54

55

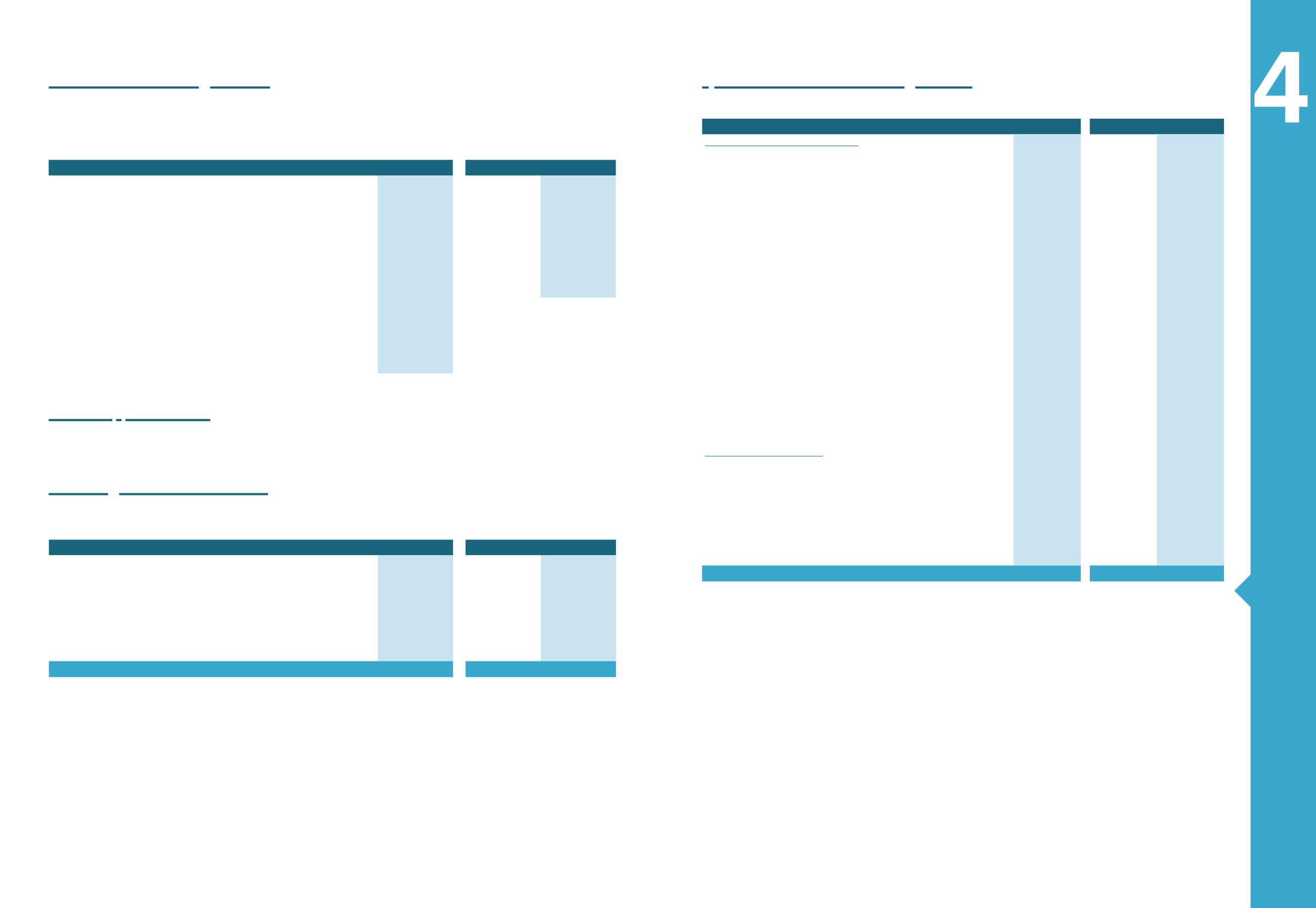

Interim Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

1/1-30/06/2016 1/1-30/06/2015 1/1-30/06/2016 1/1-30/06/2015

Equity holders of the parent

12.437

32.826

3.624

7.647

Weighted average number of shares

116.916

116.916

116.916

116.916

Basic earnings per share

0,1064

0,2808

0,0310

0,0654

Continuing Operations (Total)

Equity holders of the parent

12.966

33.751

3.624

7.647

Weighted average number of shares

116.916

116.916

116.916

116.916

Basic earnings per share

0,1109

0,2887

0,0310

0,0654

Discontinuing Operations (Total)

Equity holders of the parent

(529)

(925)

Weighted average number of shares

116.916

116.916

Basic earnings per share

(0,0045)

(0,0079)

