12

13

MYTILINEOS HOLDINGS SUSTAINABILITY REPORT

2015

Economic performance

In 2015, MYTILINEOS Group remained on a steady course of

growth and continued to consolidate its position in all its three

business activity areas, focusing on newmarkets’ 13 entry in the

EPC Projects Sector, on further improving the competitiveness

of the Metallurgy Sector and on strengthening the presence of

Protergia in the electricity market. In particular, the Group’s con-

solidated turnover for 2015 stood at €1,383 million from €1,233

million for 2014 (up 12.2%). Earnings before interest, tax, depre-

ciation and amortisation (EBITDA) stood at €234.4 million, down

7.7% from €253.9 million for 2014, with net profit after tax and

minority rights standing at €47.6 million from €64.9 million the

previous year (down 26.7%). While this performance affirms the

Group’s resilience, it also reflects the pressure from a number of

negative factors, such as the weak domestic economic environ-

ment, the delays in the process for the completion of the energy

and industrial policy, the negative developments in the global

commodities markets and the slowing down of investments in

new energy projects as a result of geopolitical changes in vari-

ous markets.

Outlook 2016

G4-1 G4-8

Metallurgy & Mining Sector

In the Metallurgy sector, the growth rate of global aluminium

demand is expected to remain strong during 2016, thus help-

ing support aluminium prices. After the record-high levels at-

tained at the end of 2014 and their rapid decline fall during 2015,

Premia appear to be stabilised. On the contrary, the significant

decrease in energy prices, raw materials and transportation,

drives production costs to lower levels. Accordingly, low Al-

uminium prices, prevailed also at the beginning of 2016, pose

significant challenges for less competitive, marginal producers,

who are expected to continue curtailing their production levels

in the upcoming months. The developments regarding the mar-

ket’s fundamentals, the performance of emerging economies

and especially the Chinese, the energy costs and the evolution of

Ο Όµιλος ΜΥΤΙΛΗΝΑΙΟΣ µε γνώµονα τη συνεχή ανάπτυξη και

πρόοδο και µε στόχο να συνεχίσει να πρωταγωνιστεί σε κάθε

τοµέα δραστηριοποίησής του, προωθεί µε συνέπεια το όραµά του

να αποτελέσει έναν ισχυρό και ανταγωνιστικό ευρωπαϊκό Όµιλο

στο πεδίο της βαριάς βιοµηχανίας. Ο Όµιλος, βασιζόµενος στο

άριστα εκπαιδευµένο ανθρώπινο δυναµικό του, στα σηµαντικά

πάγια και στην οικονοµική ευρωστία που διαθέτει, στοχεύει στη

σταθερή οργανική ανάπτυξη στην ευρύτερη περιοχή της Ν.Α.

5.

Στρατηγική & προοπτικές 2016

Ευρώπης, της Αφρικής και της Μέσης Ανατολής και στην

εδραίωση σηµαντικών συνεργειών στους βασικούς τοµείς της

δραστηριότητάς του επιδιώκοντας την ισόρροπη ανάπτυξή τους.

Παράλληλα µε τo επενδυτικό του πρόγραµµα, αναπτύσσει

µεθόδους περιορισµού των δαπανών αξιοποιώντας τις

δυνατότητες εξελιγµένων εργαλείων και µεθόδων αντιστάθµισης,

για τη διασφάλιση της βελτιστοποίησης της οικονοµικής

απόδοσής του στα επόµενα χρόνια.

