Annual Financial Report for the period from 1st of January to the 31st of December 2012

93

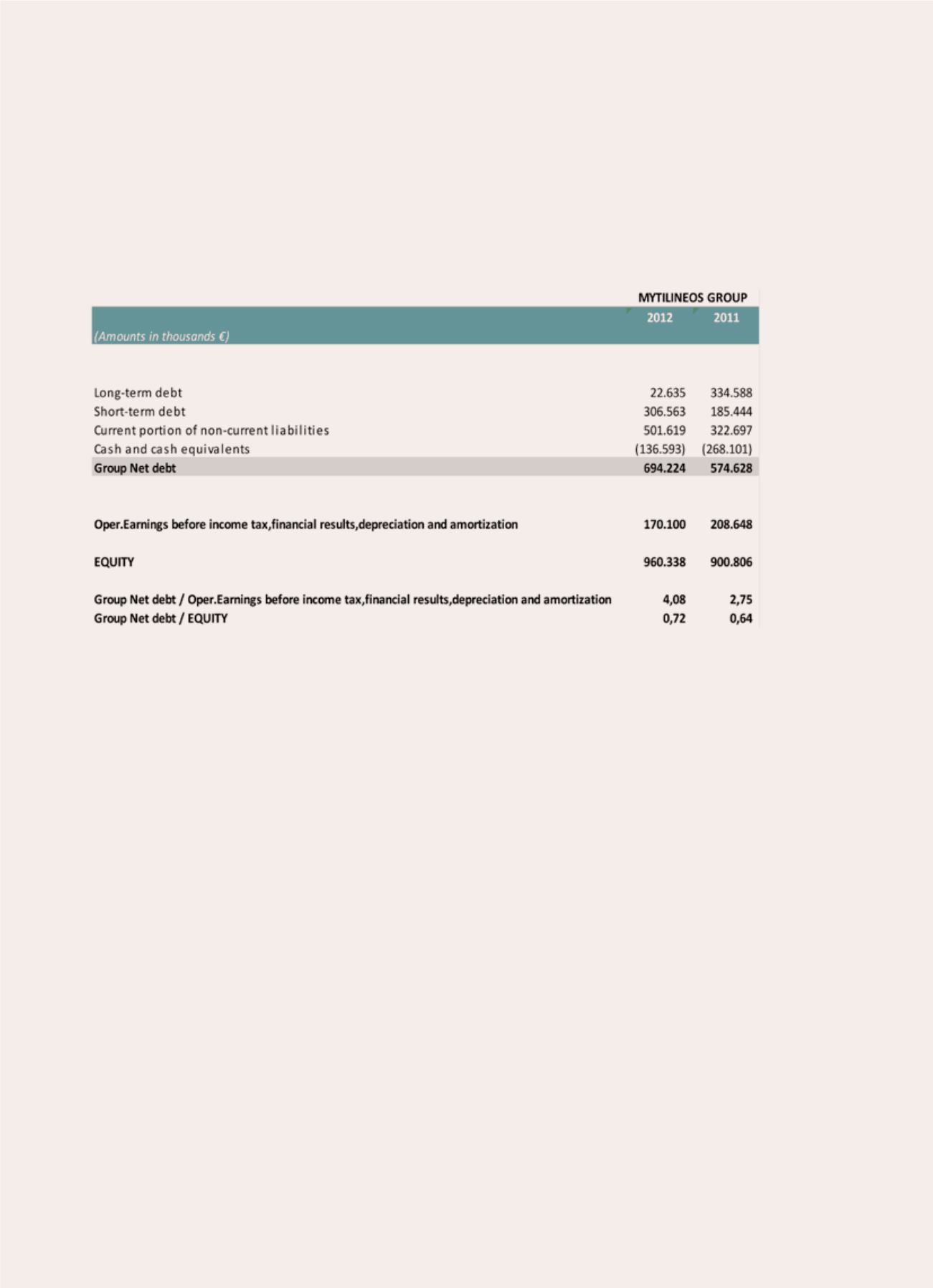

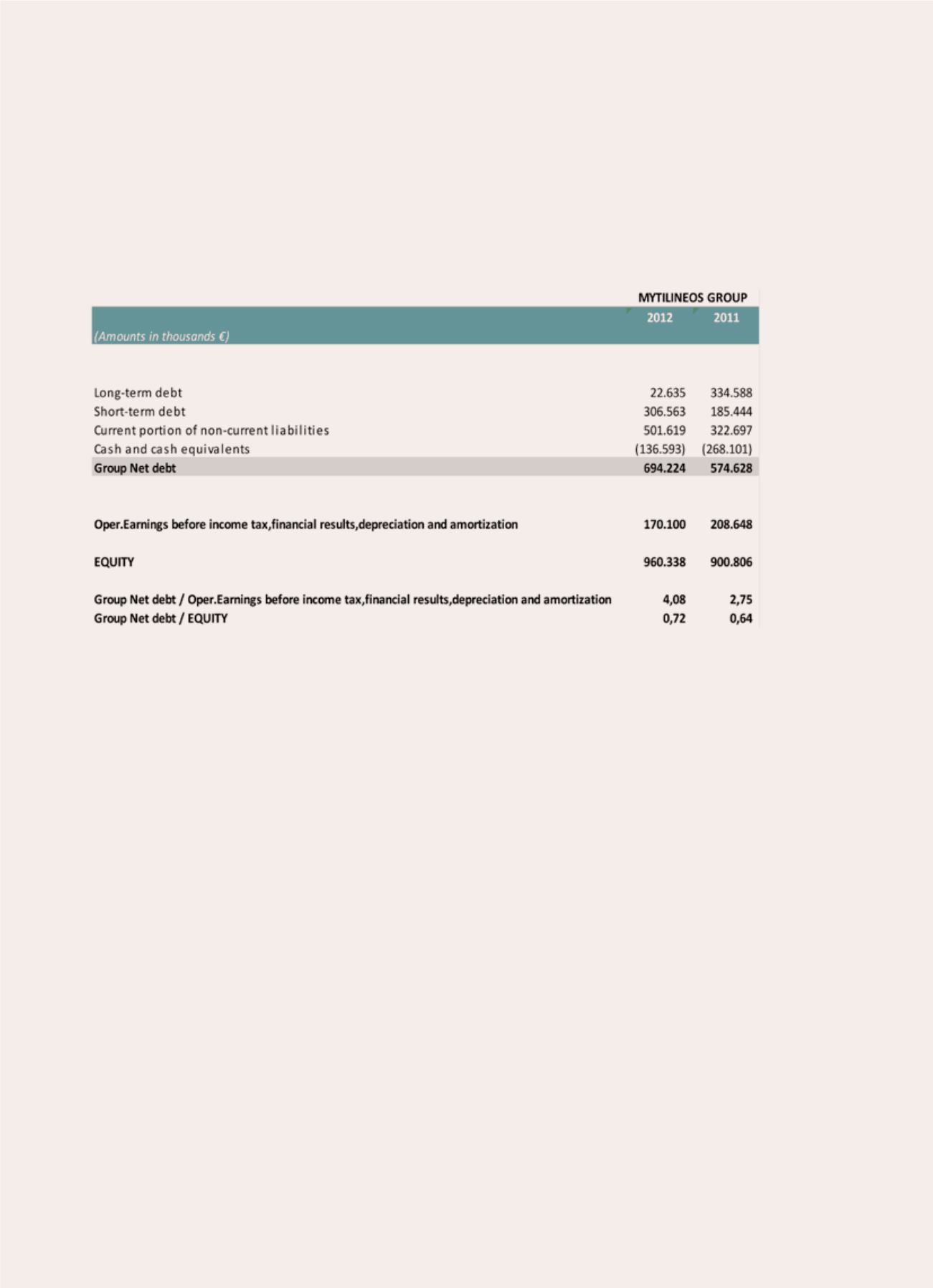

Capital Management:

The primary objective of the Group’s capital management is to ensure the continuous

smooth operation of its business activities and the achievement of its growth plans combined with an acceptable

credit rating. For the purpose of capital management, the Group monitors the ratios “Net Debt to EBITDA”

and “Net Debt to Equity”. As net debt, the Group defines interest bearing borrowings minus cash and cash

equivalents. The ratios are managed in such a way in order to ensure the Group a credit rating compatible with

its strategic growth.

The table bellow presents ratio results for the years December 31, 2012 and 2011 respectively:

The Company does not manage its capital on Company level but only on a Group level.

The Group, because of bank loans, has the obligations as the ratio of net debt to equity is less than one.

4.3 Market Risk

(i) Foreign Exchange Risk

The Group is activated in a global level and consequently is exposed to foreign exchange risk emanating mainly

from the US dollar. This kind of risk mainly results from commercial transactions in foreign currency as well

as net investments in foreign entities. For managing this type of risk, the Group Treasury Department enters

into derivative or non derivative financial instruments with financial institutions on behalf and in the name of

group companies.

In Group level these financial instruments are characterized as exchange rate risk hedges for certain assets,

liabilities or foreseen commercial transactions.

(ii) Price Risk

Group’s interest bearing assets comprises only of cash and cash equivalents. Additionally, the Group maintains

its total bank debt in products of floating interest rate. In respect of its exposure to floating interest payments,

the Group evaluates the respective risks and where deemed necessary considers the use of appropriate inter-

est rate derivatives. The policy of the Group is to minimize interest rate cash flow risk exposures on long-term

financing.