Annual Financial Report for the period from 1st of January to the 31st of December 2012

91

4. Business Risk Management

4.1 Financial Risk Factors

The Group’s activities expose it to a variety of financial risks: market risk (including foreign exchange risk

and price risk), credit risk, liquidity risk, cash flow risk and fair value interest-rate risk. The Group’s overall

risk management program focuses on the unpredictability of commodity and financial markets and seeks to

minimize potential adverse effects on the Group’s financial performance. The Group uses derivative financial

instruments to hedge the exposure to certain financial risks.

Risk management is carried out by a central treasury department (Group Treasury) under policies approved

by the Board of Directors. Group Treasury operates as a cost and service centre and provides services to all

business units within the Group, co-ordinates access to both domestic and international financial markets

and manages the financial risks relating to the Group’s operations. This includes identifying, evaluating and

if necessary, hedging financial risks in close co-operation with the various business units within the Group.

4.2 Financial Instruments

The Group’s financial instruments consist mainly of deposits with banks, bank overdrafts, FX spot and for-

wards, trade accounts receivable and payable, loans to and from subsidiaries, associates, joint ventures, in-

vestments in bonds, dividends payable and lease obligations.

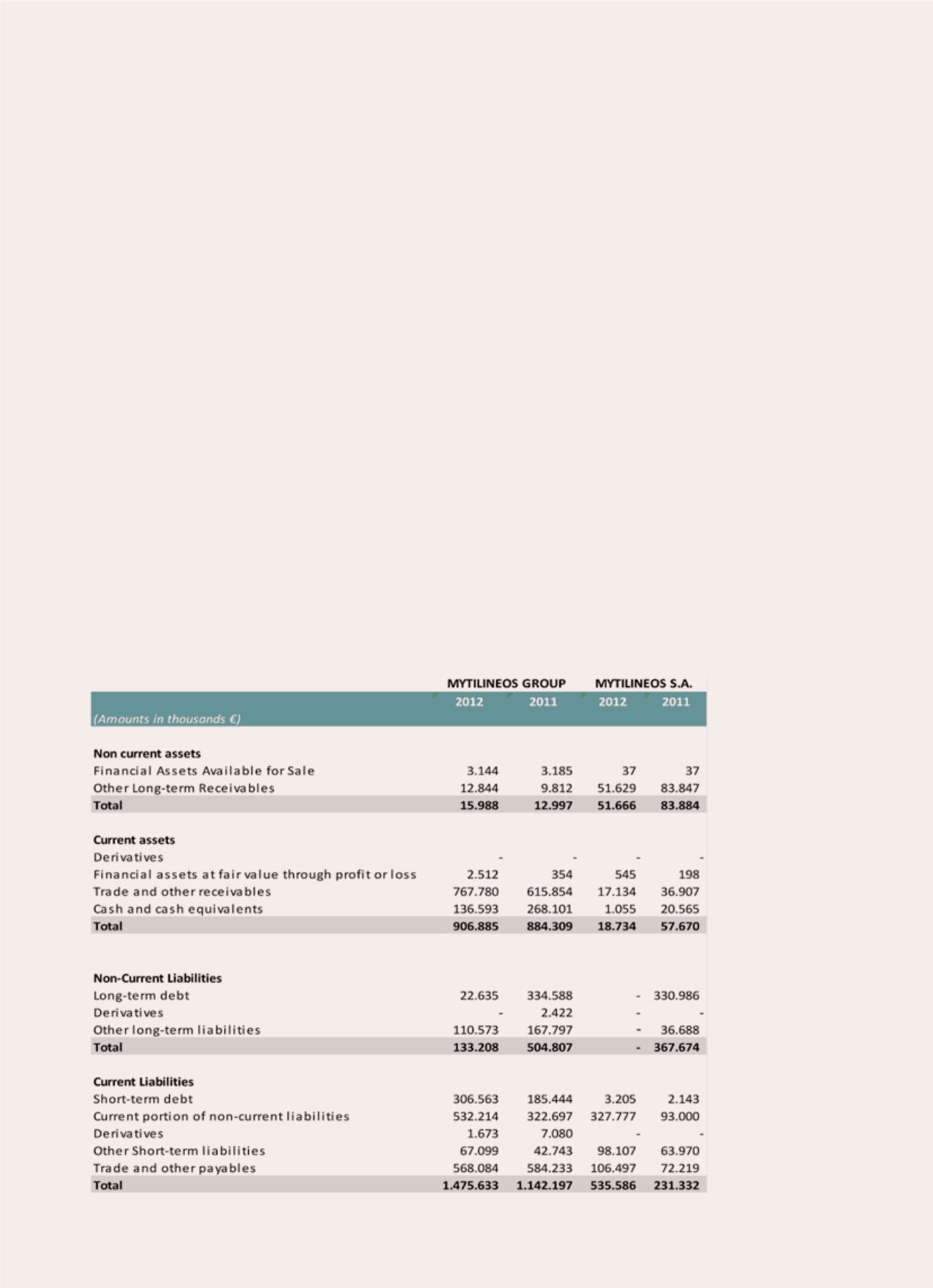

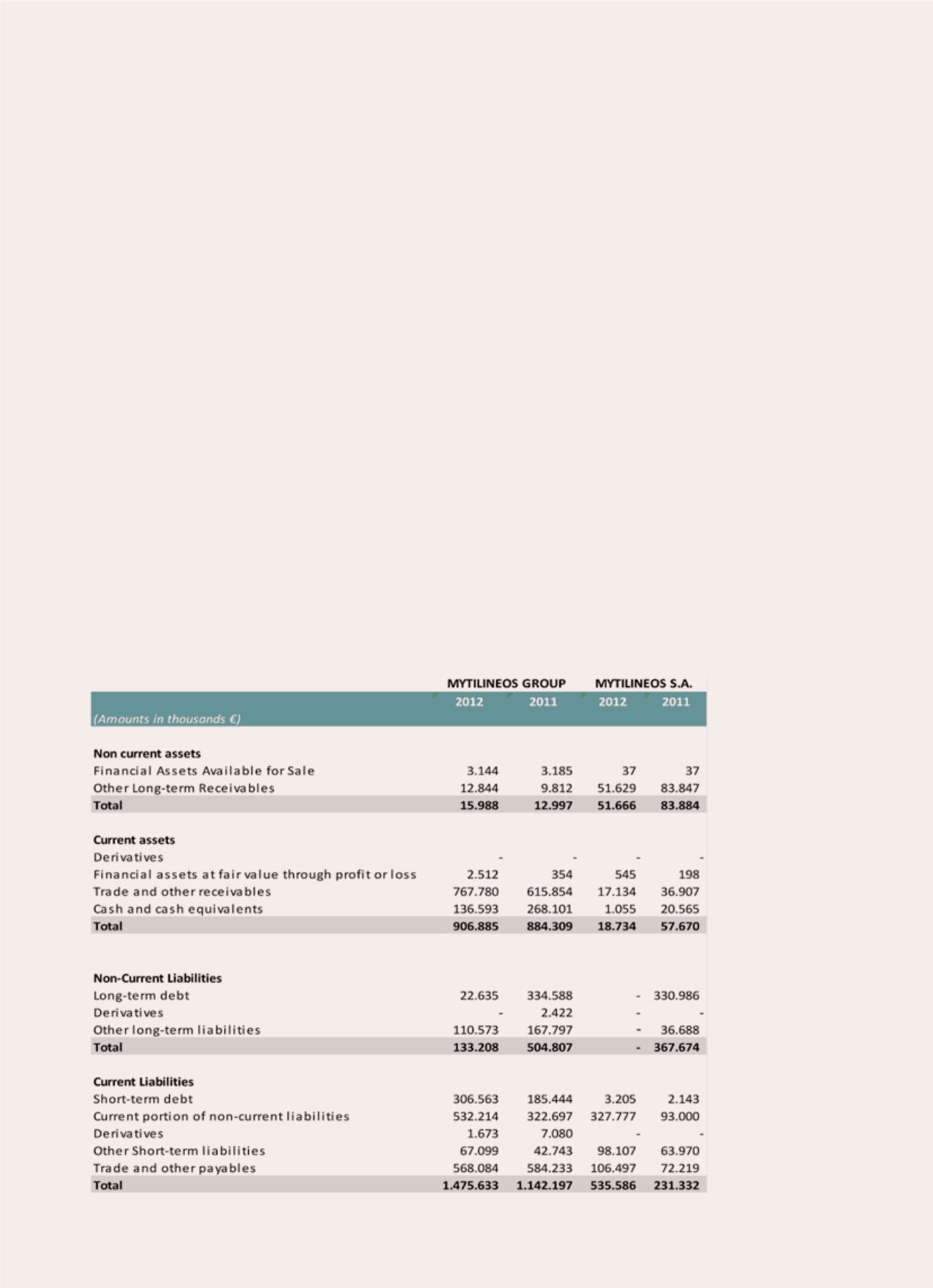

The financial instruments presented in the financial statements are categorized in the tables below: