38

Management Department establishes financial derivative and non-derivative instruments with financial

organizations for the account and in the name of the Group’s companies.

At the Group level, such financial instruments are considered to constitute compensation means for the

exchange rate risk of specific assets, liabilities or future commercial transactions.

Interest rate risk

The Group’s assets that are exposed to interest rate fluctuation primarily concern cash and cash equivalents.

The Group’s policy as regards financial assets is to invest its cash in floated interest rates so as to maintain the

necessary liquidity while achieving satisfactory return for its shareholders. In addition, for the totality of its bank

borrowing, the Group uses floating interest rate instruments. Depending on the level of liabilities in floating

interest rate, the Group proceeds to the assessment of interest rate risk and when necessary examines the

necessity to use interest bearing financial derivative instruments. The Group’s policy consists in minimizing its

exposure to interest bearing cash flow risk as regards long-term funding.

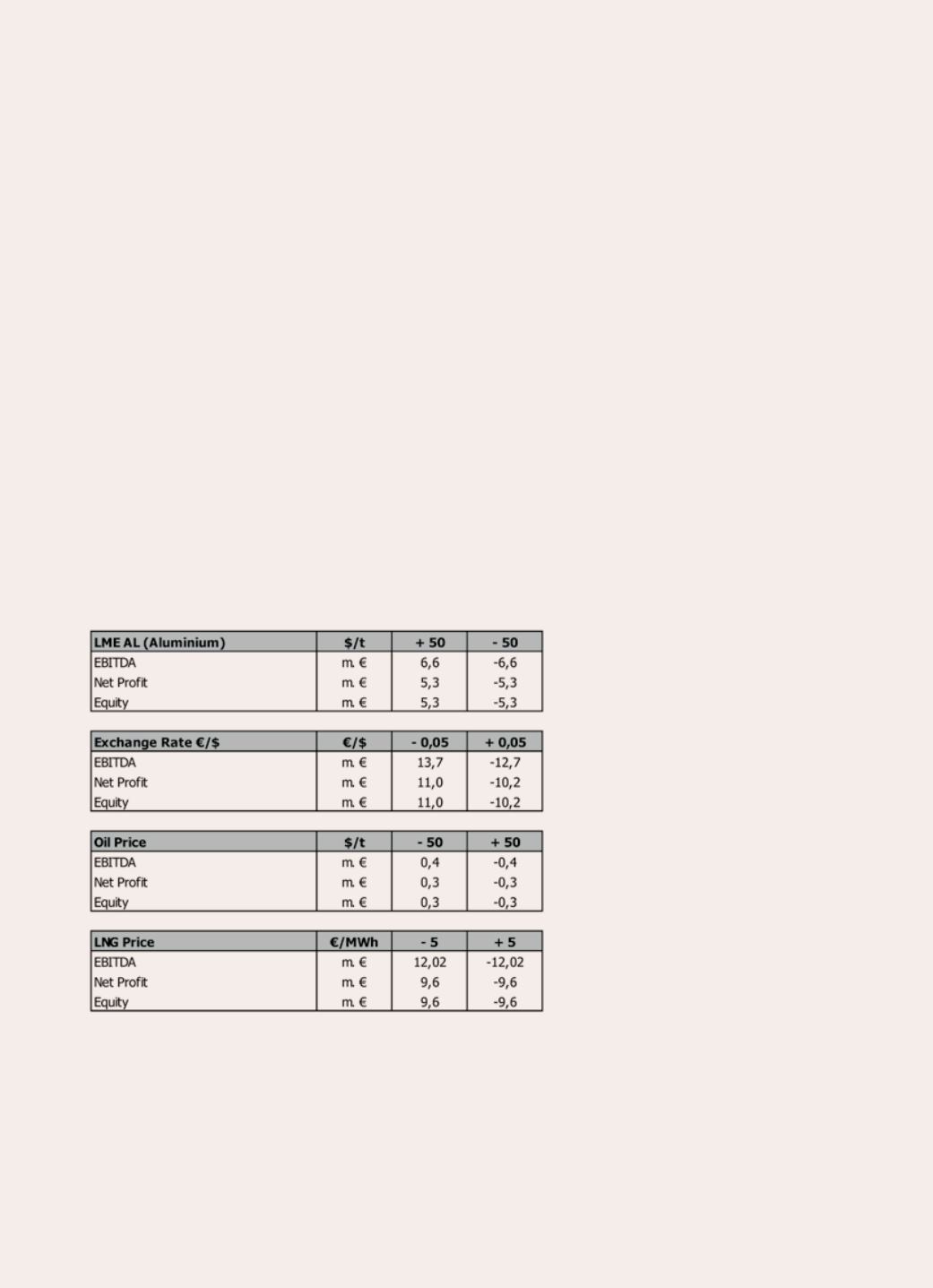

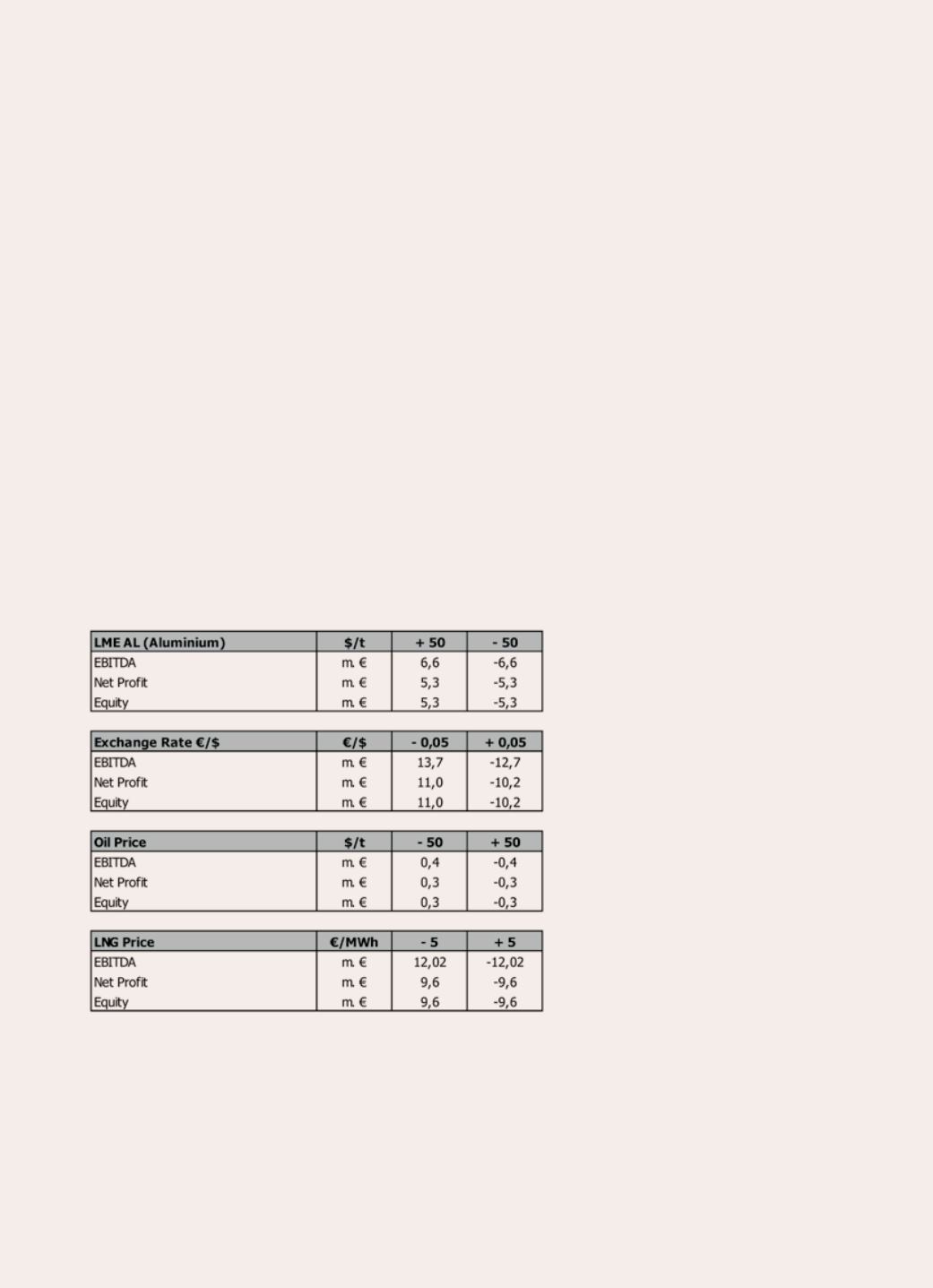

Effect from risk factors and sensitivities analysis

The effect from the above mentioned factors to Group’s operating results, equity and net results presented

in the following table:

It is noted that an increase of five (5) basis points presume a decrease of 4 mil. € on net results and Equity.

The Group’s exposure in price risk and therefore sensitivity may vary according to the transaction volume and

the price level. However the above sensitivity analysis is representative for the Group exposure in 2012.