106

(iii) Interest rate risk.

Group’s interest bearing assets comprises only of cash and cash equivalents. Additionally, the Group maintains

its total bank debt in products of floating interest rate. In respect of its exposure to floating interest payments,

the Group evaluates the respective risks and where deemed necessary considers the use of appropriate

interest rate derivatives. The policy of the Group is to minimize interest rate cash flow risk exposures on long-

term financing.

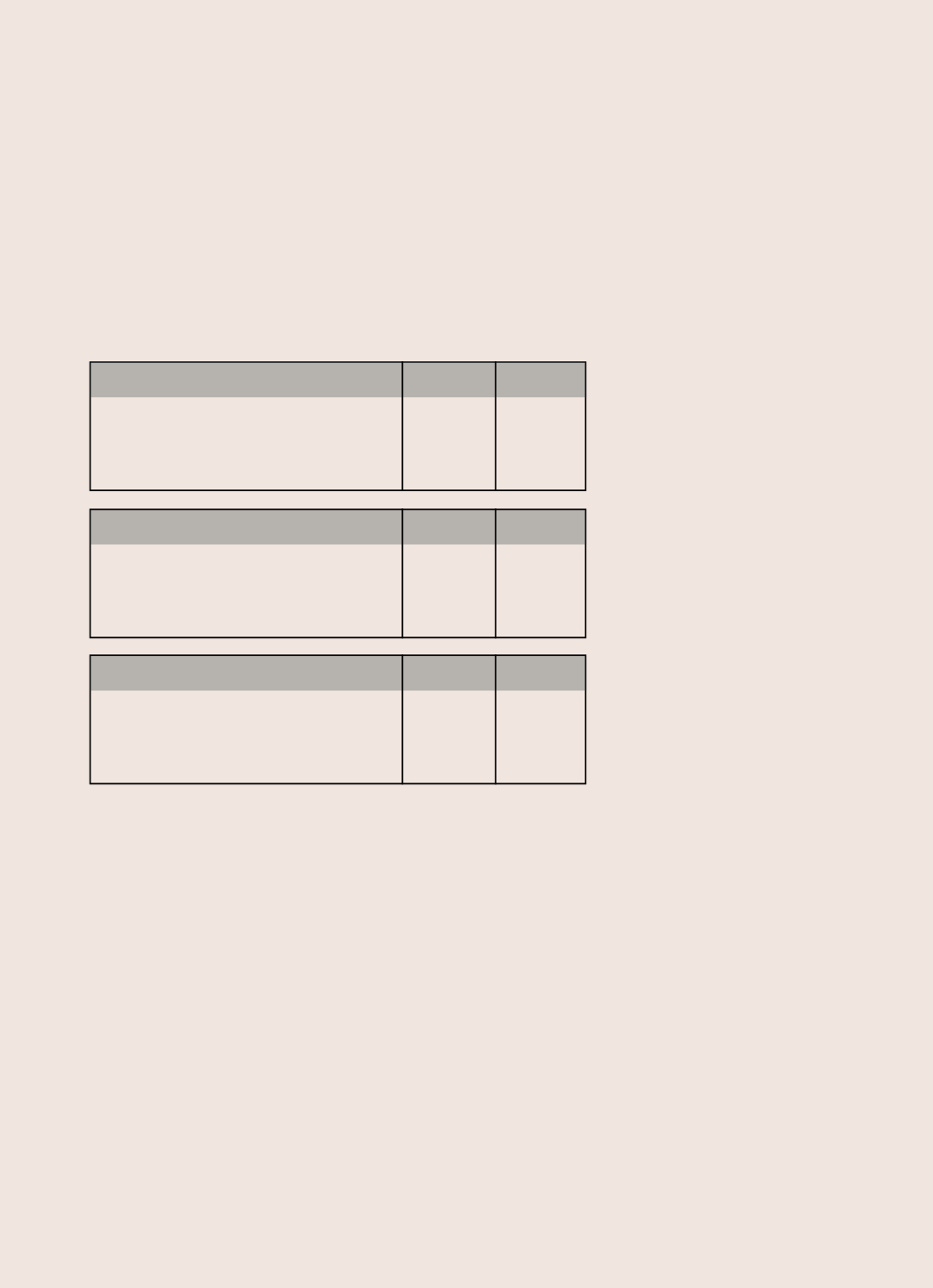

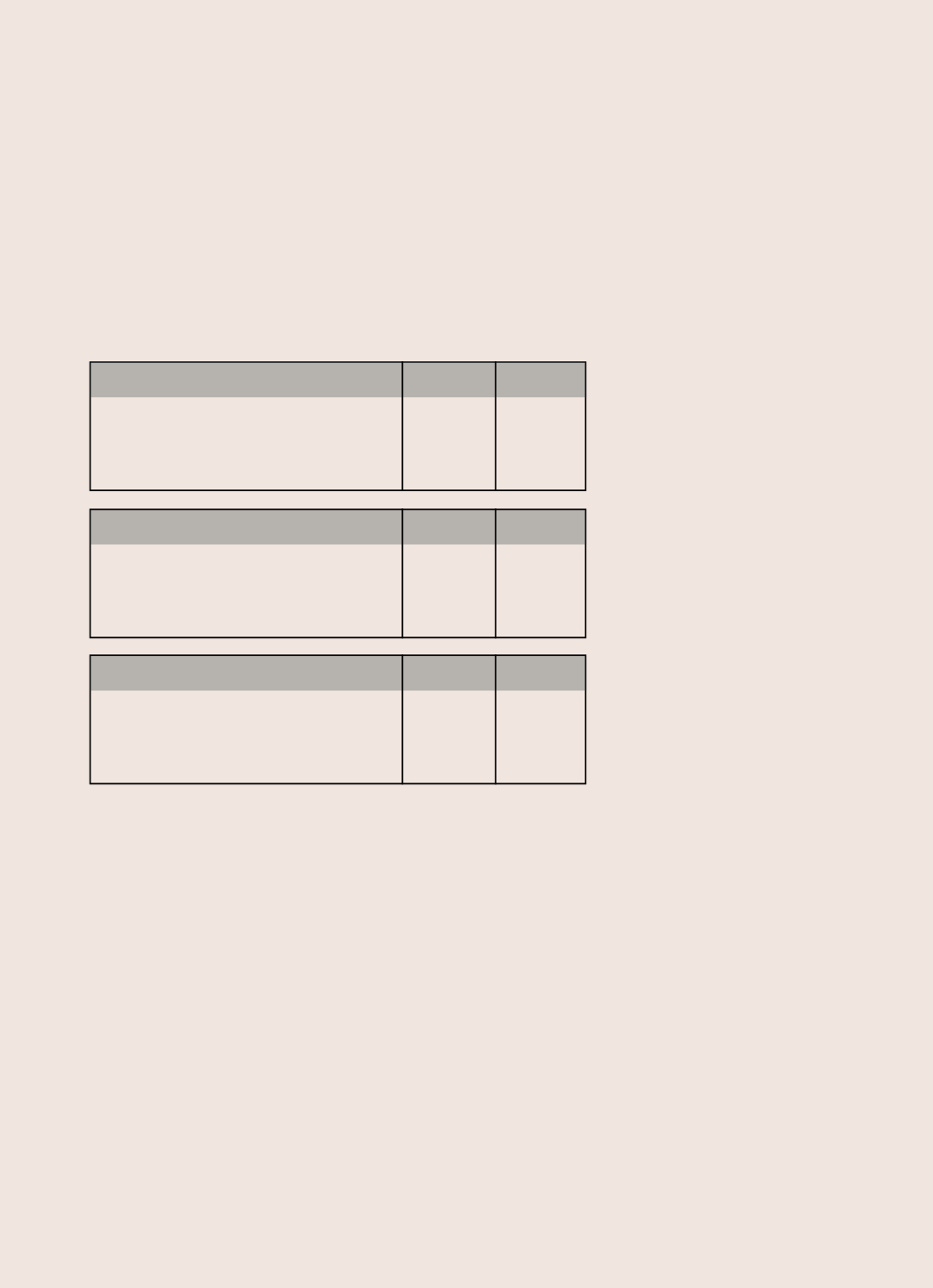

Effects and Sensitivity Analysis

The effects of the above risks at the Group’s operating results, equity, and net profitability are presented in the

table below:

LME AL (Aluminium)

$/t

+50

-50

EBITDA

m. €

6,5

-6,5

Net Profit

m. €

5,2

-5,2

Equity

m. €

5,2

-5,2

Exchange Rate €/$

€/$

-0,05

+0,05

EBITDA

m. €

10,5

-9,7

Net Profit

m. €

8,4

-7,8

Equity

εκ. €

8,4

-7,8

LNG Price

€/MWh

-5

+5

EBITDA

εκ. €

15,73

-15,73

Καθαρά Αποτελέσματα εκ. €

12,6

-12,6

Ίδια Κεφάλαια

m. €

12,6

-12,6

It is noted that an increase of five (5) basis points presume a decrease of 3.88 mil. € on net results and Equity.

The Group’s exposure in price risk and therefore sensitivity may vary according to the transaction volume and

the price level. However, the above sensitivity analysis is representative for the Group exposure in 2013.

4.6 Credit Risk

The Group has no significant concentrations of credit risk with any single counter party. Credit risk arises from

cash and cash equivalents, derivative financial instruments and deposits with banks and financial institutions,

as well as credit exposures to wholesale customers.

Concerning trade accounts receivables, the Group is not exposed to significant credit risks as they mainly

consist of a large, widespread customer base. However, the atypical conditions that dominate the Greek market

and several other markets in Europe are forcing the Group to constantly monitor its business claims and also

to adopt policies and practices to ensure that such claims are collected. By way of example, such policies and

practices include insuring credits where possible; pre-collection of the value of product sold to a considerable