Annual Financial Report for the period from1st of January to the 31st of December 2013

105

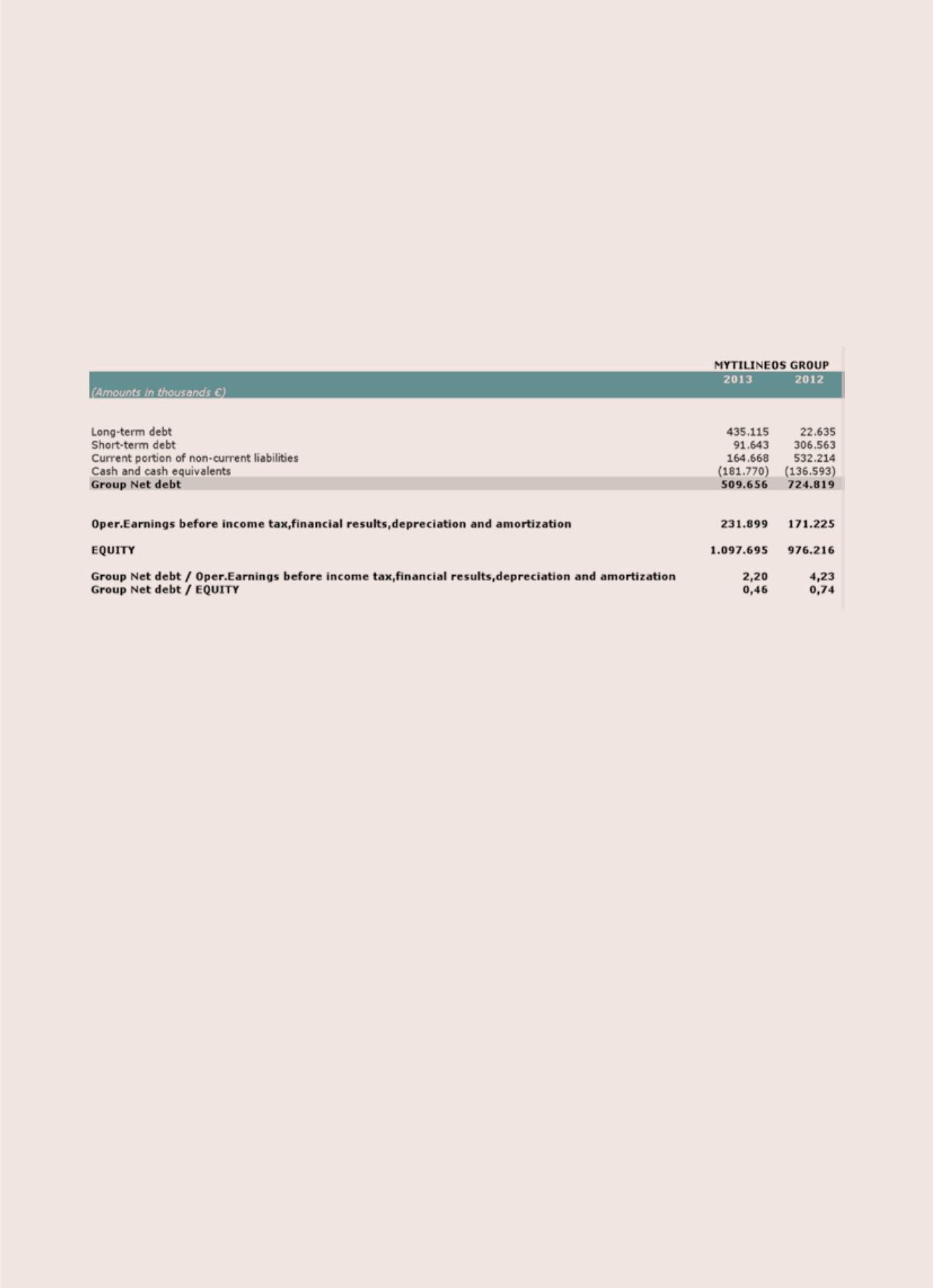

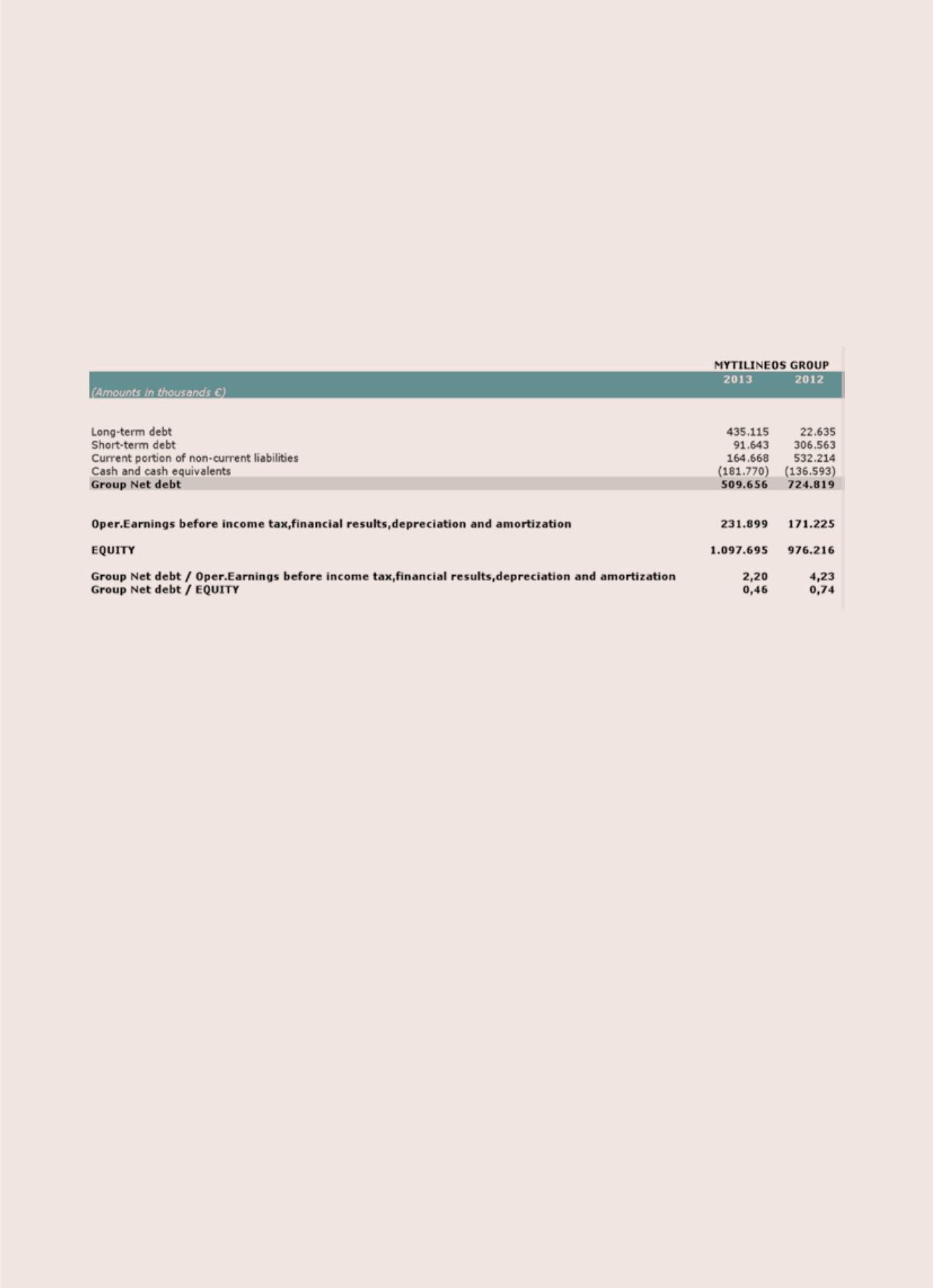

4.4 Capital Management

The primary objective of the Group’s capital management is to ensure the continuous smooth operation of its

business activities and the achievement of its growth plans combined with an acceptable credit rating. For the

purpose of capital management, the Group monitors the ratios “Net Debt to EBITDA” and “Net Debt to Equity”.

As net debt, the Group defines interest bearing borrowings minus cash and cash equivalents. The ratios are

managed in such a way in order to ensure the Group a credit rating compatible with its strategic growth.

The table below presents ratio results for the years December 31, 2013 and 2012 respectively:

The Company does not manage its capital on Company level but only on a Group level.

The Group, because of bank loans, has the obligations as the ratio of net debt to equity is less than one.

4.5 Market Risk

(i) Foreign Exchange Risk

The Group is activated in a global level and consequently is exposed to foreign exchange risk emanating mainly

from the US dollar. This kind of risk mainly results from commercial transactions in foreign currency as well

as net investments in foreign entities. For managing this type of risk, the Group Treasury Department enters

into derivative or non derivative financial instruments with financial institutions on behalf and in the name of

group companies.

In Group level these financial instruments are characterized as exchange rate risk hedges for certain assets,

liabilities or foreseen commercial transactions.

(ii) Price Risk

The Group’s earnings are exposed to movements in the prices of the commodities it produces, which are

determined by the international markets and the global demand and supply.

The Group is price risk from fluctuations in the prices of variables that determine either the sales and/or the

cost of sales of the group entities (i.e. products’ prices (LME), raw materials, other cost elements etc.). The

Group’s activities expose it to the fluctuations of the prices of Aluminium (AL), Zinc (Zn), Lead (Pb) as well as

to Fuel Oil as a production cost.

Commodity price risk can be reduced through the negotiation of long term contracts or through the use of

financial derivatives.