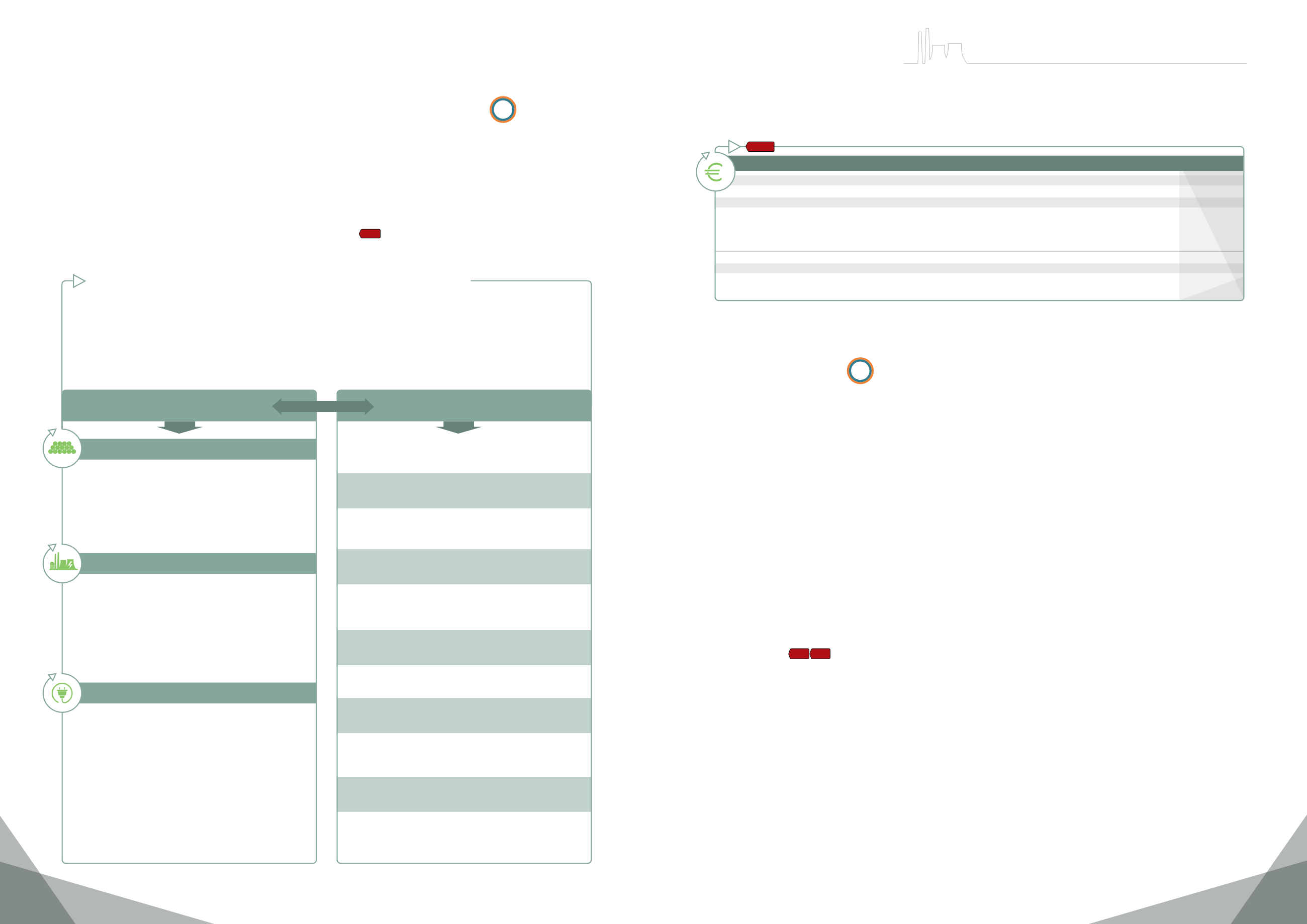

1,382,872,590.1

1,122,043,109.6

87,258,503.0

64,350,111.0

64,539,251.1

1,135,037.0

1,399,326,01.7

96.9%

3.1%

2014

2015

Generated Value

Turnover (€)

Distributed Value

Operating costs (€)

Employee salaries and benefits (€)

Payment of income tax & other taxes (€)

Payments to capital providers (€)*

Investments in local communities (€)

Total (€)

% of economic value distributed

% of economic value retained

1,232,604,268.9

965,796,625.7

83,876,209.0

53,641,409.8

62,250,594.0

852.000

1,166,416,838.5

94.6%

5.4%

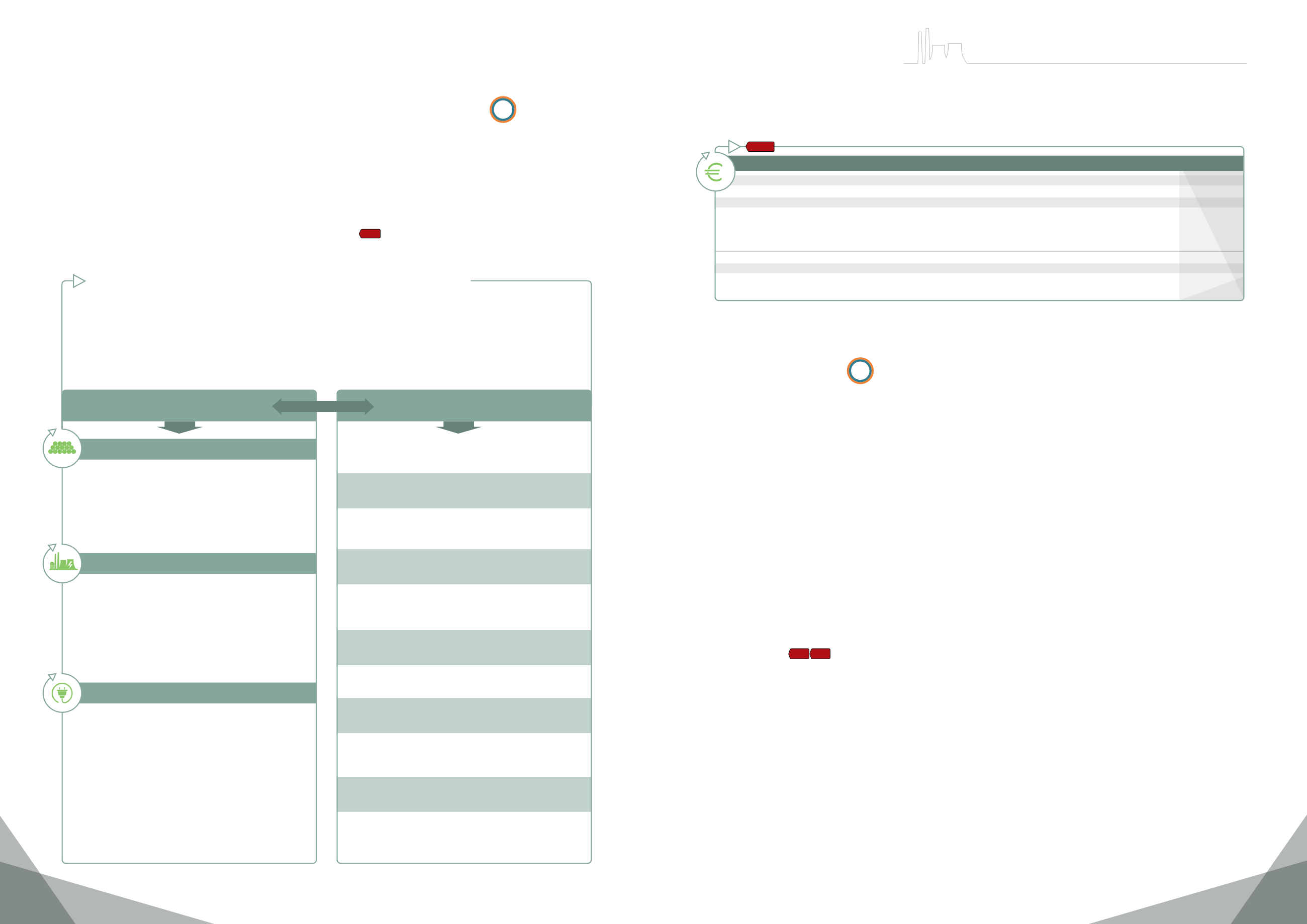

Strengthen the Group’s position in all three activity sectors

Develop and leverage effective and efficient synergies

Create value for Stakeholder groups

Strategic directions for Business Growth

2015-2019

Strategic directions for

Responsible Development 2015-2019

• Increase market share in the electricity market and

establishment of the Group as the largest independent

electricity producer in Greece.

• Continuation of the investment plan in RES plants, to

develop full integrated electricity production/supply

operations.

• Pursuit of strategic alliances.

• Optimisation of the coverage under competitive terms

of business needs in natural gas and achievement of

strategic synergies in natural gas trading to third

parties.

