52

53

Interim Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

30/06/2016

31/12/2015

30/06/2016

31/12/2015

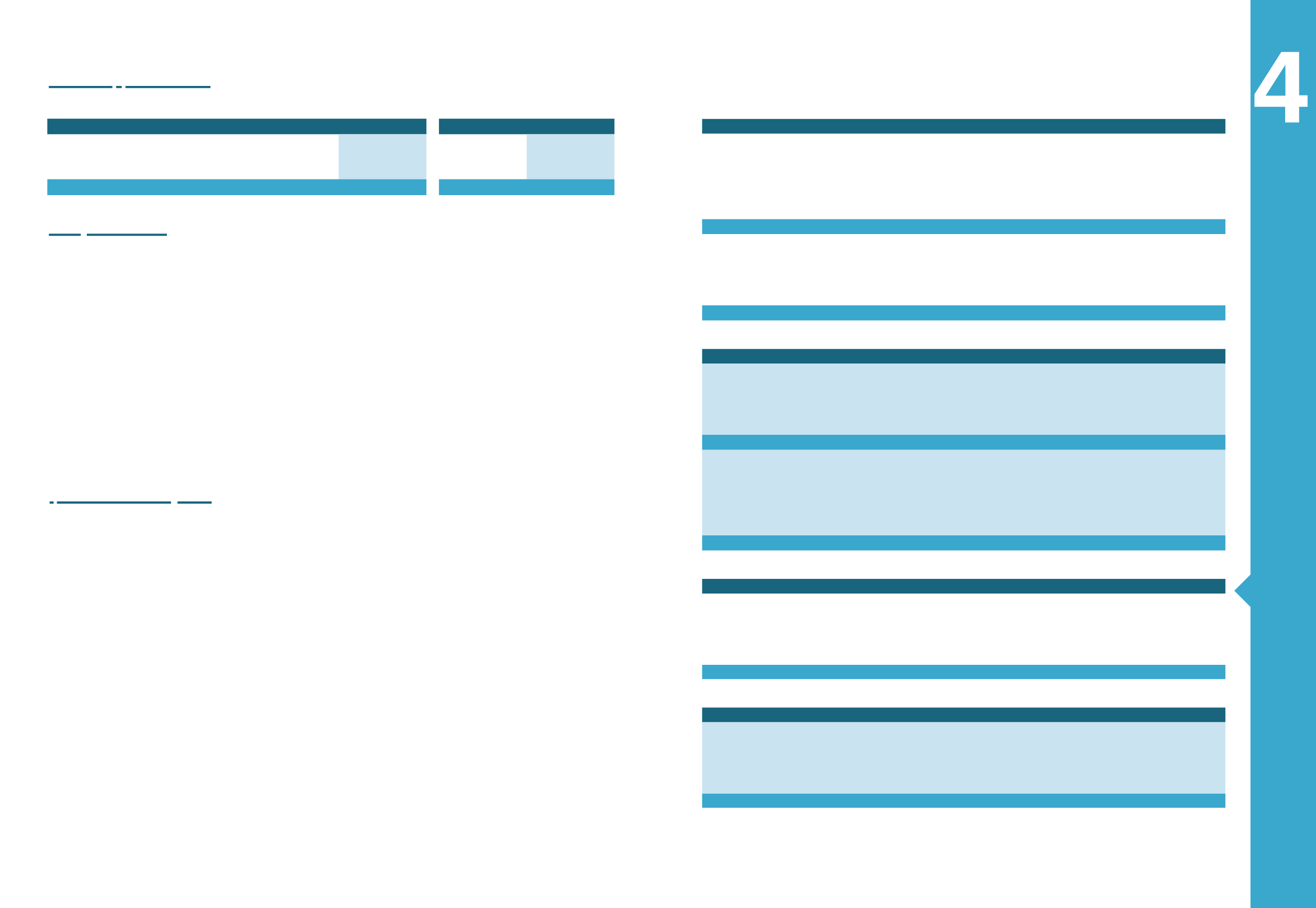

Suppliers

254.283

305.295

13.891

17.994

Customers’ Advances

64.824

61.277

-

-

Liabilities to customers for project implementation

159.216

200.719

-

-

Total

478.323

567.291

13.891

17.994

8.21 Trade Creditors

8.22 Share Capital

On 18 May 2015, the 1st Repeat Annual General Meeting of the Company’s Shareholders was held. With 60,816,650 valid votes cast rep-