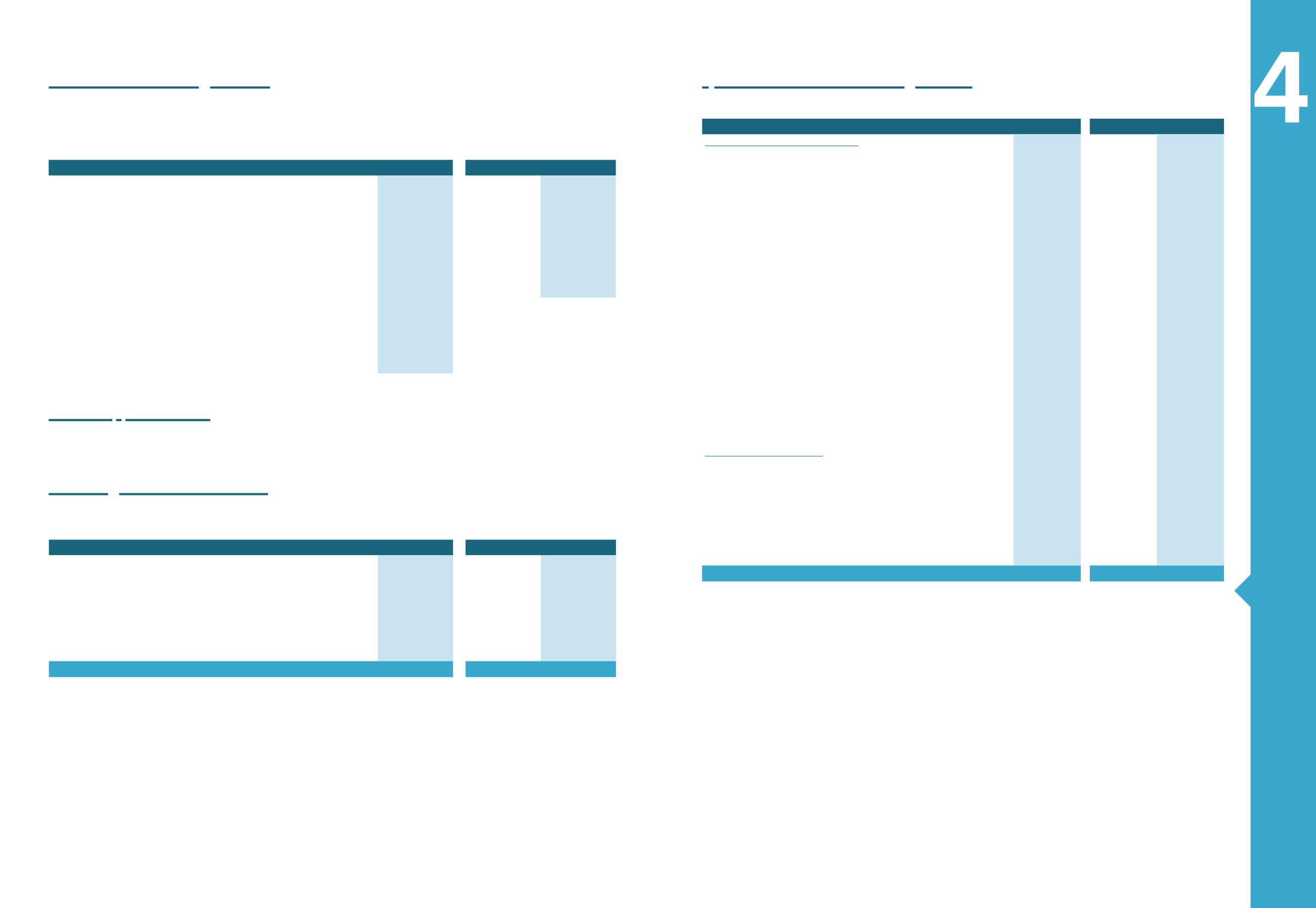

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

30/06/2016

30/06/2015

30/06/2016

30/06/2015

Short term employee benefits

- Wages and Salaries and BOD Fees

8.245

10.653

1.233

1.632

- Insurance service cost

317

306

132

129

8.562

10.959

1.365

1.761

Pension Benefits:

- Defined benefits scheme

-

2

-

-

- Defined contribution scheme

15

3

-

-

Total

8.578

10.964

1.365

1.761

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

1/1-30/06/2016 1/1-30/06/2015 1/1-30/06/2016 1/1-30/06/2015

Cash flows from operating activities

Profit for the period

24.262

45.636

3.624

7.647

Adjustments for:

Tax

10.076

14.883

(1.534)

(1.871)

Depreciation of property,plant and equipment

32.201

25.512

154

155

Depreciation of intangible assets

3.294

2.900

23

16

Impairments

149

-

-

-

Provisions

(719)

(1.554)

-

(1.100)

Income from reversal of prior year’s provisions

-

(22)

-

-

Profit/Loss from sale of tangible assets

(60)

69

-

-

Profit/Loss from fair value valuation of investment property

-

(44)

-

-

Profit/Loss from fair value valuation of financ.assets at fair

value through PnL

2.826

887

63

(40)

Profit/Loss from sale of held-for-sale financial assets

-

22

-

-

Interest income

(1.221)

(1.808)

(170)

(3)

Interest expenses

26.136

26.296

3.974

8.474

Dividends

-

-

(4.617)

(14.463)

Grants amortization

(869)

(871)

-

-

Parent company’s portion to the profit of associates

(153)

(218)

-

-

Exchange differences

1.405

(572)

(405)

(2.008)

73.064

65.479

(2.512)

(10.841)

Changes in Working Capital

(Increase)/Decrease in stocks

89.448

(1.212)

11

-

(Increase)/Decrease in trade receivables

(3.211)

156.103

2.815

3.442

(Increase)/Decrease in other receivables

5.316

(990)

-

-

Increase / (Decrease) in liabilities

(86.943)

(264.614)

(10.554)

3.171

Provisions

-

(18)

-

-

Pension plans

(1.117)

(1.678)

25

12

3.493

(112.410)

(7.703)

6.625

Cash flows from operating activities

100.819

(1.294)

(6.591)

3.431

8.24 Earnings per Share

Earnings per share have been calculated on the total weighted average number of common and preference shares excluding the average

number of treasury shares.

8.25 Number of employees

The number of employees at the end of the current reporting period amounts for the Group to 1.886 and for the Company to 71. Accordingly,

on 30/06/2015, amounted for the amounts for the Group to 1.808 and for the Company to 75.

8.26 Management remuneration and fringes

No loans have been given to members of BoD or other management members of the Group (and their families).

8.27 Cash Flows from Operating Activities