36

37

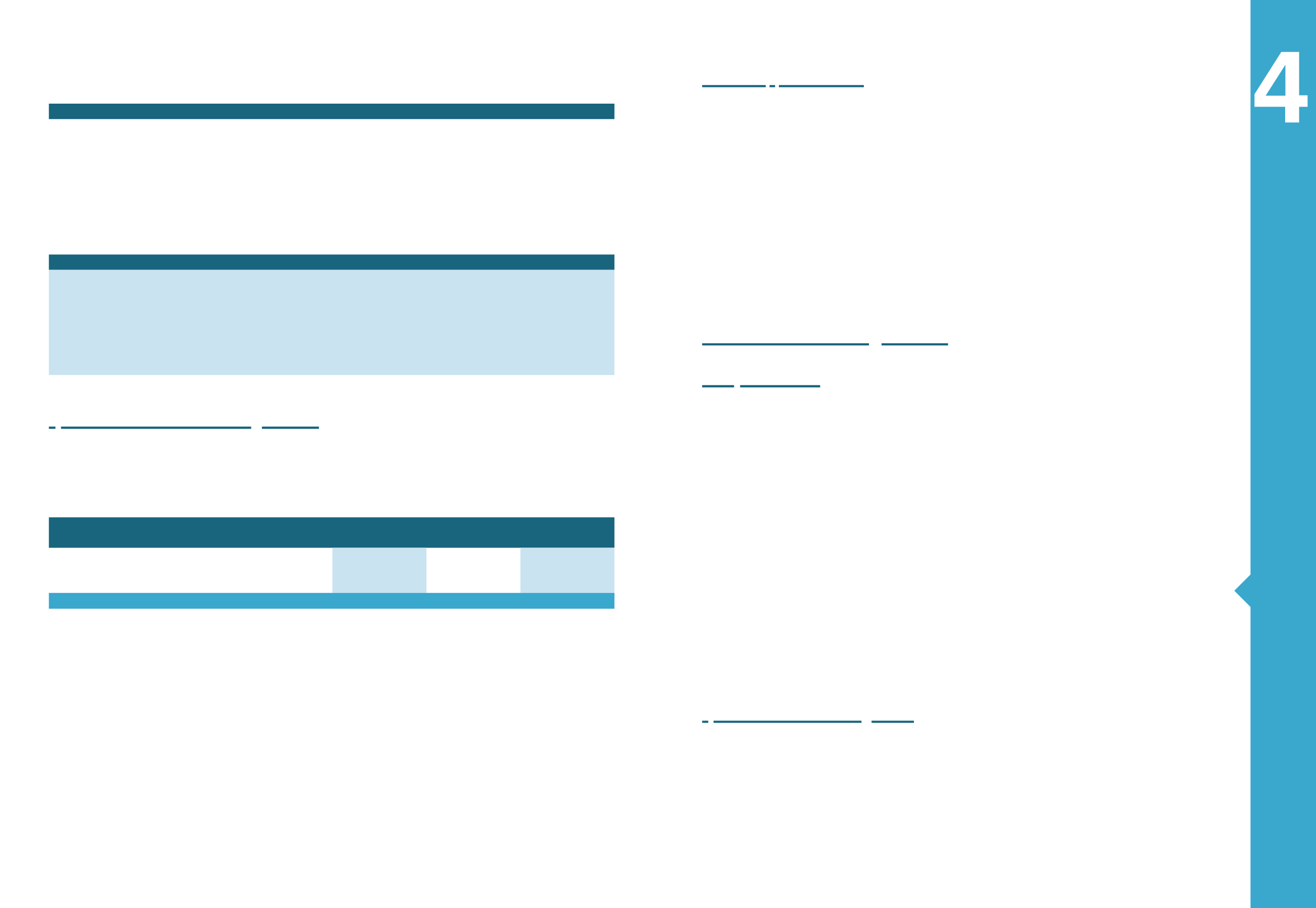

Interim Financial Statements

(Amounts in thousands

€

)

Metallurgy Constructions Energy

Others Total Segment

30/06/2016

Assets

896.176

1.038.010

1.079.840

(97.354)

2.916.672

Consolidated assets

896.176

1.038.010

1.079.840

(97.354)

2.916.672

Liabilities

614.558

454.423

423.103

186.773

1.678.857

Consolidated liabilities

614.558

454.423

423.103

186.773

1.678.857

(Amounts in thousands

€

)

Metallurgy Constructions Energy

Others Total Segment

31/12/2015

Assets

829.855

1.097.607

1.064.840

(92.898)

2.899.404

Consolidated assets

829.855

1.097.607

1.064.840

(92.898)

