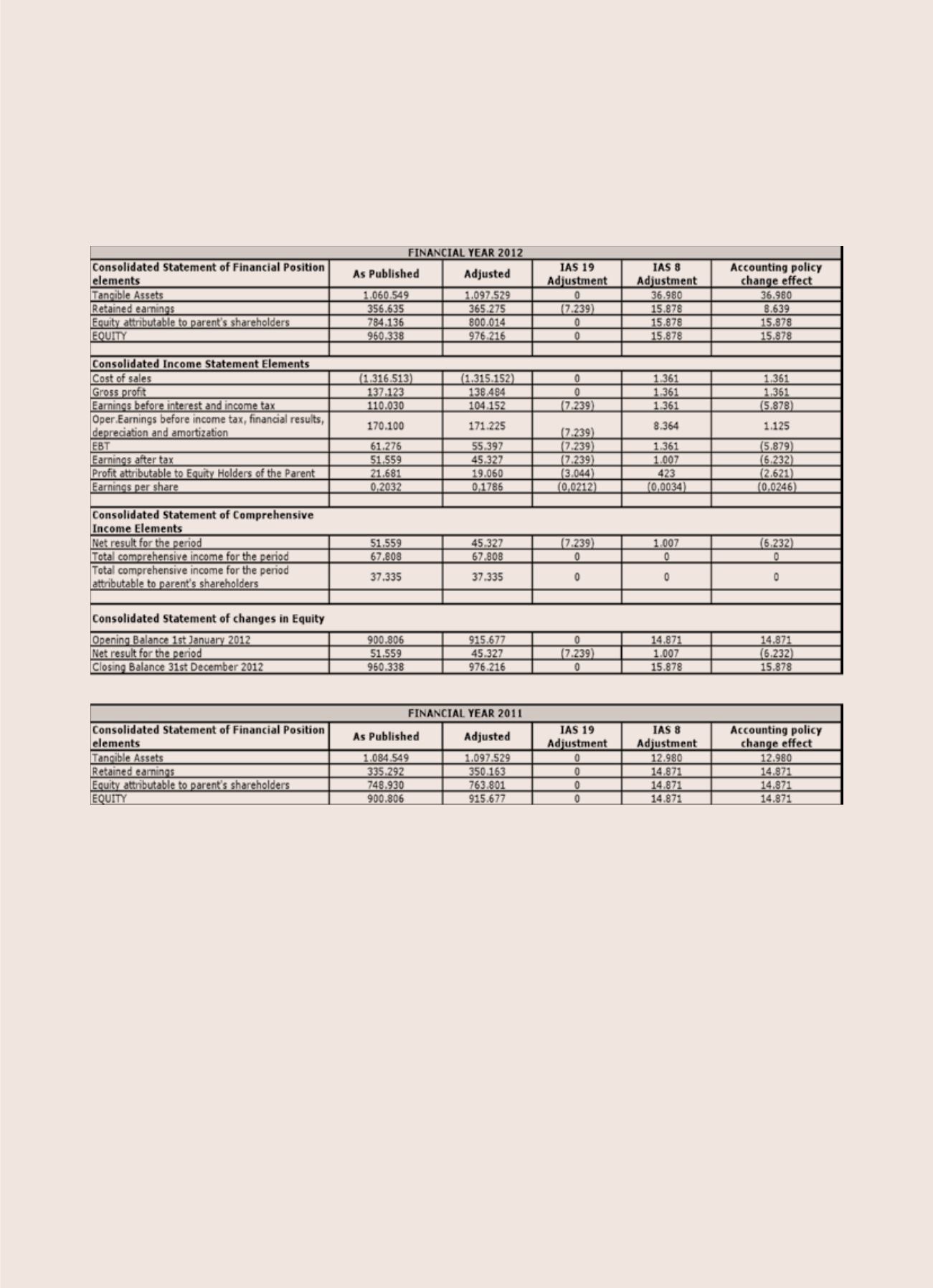

This accounting policy change, had zero effect on Company’s figures. The effect on consolidated figures is as

follows:

• Possible reductions in Goodwill

The Group test goodwill for impairment annually and whenever events or circumstances make it more likely

than not that an impairment may have occurred, such as a significant adverse change in the business climate

or a decision to sell or dispose of a reporting unit. Determining whether an impairment has occurred requires

valuation of the respective reporting unit, which we estimate using a discounted cash flow method. When

available and as appropriate, we use comparative market multiples to corroborate discounted cash flow

results. In applying this methodology, we rely on a number of factors, including actual operating results, future

business plans, economic projections and market data.

If this analysis indicates goodwill impaired, measuring the impairment requires a fair value estimate of each

identified tangible and intangible asset. In this case we supplement the cash flow approach discussed above

with independent appraisals, as appropriate.

We test other identified intangible assets with defined useful lives and subject to amortization by comparing

the carrying amount to the sum of undiscounted cash flows expected to be generated by the asset. We test