resenting 52.02% of the paid-up share capital with right to vote, the Meeting approved unanimously Item 4 on the original Agenda concern-

ing the decrease of the Company’s share capital by the amount of eleven million six hundred and ninety-one thousand five hundred and

eighty-six euro and twenty cents (

€

11,691,586.20) by means of a decrease of the nominal value of each share from one euro and seven

cents (

€

1.07) to ninety-seven eurocents (

€

0.97), with reimbursement to the shareholders of the amount of the decrease in the sum of ten

eurocents (

€

0.10) per share, and the amendment of article 5 of the Company’s Articles of Association accordingly.

On 09.06.2015, Decision no. 62296/09.06.2015 of the Ministry of Economy, Infrastructure, Shipping & Tourism (ΑΔΑ: ΩΔΓΜ465ΦΘΘ-ΔΓΡ),

approving the amendment of article 5 of the Company’s Articles of Association, was registered with the General Commercial Register

(GEMI), under Registration Number 370695. The Stock Markets Steering Committee, in its meeting of 15/10/2015, was informed of the

decrease as above of the nominal value of the Company’s shares and of the reimbursement of capital by payment to the shareholders of

the amount of ten eurocents (

€

0.10) per share.

Following the above, as of 19/10/2015 the Company’s shares were traded in the Athens Exchange at the new nominal value of Euro 0.97

per share and without the right to participate in the reimbursement of capital by means of payment to the shareholders of the amount of

ten eurocents (

€

0.10) per share. As of the same date, the starting price of the Company’s shares in the Athens Exchange was determined

in accordance with the Athens Exchange Rule Book, in combination with Decision no. 26 of the ATHEX Board of Directors, as in force. The

beneficiaries entitled to the capital return in the form of payments in the sum of Euro 0.10 per share were the persons registered as share-

holders in the Dematerialised Securities System (DSS) on 20/10/2015.

The capital return was settled on the 23/10/2015.