2.899.404

Liabilities

637.178

509.848

384.327

137.713

1.669.066

Consolidated liabilities

637.178

509.848

384.327

137.713

1.669.066

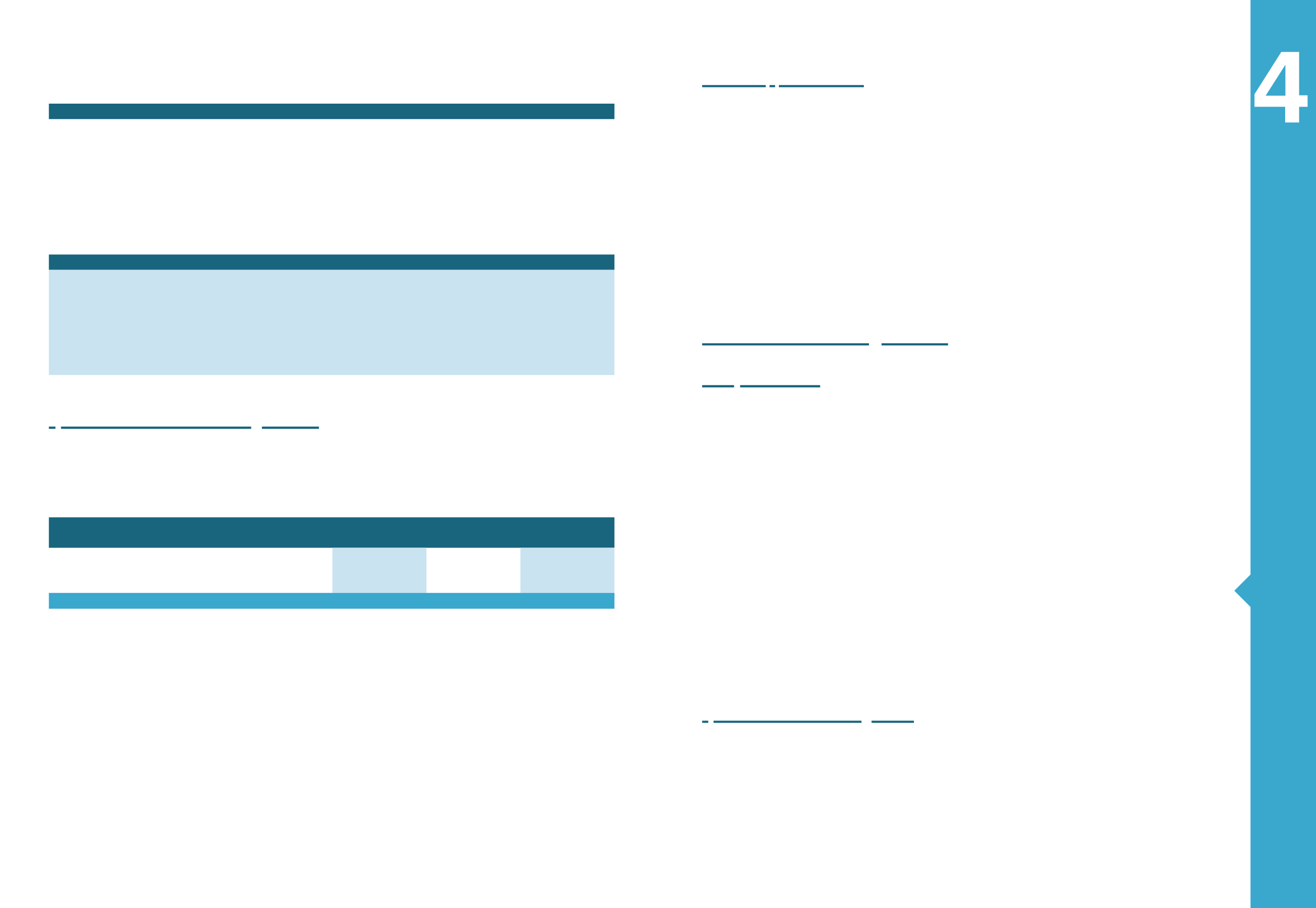

MYTILINEOS GROUP

Sales

Sales

Non current assets Non current assets

(Amounts in thousands

€

)

30/06/2016

30/06/2015

30/06/2016

31/12/2015

Hellas

256.892

230.597

1.518.805

1.487.626

European Union

165.240

197.288

11.117

28.965

Other Countries

213.619

208.646

2.394

2.603

Regional Analysis

635.750

636.531

1.532.316

1.519.194

Segment’s assets and liabilities are as follows:

Geographical Information

The Group’s Sales and its non-current assets (other than financial instruments, investments, deferred tax assets and postemployment ben-

efit assets) are divided into the following geographical areas:

7. Information about MYTILINEOS HOLDINGS S.A.

MYTILINEOS Holdings S.A. is today one of the biggest industrial

Groups internationally, activated in the sectors of Metallurgy, EPC,

Energy, and Defence. The Company, which was founded in 1990 as

a metallurgical company of international trade and participations, is

an evolution of an old metallurgical family business which began its

activity in 1908.

Devoted to continuous growth and progress and aiming to be a leader

in all its activities, the Group promotes through its long presence its

vision to be a powerful and competitive European Group of “Heavy

Industry”.

