108

The group monitors the developments regarding this draft law and will recognize the appropriate impact on the

results of the year 2014. Said impact is to be crystalized after the voting of the final text of the Law, following

the assessment of comments obtained during the process of public consultation of the draft law, comments

which were in total negative.

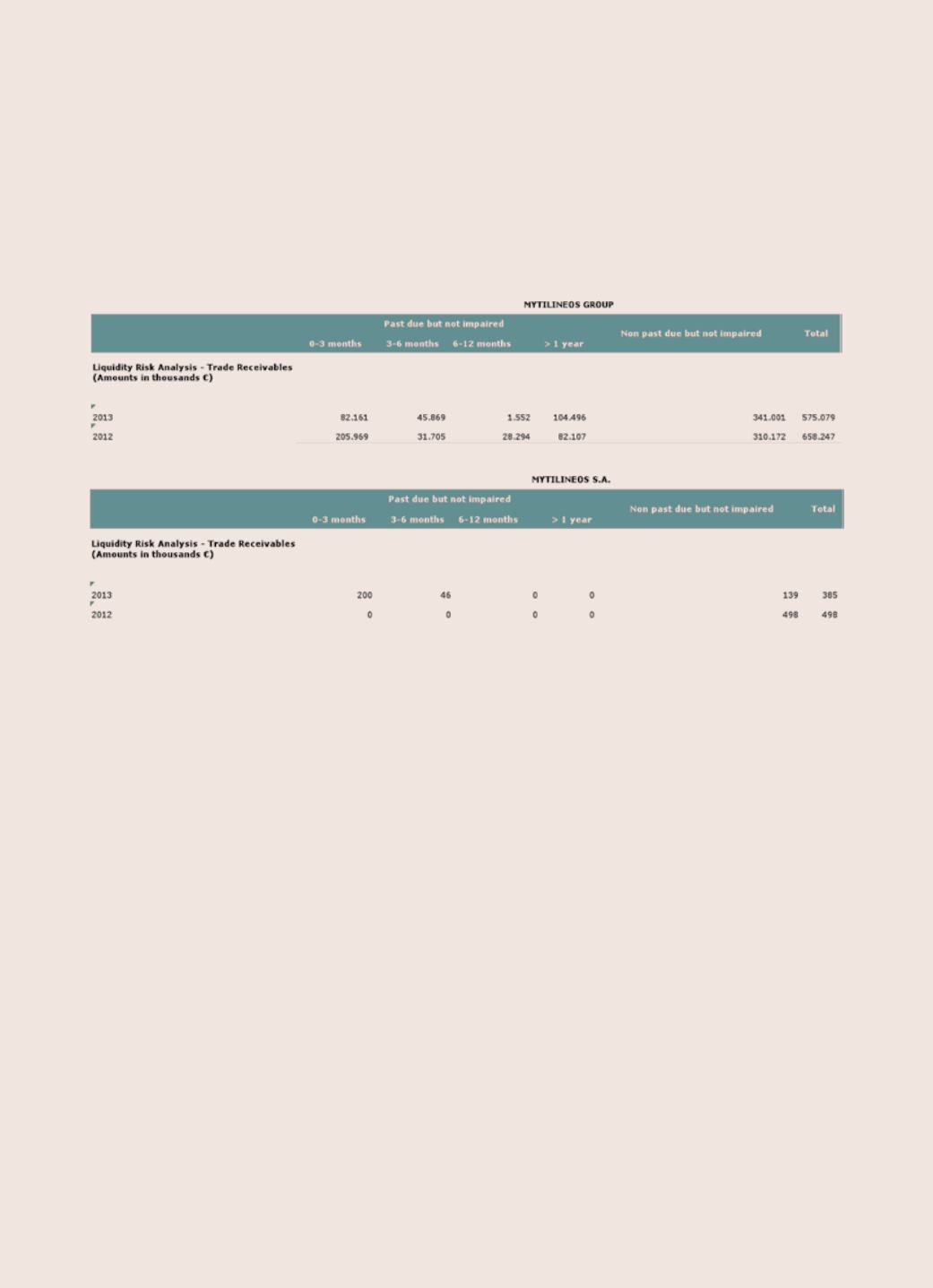

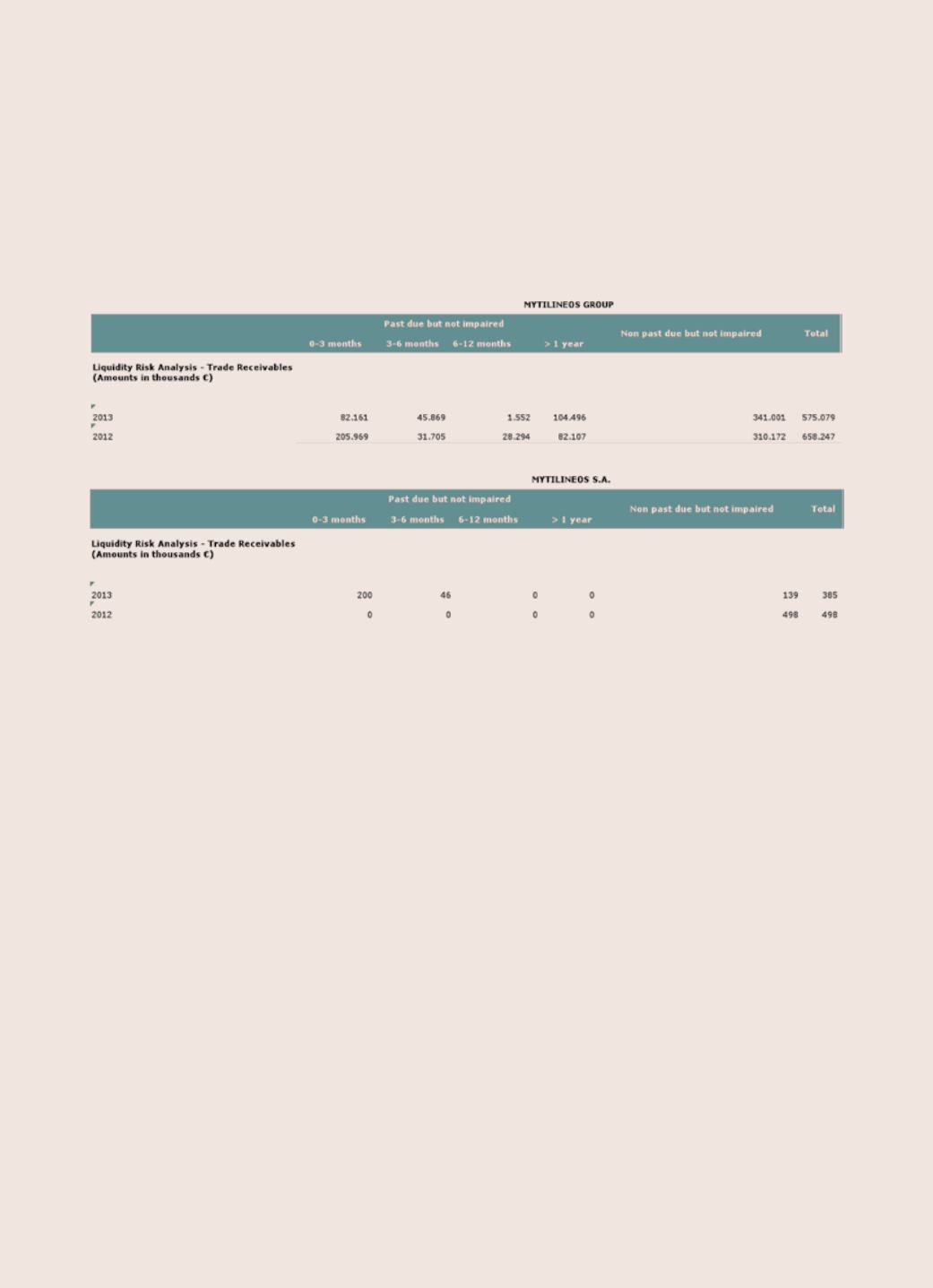

The tables below summarize the maturity profile of the Group’s financial assets as at 31.12.2013 and 31.12.2012

respectively:

4.7 Liquidity Risk

Liquidity risk is related with the Group’s need for the sufficient financing of its operations and development.

The relevant liquidity requirements are the subject of management through the meticulous monitoring of

debts of long term financial liabilities and also of payments made on a daily basis.

On 31/12/2013, the positive balance between Group’s Working Capital and Short-Term Liabilities secures the

adequate funding of the Parent Company.

The Group ensures that there is sufficient available credit facilities to be able to cover its short-term business

needs, after the calculation of cash flows arising from the operation as well as cash and cash equivalents

which are held. The funds for long-term liquidity needs ensured by a sufficient amount of loanable funds and

the ability to sell long-term financial assets.

The tables below summarize the maturity profile of the Group’s financial liabilities as at 31.12.2013 and

31.12.2012 respectively: