Annual Financial Report for the period from 1st of January to the 31st of December 2012

37

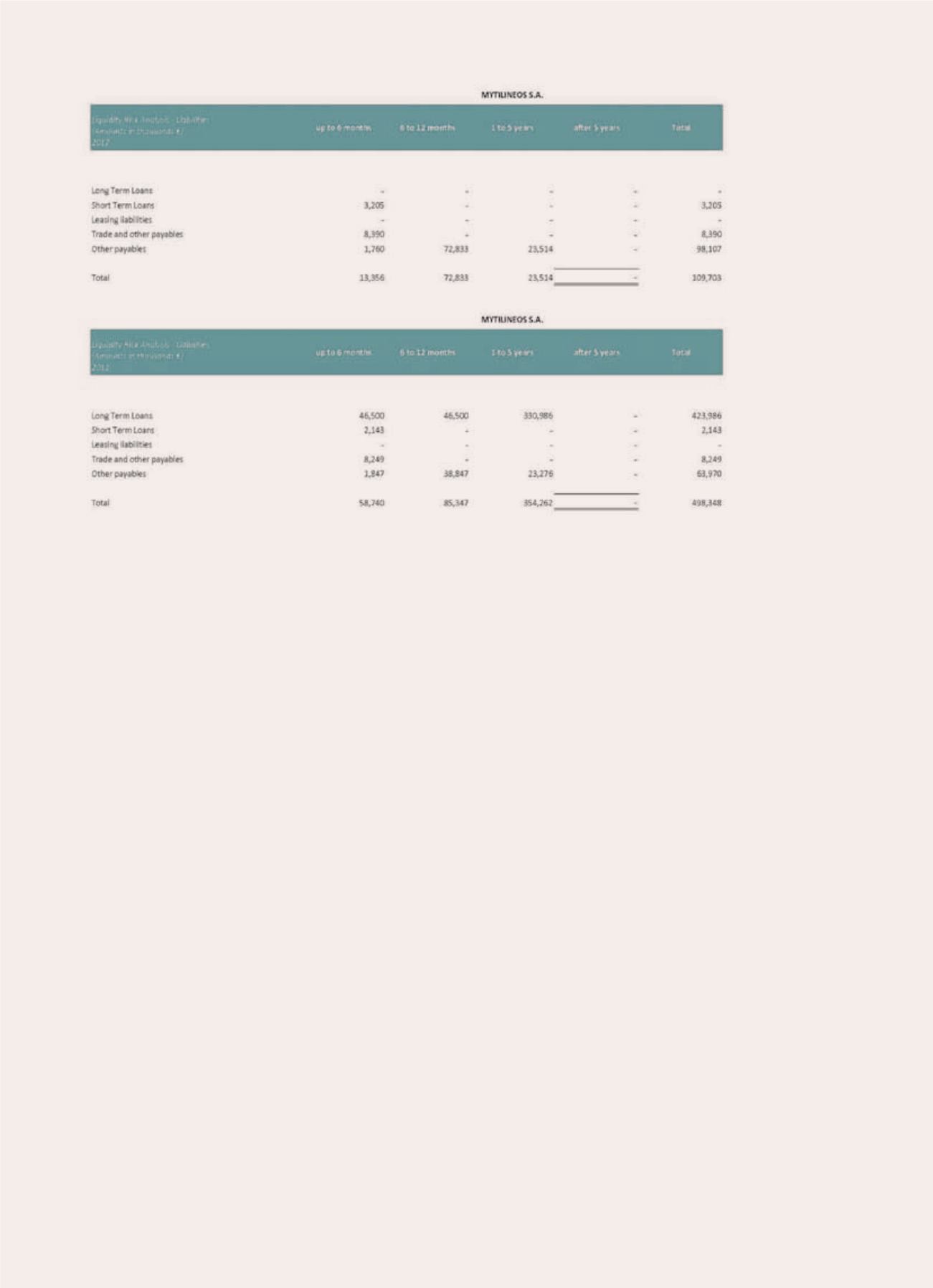

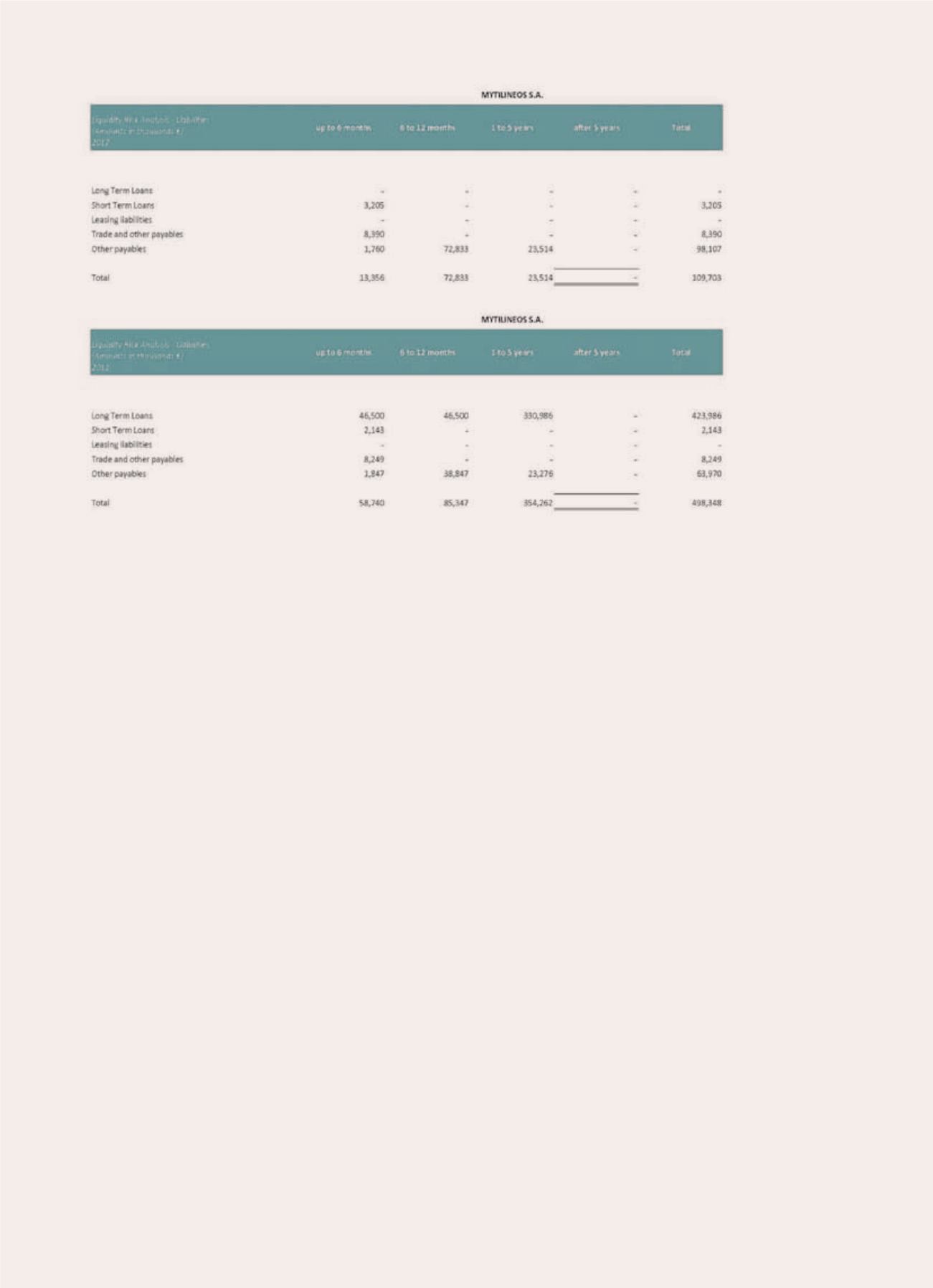

It must be noted that the above table does not include liabilities to clients from the performance of construc-

tion projects, as the maturity of such values cannot be assessed.

Finally, regarding the outstanding litigation between subsidiary Aluminium S.A. and PPC S.A. (ref. note 6.34

of the Financial Statements of the presented fiscal year) and potential consequences to the solvency of the

company and the Group, detailed reference is made in note 3.8 of the Financial Statements of the presented

fiscal year.

Market Risk

Price Risk

Goods prices that are mainly determined by international markets and global offer and demand result in the

Group’s exposure to the relevant prices fluctuation risk.

Goods’ prices are connected both to variables that determine revenues (e.g. metal prices at LME) and to the

cost (e.g. fuel oil prices) of the Group’s companies. Due to its activity, the Group is exposed to price fluctuation

of aluminium (AL), zinc (Zn), lead (Pb) as well as to price fluctuation of fuel oil, as production cost.

As regards price fluctuation of metals, the Group’s policy is to minimize risk by using financial derivative

instruments.

Exchange rate risk

The Group develops activity at international level and is therefore exposed to exchange rate risk that arises

mainly from the US dollar. Such risk primarily stems from commercial transactions in foreign currency as well

as from net investments in foreign financial entities. For the management of such risk, the Group’s Financial