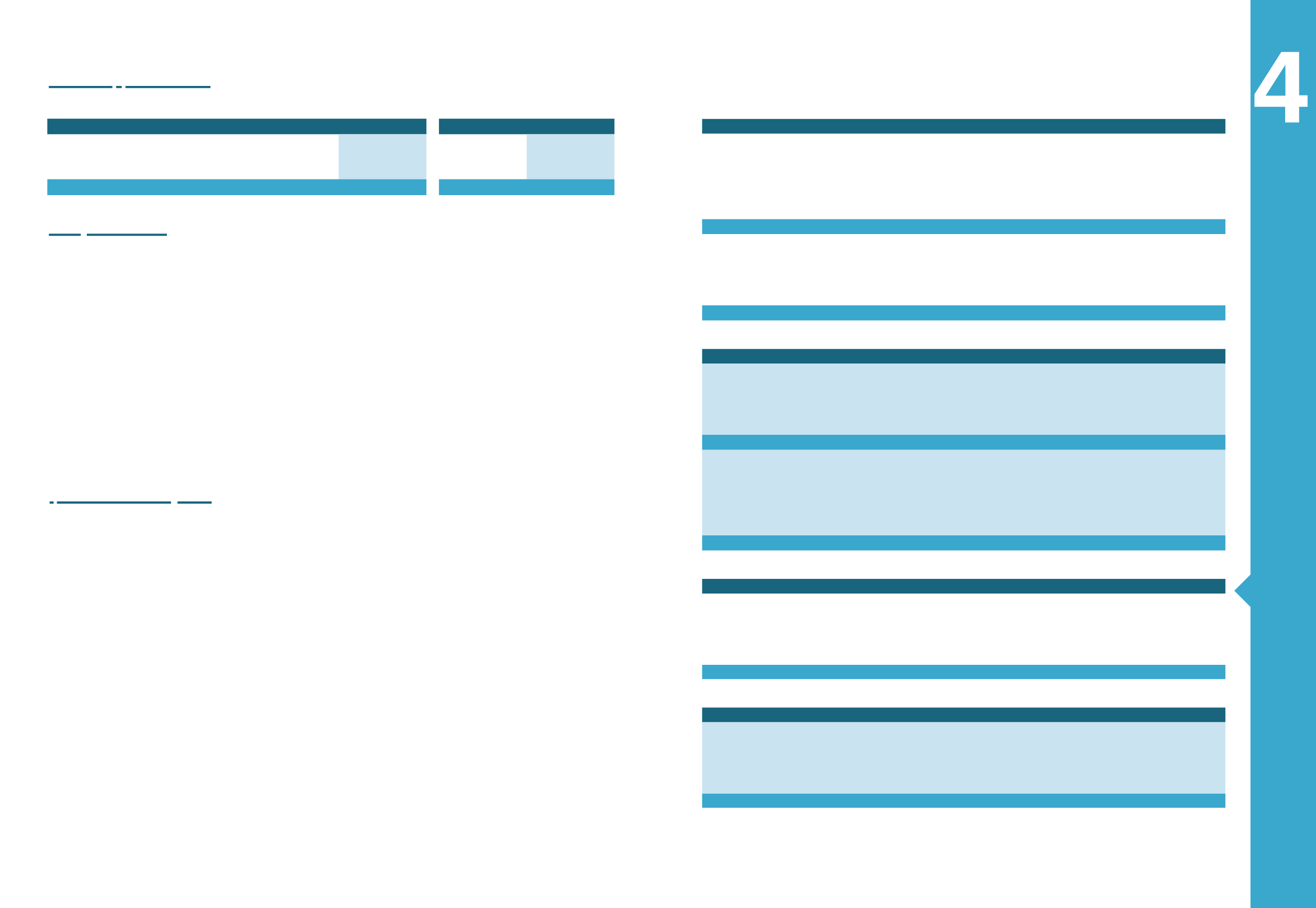

8.23 Financial Assets – Financial Liabilities

The following table presents financial assets and liabilities measured at fair value in the statement of financial position in accordance with

the fair value hierarchy. This hierarchy groups financial assets and liabilities into three levels based on the significance of inputs used in

measuring the fair value of the financial assets and liabilities. The fair value hierarchy has the following levels:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- Level 2: inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or

indirectly (i.e. derived from prices); and

- Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The level within which the financial asset or liability is classified is determined based on the lowest level of significant input to the fair value

measurement.

The Group’s financial assets and liabilities measured at fair value in the statement of financial position are grouped into the fair value hier-

archy for 30/06/2016 and 31/12/2015 as follows:

MYTILINEOS GROUP

(Amounts in thousands

€

)

30/06/2016 Level 1 Level 2 Level 3

Financial Assets

Financial assets at fair value through profit or loss

Stock Shares

1.160

1.160

-

-

Bank Bonds

58

58

-

-

Financial Assets Available For Sale

1.270

1.150

8

112

Commodity Futures

1.582

-

1.582

-

Financial Assets

4.070

2.367

1.591

112

Financial Liabilities

Foreign Exchange Swap Contracts (Swaps)

3.402

-

3.402

-

Foreign Exchange Contracts For Cash Flow Hedging (Forward)

783

-

783

-

Commodity Options

5.337

-

5.337

-

Financial Liabilities

9.521

-

9.521

-

MYTILINEOS GROUP

(Amounts in thousands

€

)

31/12/2015 Level 1 Level 2 Level 3

Financial Assets

Financial assets at fair value through profit or loss

Stock Shares

1.020

1.020

-

-

Bank Bonds

57

57

-

-

Financial Assets Available For Sale

2.253

2.132

8

112

Financial Assets

3.330

3.209

9

112

Financial Liabilities

Foreign Exchange Swap Contracts (Swaps)

3.198

-

3.198

-

Foreign Exchange Contracts For Cash Flow Hedging (Forward)

1

-

1

-

Foreign Exchange Contracts (Forward)

(11)

-

(11)

-

Options

205

-

205

-

Financial Liabilities

3.392

-

3.392

-

MYTILINEOS S.A.

(Amounts in thousands

€

)

30/06/2016 Level 1 Level 2 Level 3

Financial Assets

Financial assets at fair value through profit or loss

Stock Shares

30

30

-

-

Bank Bonds

58

58

-

-

Financial Assets Available For Sale

112

-

-

112

Financial Assets

200

88

-

112

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015 Level 1 Level 2 Level 3

Financial Assets

Financial assets at fair value through profit or loss

Stock Shares

93

93

-

-

Bank Bonds

57

57

-

-

Financial Assets Available For Sale

112

-

-

112

Financial Assets

262

150

-

112