• Further strengthening of competitiveness through the

implementation of the new “Excellence” cost reduction

programme.

• Concentration on exports.

• Continuation of investments.

• Pursuit of new vertical integration projects or projects

for expanding Metallurgy operations.

• Continuous adherence to the law across all hierarchical

levels and activities of the Group.

• Strict commitment to employees Health & Safety.

• Continuous Stakeholder engagement and collaboration.

• Implementation of best practices that enhance

harmonious coexistence with the local communities.

• Maintaining transparency and strengthening of the

corporate governance system.

• Strengthening of the Group’s role as a key sustainability

actor in Greece.

• Improvement in the use of natural resources.

• Further strengthening of waste recycling and utilisation.

• Stabilisation and reduction of air emissions.

• Maintaining the high efficiency rate of power plants.

• Raising public awareness of issues related to Respon-

sible Entrepreneurship.

Metallurgy & Mining Sector

• Expansion to existing and new developing markets,

building on the Group’s significant industrial know-how

and infrastructure.

• Business focus on large-scale turn-key projects.

• Expansion of activities to new products.

• Exploration of new opportunities for securing

infrastructure projects in the domestic market.

EPC Projects Sector

Energy Sector

* shareholder dividends, payment of interest to creditors, including interest on all types of debts and loans, as well as retrospective payment of dividend amounts owed to

preference shareholders.

Group Strategy "Continuous Responsible Development

Economic Value Table

G4-EC1

1

4

7

8

9

17

15

20

23

24

25

26

27

29

30

28

21

10

11

22

12

13

5

2

3

18

16

6

14

19

5. Strategy & Outlook 2016

Driven by its commitment to continuous development and pro-

gress and seeking to always be at the forefront of developments

in each one of its activity sectors MYTILINEOS Group consistently

pursues its vision to become a strong and competitive European

heavy industry group. Drawing on its highly qualified employees,

significant assets and financial robustness, the Group aims to

achieve steady organisational growth in the wider region of SE

Europe, Africa and the Middle East and to consolidate the signif-

icant synergies available between its core activity sectors, seek-

ing, in this way to ensure their balanced development. In parallel

with its investment plan, it develops methods to curtail costs and

exploits the capabilities of sophisticated risk-hedging tools and

techniques to optimise its economic performance in the coming

years.

G4-1

Ο Όµιλος ΜΥΤΙΛΗΝΑΙΟΣ µε γνώµονα τη συνεχή ανάπτυξη και

πρόοδο και µε στόχο να συνεχίσ ι να πρωταγ νιστεί

κάθε

τοµέα δρ στηριοποίησής του, προωθεί µε συνέπεια το όραµά του

να αποτελέσ ι έναν ισχυρό και ανταγωνιστικό ευρωπαϊκό Όµιλο

στο πεδίο της βαριάς βιοµηχανίας. Ο Όµιλος, βασιζόµενος στο

άριστα εκπαιδευµένο ανθρώπινο δυναµικό του, στα σηµαντικά

πάγια και στην οικονοµική ευρωστία που διαθέτει, στοχεύει στη

σταθερή οργανική ανάπτυξη στ ν ευρύτε η περιοχή της Ν.Α.

5.

Στρατηγική & προοπτικές 2016

Ευρώπης, της Αφρικής και της Μέσης Ανατολής και στην

εδραίωση σηµαντικών συνεργειών στους βασικούς τοµείς τη

δραστηριότητάς του επιδιώκοντας την ισόρροπη ανάπτυξή τους.

Παράλληλα µε τo επενδυτικό του πρόγραµµα, αναπτύσσει

µεθόδους περιορισµού των δαπανών αξιοποιώντας τις

δυνατότητες εξελιγµένων εργαλείων και µεθόδων αντιστάθµισης,

για τη διασφάλιση τ ς βελτιστοποίησης της οικονοµικής

απόδοσής του στα επόµενα χρόνια.

1,382,872,590.1

1,122,043,1 9.6

87,258,503.0

64,350,111.

