42

43

Interim Financial Statements

8.5.1 Foundation & Acquisition

-

On 07/06/2016, the 50% Group’s subsidiary company, METKA S.A., founded

METKA POWER WEST AFRICA LIMITED in Nigeria, in which she’s a share-

holder of 100%. The incorporation of the foresaid company in the consoli-

dated financial statements was made using the full consolidation method.

Since the newly founded company hasn’t started its operation yet, it has no

contribution on the Group’s Consolidated Financial Results.

-

In April 2016, the 100% Group’s subsidiary company ALUMINIUM OF

GREECE S.A., has acquired the 100% of the subsidiary company REYCOM

RECYCLING (REYCOM) in Romania.

8.5.2 Other changes

-

On 11/05/2016, the Annual General Meeting of the company’s Shareholders

resolved, among others, to change the company’s business name to “MET-

KA INDUSTRIAL-CONSTRUCTION S.A.”, with the distinctive title “METKA”.

8.6 Significant information

•

On 31/12/2014 the transitional Capacity Assurance mechanism expired. A

new Flexibility Remuneration Mechanism, was expected to come into force

from 1/1/2015.However and despite the fact that the public consultation pro-

cess had been completed from January 2015, the final information required

by the DG Competition of the EU were sent with a significant delay (Septem-

ber 2015) by the Greek authorities. Said delay had as result the lapse of time

required to set the new mechanism in force for the year 2015.Consequently,

the EBITDA of Mytilineos Group for the 1st half of 2015, are reduced by the

amount of approximately 22.3 mio

€

.

The transitional Flexibility Remuneration Mechanism was enacted and en-

tered into force from 1.5.2016, following the decision of the European Com-

mission No. C (2016) 1791 final dated 31.3.2016, through the article 150 of

L. 4389/2016 in accordance to the provisions set in the 3rd Memorandum

between the Hellenic Republic and the Institutions, as embodied in the L.

4336/2015.

According to the provisions of the aforementioned article, the duration of the

new transitional Flexibility Remuneration Mechanism is set for twelve months,

meaning up to 30.4.2017 (unless a new permanent Capacity and/or Flexibility

Mechanism comes into force at an earlier date).

The remuneration of the transitional Flexibility Mechanism has been set to

forty five thousand (45.000) euros per MW of net installed capacity with a cap

of fifteen million (15.000.000) euros per power plant.

The consultation held by the Regulating Authority for Energy (RAE) regarding

the implementation of the transitional Flexibility Remuneration Mechanism

was completed as of 18.7.2016. The Law expressly stipulates that the remu-

neration provided by said mechanism is guaranteed from 1.5.2016, but will

be collected from the entitled producers after they have been registered in

the Flexible Plants Registry. It is noted that if said mechanism was put into

force from 1.1.2016 (instead of 1.5.2016), the EBITDA of Mytilineos Group

would have been increased by 12,6mil

€

.

•

The shareholder of the Romanian company “REYCOM RECYCLING S.A.”

(“Reycom”) and the Board of Directors of the Greek company “ALUMINIUM

OF GREECE INDUSTRIAL AND COMMERCIAL SOCIETE ANONYME ICSA”

(“AoG”) respectively resolved on 30/05/2016 the merger of Reycom and AoG

by way of AoG (hereinafter the “Absorbing Company”) absorbing Reycom

(hereinafter the “Absorbed Company”).

Τhe Cross Border Merger will strengthen the Ab-

sorbing Company offering AoG the opportunity

to diversify its sources of revenue as well as its

exposure to commodity prices which is currently

concentrated on Aluminium. By being able to

produce Zn and Pb alongside Aluminium, Ab-

sorbing Company will diversify its sources of

revenue at a time that the price of its current

product (Aluminium) is experiencing increased

pressure in the commodity markets.

At the same time, AoG will be able to obtain

valuable know-how in the recycling of metallur-

gical waste thus enhancing its knowledge-base

on environmental compliance in all markets in

which Absorbing Company operates.

•

In June, MYTILINEOS Group and OTE Group

announced a strategic partnership in the retail

electricity market. In this framework, COSMOTE

and Germanos stores enrich their customer

services portfolio with electricity supply from

PROTERGIA, the largest independent electric-

ity producer in Greece. Meanwhile, PROTERGIA

strengthens its points of sale and promotion

network, making its products available across

Greece through more than 450 COSMOTE and

Germanos stores.

•

METKA’s New EPC project in GHANA

METKA S.A. announced the signature of a new

EPC contract with Amandi Energy Limited for a

new power plant in Ghana. The contract signa-

ture took place in London on 11 March 2016.

The project will be executed by METKA in con-

sortium with General Electric, and includes the

engineering, procurement, construction and

commissioning of a 192MW combined cycle

power plant in Takoradi. The plant will be im-

plemented with capability to operate on both

natural gas and light crude oil, and will utilize

the latest advanced version of General Electric’s

well proven 9E gas turbine. The project will be

constructed in 28 months. The contract value for

METKA is approximately $174 million.

8.7 Impairments testing of goodwill

and intangible assets

On 30/06/2016 the Group analyzed the sensitivity

of recoverable amount in relation to a reasonable

or possible change in some of key assumptions

which were disclosed in the financial statements for

the year ended 31 December 2015 (discount rate or

growth rate).

This analysis doesn’t indicate that the Group’s car-

rying amount of Cash Generating Units exceeds the

recoverable amount.

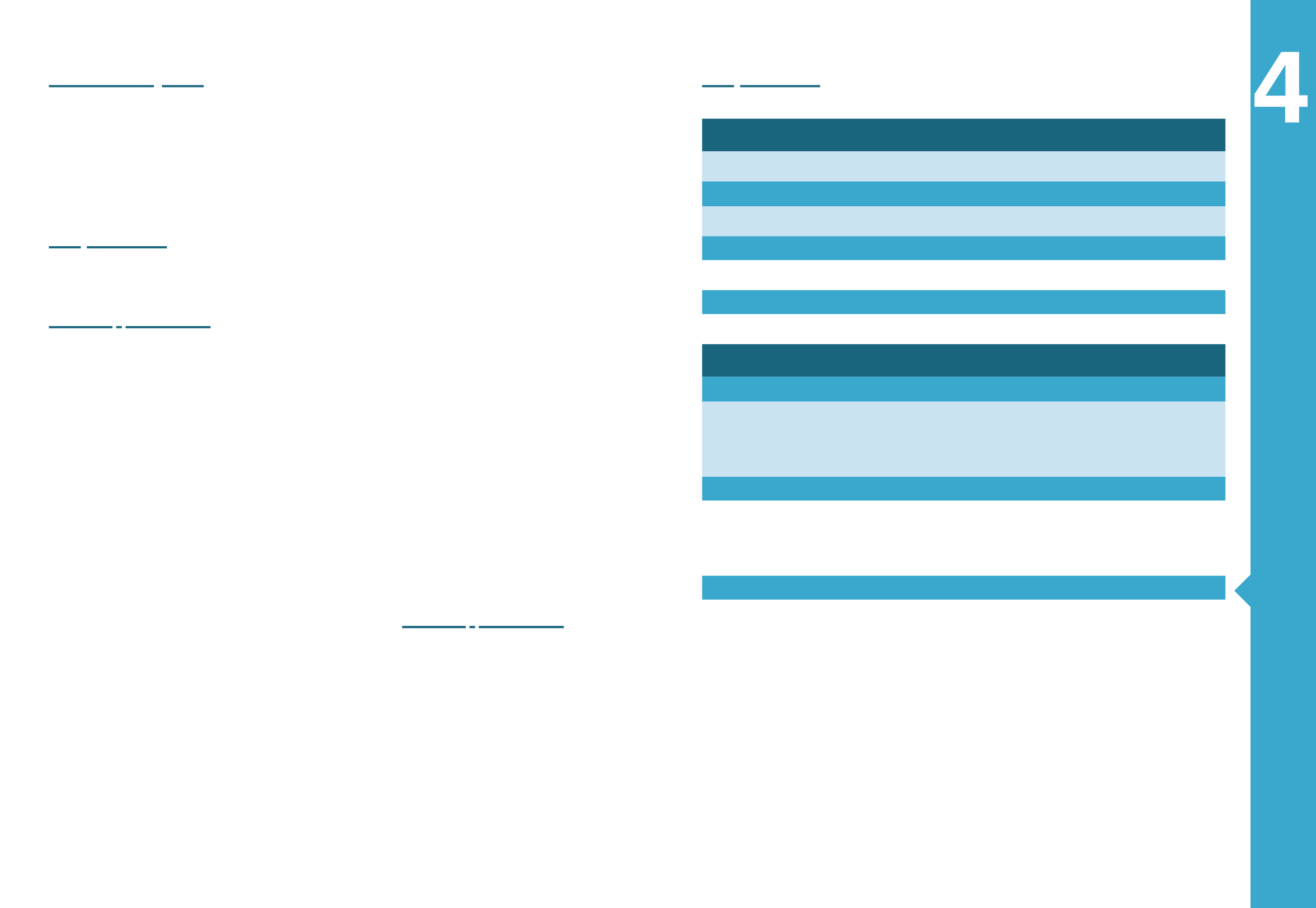

8.8 Tangible Assets

MYTILINEOS GROUP

(Amounts in thousands

€

)

Land &

Buildings

Vehicles &

mechanical

equipment

Furniture and

other

equipment

Tangible

assets under

construction

Total

Gross Book Value

389.660

1.384.596

32.822

41.630

1.848.709

Accumulated depreciation and/or impairment

(79.427)

(681.291)

(24.633)

-

785.352

Net Book Value as at

1/1/2015

310.233

703.305

8.189

41.630

1.063.357

Gross Book Value

398.105

1.417.786

33.839

56.646

1.906.376

Accumulated depreciation and/or impairment

(86.814)

(723.259)

(25.928)

-

(836.002)

Net Book Value as at

31/12/2015

311.291

694.527

7.911

56.646

1.070.375

Gross Book Value

372.586

1.399.141

34.074

91.538

1.897.339

Accumulated depreciation and/or impairment

(66.722)

(720.775)

(26.409)

-

(813.907)

Net Book Value as at

30/06/2016

305.864

678.366

7.664

91.538

1.083.432

(Amounts in thousands

€

)

Land &

Buildings

Vehicles &

mechanical

equipment

Furniture and

other

equipment

Tangible

assets under

construction

Total

Net Book Value as at

1/1/2015

310.233

703.305

8.189

41.630

1.063.357

Additions

3.779

35.843

812

35.264

75.698

Sales - Reductions

(22)

(14.574)

(9)

(384)

(14.989)

Depreciation

(7.411)

(47.219)

(1.402)

-

(56.033)

Reclassifications

2.357

17.160

329

(20.400)

(554)

Net Foreign Exchange Differences

2.356

13

(9)

536

2.896

Net Book Value as at

31/12/2015

311.291

694.527

7.911

56.646

1.070.375

Additions

729

10.507

438

38.299

49.973

Sales - Reductions

(704)

475

(4)

(3.473)

(3.705)

Depreciation

(3.531)

(27.237)

(685)

-

(31.454)

Reclassifications

(1.602)

96

6

(110)

(1.610)

Net Foreign Exchange Differences

(321)

-

(1)

-

(322)

Net Book Value as at

30/06/2016

305.864

678.366

7.664

91.538

1.083.432