The group’s headquarters is located in Athens – Maroussi (5-7 Pa-

troklou Str., P.C. 151 25) and its shares were listed in the Athens Stock

Exchange in 1995.

The financial statements for the period ended 30.06.2016 (along with

the respective comparative information for the previous year 2015),

were approved by the Board of directors on 2 August 2016.

8. Additional Information

8.1 Basis for preparation of the financial statements

The accompanying consolidated financial statements that constitute

the Group’s consolidated financial statements for the period from

01.01 to 30.06.2016 have been prepared in accordance with Interna-

tional Financial Reporting Standards (“IFRS”), adopted by the Europe-

an Union, and more specifically with the provisions of IAS 34 “Interim

financial reporting”. Moreover, the consolidated financial statements

have been compiled on the basis of the historic cost principle as is

amended by the readjustment of specific asset and liability items into

market values, the going concern principle and are in accordance with

the International Financial Reporting Standards (IFRS) that have been

issued by the International Accounting Standards Board (IASB) and

their interpretations that have been issued by the International Finan-

cial Reporting Interpretations Committee (IFRIC) of the IASB.

The reporting currency is Euro (currency of the country of the domicile

of the parent Company) and all amounts are reported in thousands

unless stated otherwise.

According to the IFRS, the preparation of the Financial Statements re-

quires estimations during the application of the Company’s account-

ing principles. Important admissions are presented wherever it has

been judged appropriate. The accounting principles, applied by the

Group for the reporting period are consistent with the accounting prin-

ciples applied for fiscal year 2015.

8.2 New Standards, Interpretations, Revisions and

Amendments to existing Standards that are effective

and have been adopted by the European Union

The following amendments of IFRSs have been issued by the Interna-

tional Accounting Standards Board (IASB), adopted by the European

Union, and their application is mandatory from or after 01/01/2016.

Amendments to IFRS 11: “Accounting for Acquisitions of Inter-

ests in Joint Operations” (effective for annual periods starting

on or after 01/01/2016)

In May 2014, the IASB issued amendments to IFRS 11. The amend-

ments add new guidance on how to account for the acquisition of an

interest in a joint operation that constitutes a business and specify the

appropriate acounting treatment for such acquisitions. The amend-

ments do not affect the consolidated Financial Statements.

Amendments to IAS 16 and IAS 38: “Clarifica-

tion of Acceptable Methods of Depreciation

and Amortisation” (effective for annual periods

starting on or after 01/01/2016)

In May 2014, the IASB published amendments to

IAS 16 and IAS 38. IAS 16 and IAS 38 both establish

the principle for the basis of depreciation and amor-

tisation as being the expected pattern of consump-

tion of the future economic benefits of an asset. The

IASB has clarified that the use of revenue-based

methods to calculate the depreciation of an asset

is not appropriate because revenue generated by

an activity that includes the use of an asset gener-

ally reflects factors other than the consumption of

the economic benefits embodied in the asset. The

amendments do not affect the consolidated Finan-

cial Statements.

Amendments to IAS 16 and IAS 41: “Agricul-

ture: Bearer Plants” (effective for annual peri-

ods starting on or after 01/01/2016)

In June 2014, the IASB published amendments that

change the financial reporting for bearer plants. The

IASB decided that bearer plants should be account-

ed for in the same way as property, plant and equip-

ment in IAS 16. Consequently, the amendments

include bearer plants within the scope of IAS 16,

instead of IAS 41. The produce growing on bearer

plants will remain within the scope of IAS 41. The

amendments do not affect the consolidated Finan-

cial Statements.

Amendments to IAS 27: “Equity Method in

Separate Financial Statements” (effective for

annual periods starting on or after 01/01/2016)

In August 2014, the IASB published narrow scope

amendments to IAS 27. Under the amendments,

entities are permitted to use the equity method to

account for investments in subsidiaries, joint ven-

tures and associates in their separate Financial

Statements – an option that was not effective prior

to the issuance of the current amendments. The

amendments do not affect the consolidated Finan-

cial Statements.

Annual Improvements to IFRSs – 2012-2014

Cycle (effective for annual periods starting on

or after 01/01/2016)

In September 2014, the IASB issued Annual Im-

provements to IFRSs - 2012-2014 Cycle, a collection

of amendments to IFRSs, in response to four issues

addressed during the 2012-2014 cycle. The amend-

ments are effective for annual periods beginning on

or after 1 January 2016, although entities are permit-

ted to apply them earlier. The issues included in this

cycle are the following: IFRS 5: Changes in methods

of disposal, IFRS 7: Servicing Contracts and Appli-

cability of the amendments to IFRS 7 to condensed

interim financial statements, IAS 19: Discount rate:

regional market issue, and IAS 34: Disclosure of in-

formation “elsewhere in the interim financial report”.

The amendments do not affect the consolidated Fi-

nancial Statements.