Annual Financial Report for the period from 1st of January to the 31st of December 2012

35

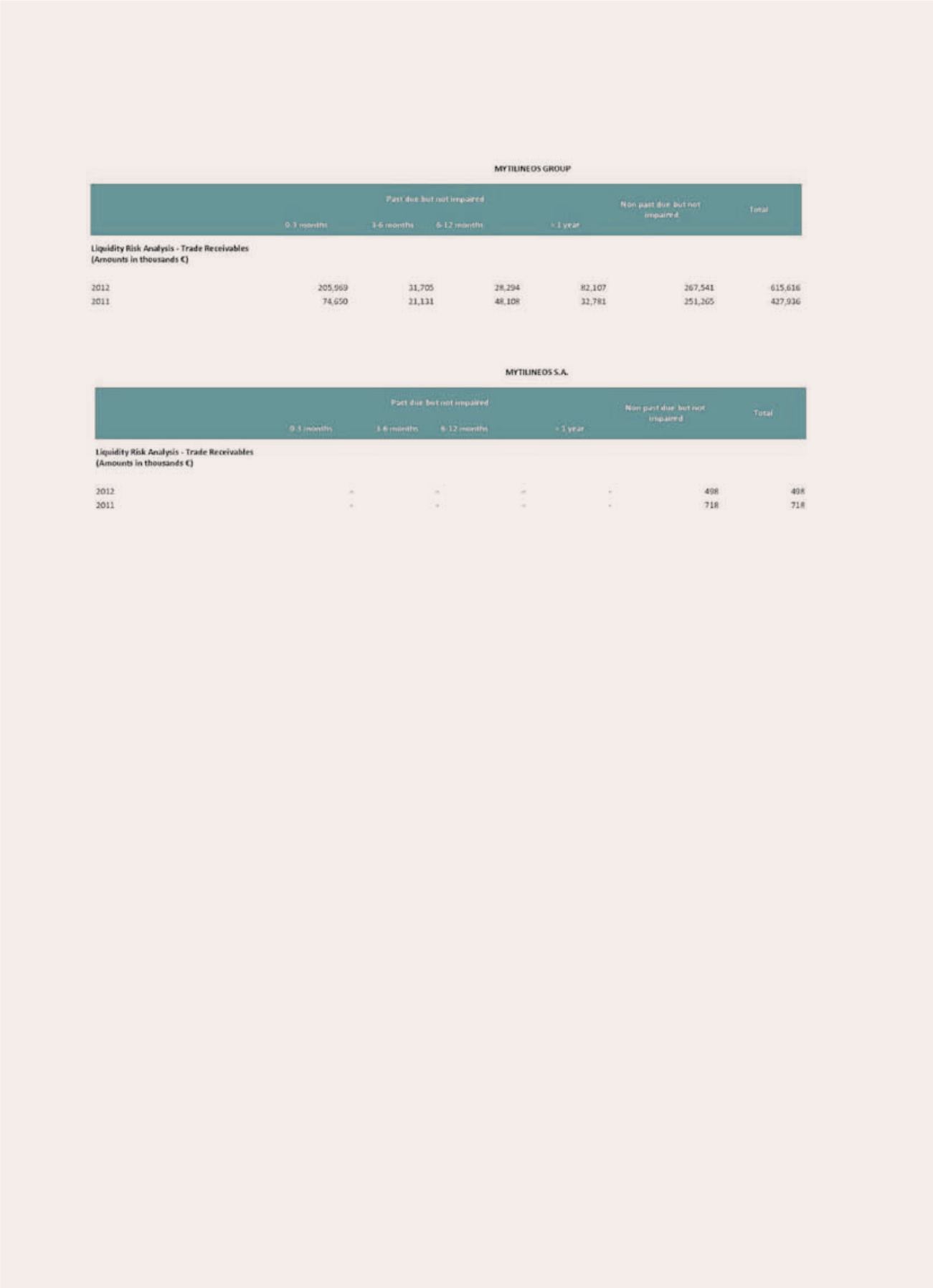

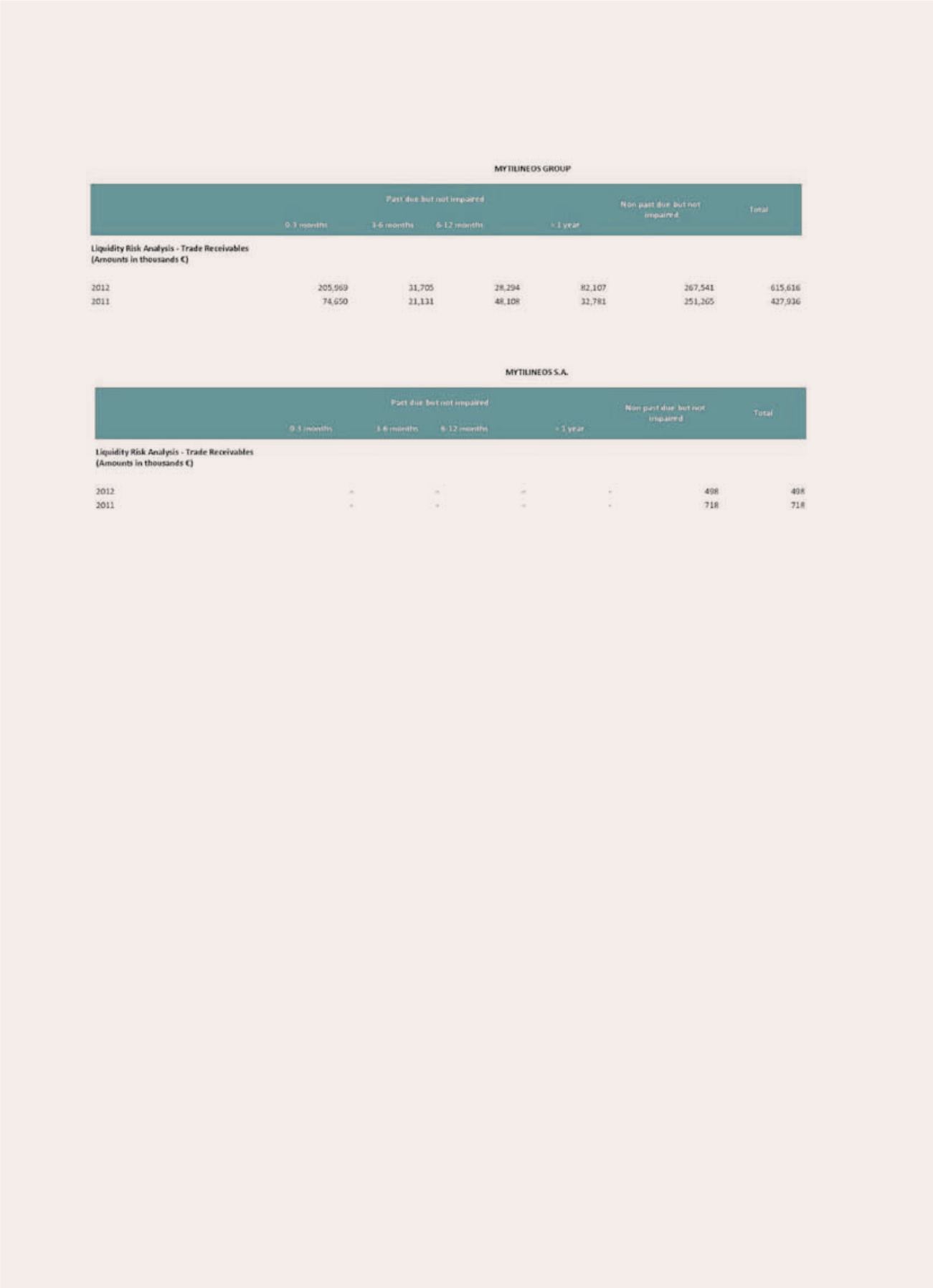

The tables below summarize the maturity profile of the Group’s financial assets as at 31.12.2012 and 31.12.2011

respectively:

Solvency Risk

The solvency risk is linked to the need to sufficiently finance the Group’s activity and growth. The relevant

solvency requirements are the subject of management through the meticulous monitoring of debts of long

term financial liabilities and also of payments made on a daily basis.

On 31/12/2012, the Group exhibits a temporary negative balance between Working Capital and Short-Term

Liabilities amounting to € 361,63 mio. The above mentioned difference is attributed to Loan Liabilities that

mature in the 2013 fiscal year, amounting to € 498 mio, as well as short term loan liabilities amounting to €

255 mio, which are analyzed as follows:

46,5 mio € for installment and €243, mio € for balance of the Bond Debt owned by the parent company, payable

in February and August 2013 respectively; a sum of 172,5 mio € for the Bond Loan of subsidiary Korinthos

Power which is payable in September 2012; a sum of 105,00 mio € for short term loan liabilities by subsidiary

Protergia S.A.; and lastly, a sum of 150,00 mio € for short term loan liabilities of subsidiary Aluminium S.A.

Regarding the above mentioned obligations, the Management notes the following:

Until approval of Financial Statements, the parent company’s Bond Loan installment referring to February

2013, which amounts to the sum of 46,5 mio € has been already cleared by refinancing by the Banks that

participate to the Bond Loan, to a 87% share. Moreover, also in accordance with a relevant letter endorsed by

the Participating Banks, addressed to parent company Management, the latter is in the middle of discussions

on revising the current Bond Loan made by Mytilineos HOLDINGS S.A, and assigning the Banks with the

preparation of issuing new Common Bond Loans by subsidiary Aluminium S.A. and also by subsidiary Protergia

Α.Ε., whose purpose is to refinance the existing long - term lending of the above mentioned companies.

Regarding the above, as particularly noted in the above mentioned letter by the Participating Banks, the terms

that will apply to the Banks intending to prepare the above mentioned loans, are finalized in their main parts,

with reservation for approval by their competent authorizing bodies.