64,539,2 1.1

1,135,037.0

1,399,326,01.7

96.9%

3.1%

2014

2015

Generated Value

Turnover (€)

Distributed Value

Operating costs (€)

Employee salaries and benefits (€)

Payment of i c me tax & other tax s (€)

Payments to capital providers (€)*

Investm nts in local c mmunities (€)

Total (€)

% of economic value distributed

% of economic value retained

1,232,604,268.9

965,7 ,625.7

83,876,209.0

53,641,409.8

62,250,594.

852.000

1,166,4 ,838.5

94.6%

5.4%

Strengthen the Group’s o iti n in all three activity sectors

Develop and leverage eff ctive and efficient synergi s

Create value for Stakeholder groups

Strategic directions f r Business Growth

2015-2019

Strategic directions f r

Respon ible Development 2015-2019

• Increase market share in the electricity market and

establishment of the Group as the largest independent

electricity producer in Greece.

• Continuation of the inv stment plan in RES plants, to

develop full integrated electricity production/supply

operations.

• Pursuit of strategic alliances.

• Optimisation of the coverage under competitive terms

of busine s needs in natur l gas and chievement of

strategic synergi s in natur l gas tr ding to third

parties.

• Furthe strengthening of competitiv ness through the

imple entation of the new “Excellence” cost reduction

programme.

• Concentration on exports.

• Continuation of investments.

• Pursuit of new v rtical integration projects or projects

for expanding Metallurgy operations.

• Continuous adherence to the law across all hierarchical

levels and ctivities of the Group.

• Strict commit ent to employees H alth & Safety.

• Continuous Stakeholder engagement and collaboration.

• Imple entation of best practices that enha ce

harmonious coexist nce with the local communities.

• Maintaining transparency and strengthening of the

corporate governance system.

• Strengthening of the Group’s role as a key sustainability

actor in Greece.

• Improvement in the us of natur l resources.

• Furthe strengthening of waste recycling a d utilisation.

• Stabilisation and reduction of air emissions.

• Maintaining the high effici n y rate of power plants.

• Raising public awareness of i sues r lated to Respon-

sible Entrepreneurship.

Metallurgy & Mining Sector

• Expansio to existing a d new d veloping markets,

building o the Group’s significant industrial know-how

and infrastructure.

• Busine s focus on large-scale turn-key projects.

• Expansio of activities to new products.

• Explorati n of ew opportunities for securing

infrastructure projects in the domestic market.

EPC Projects Sector

Energy Sector

* sharehold r dividends, payment of i terest to creditors, including interest on all types of debts and loans, as well as retrospective payment of dividend amounts owed to

preferenc sharehold rs.

Group Strategy "Conti uo s Responsible Dev lopment

Economic Value Table

G4-EC1

1

4

7

8

9

17

15

20

23

24

25

26

27

29

30

28

21

10

11

22

12

13

5

2

3

18

16

6

14

19

the Euro/USD parity, along with the monetary policy by the Cen-

tral Banks, are expected to be the catalysts for the sector in the

months to come. Within this international landscape, the Group

is focusing on further strengthening its competitiveness and is

expecting a satisfactory financial performance from its Metallurgy

Sector in 2016.

EPC Sector

Implementation of the signed backlog, currently standing at €1.2

billion, is expected to continue during 2016. METKA has laid the

foundations for yet another year of satisfactory results, driven

mainly by the projects it has been awarded in the markets of

Ghana, Algeria and Iraq. For the immediate future, METKA will

focus on ensuring the successful implementation of its contracts

abroad and on securing new projects in existing and/or in new

markets, in order to expand its share of the market for energy

infrastructure projects in Europe, Turkey, N. Africa and the Middle

East. In parallel, the company continues to diversify its activities

by expanding to new products, with the establishment of MET-

KA-EGN, active in the fast-growing global solar energy market,

being a recent such example.

Energy Sector

2016 is expected to be a turning point for the Energy Sector, as

the reduction of natural gas prices favours the competitiveness

of the Group’s thermal plants, especially regarding the merit to

order compared to the Lignite fired plants. In addition, PROTER-

GIA is expected to continue increasing its share in the retail elec-

tricity market, while it also keeps up with the implementation of

its investment plan in new RES projects. In this context, the En-

ergy Sector is expected to have an increased contribution in the

Group’s consolidated financial results for 2016.