94

(iii) Interest rate risk.

Group’s interest bearing assets comprises only of cash and cash equivalents. Additionally, the Group maintains

its total bank debt in products of floating interest rate. In respect of its exposure to floating interest payments,

the Group evaluates the respective risks and where deemed necessary considers the use of appropriate inter-

est rate derivatives. The policy of the Group is to minimize interest rate cash flow risk exposures on long-term

financing.

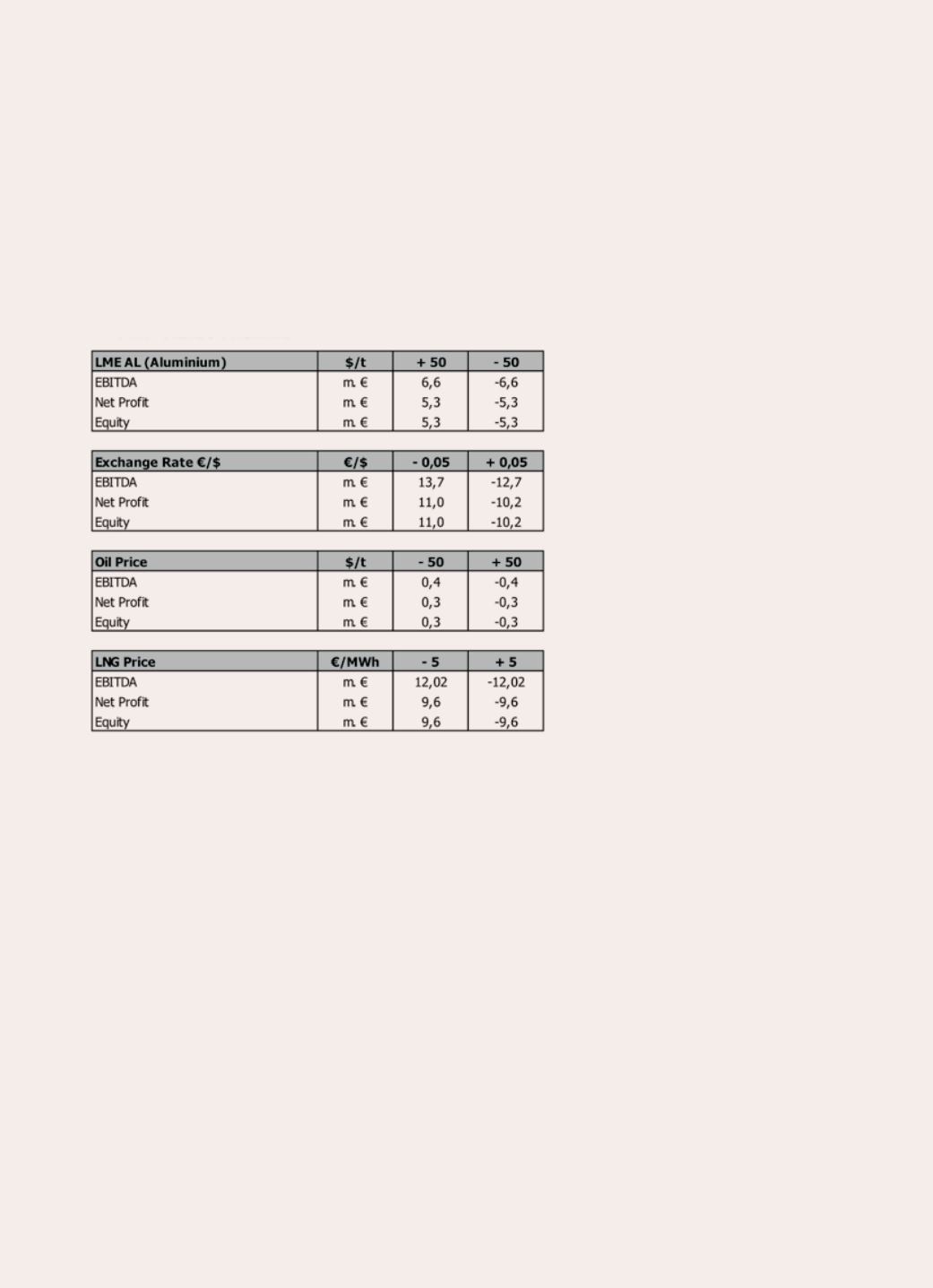

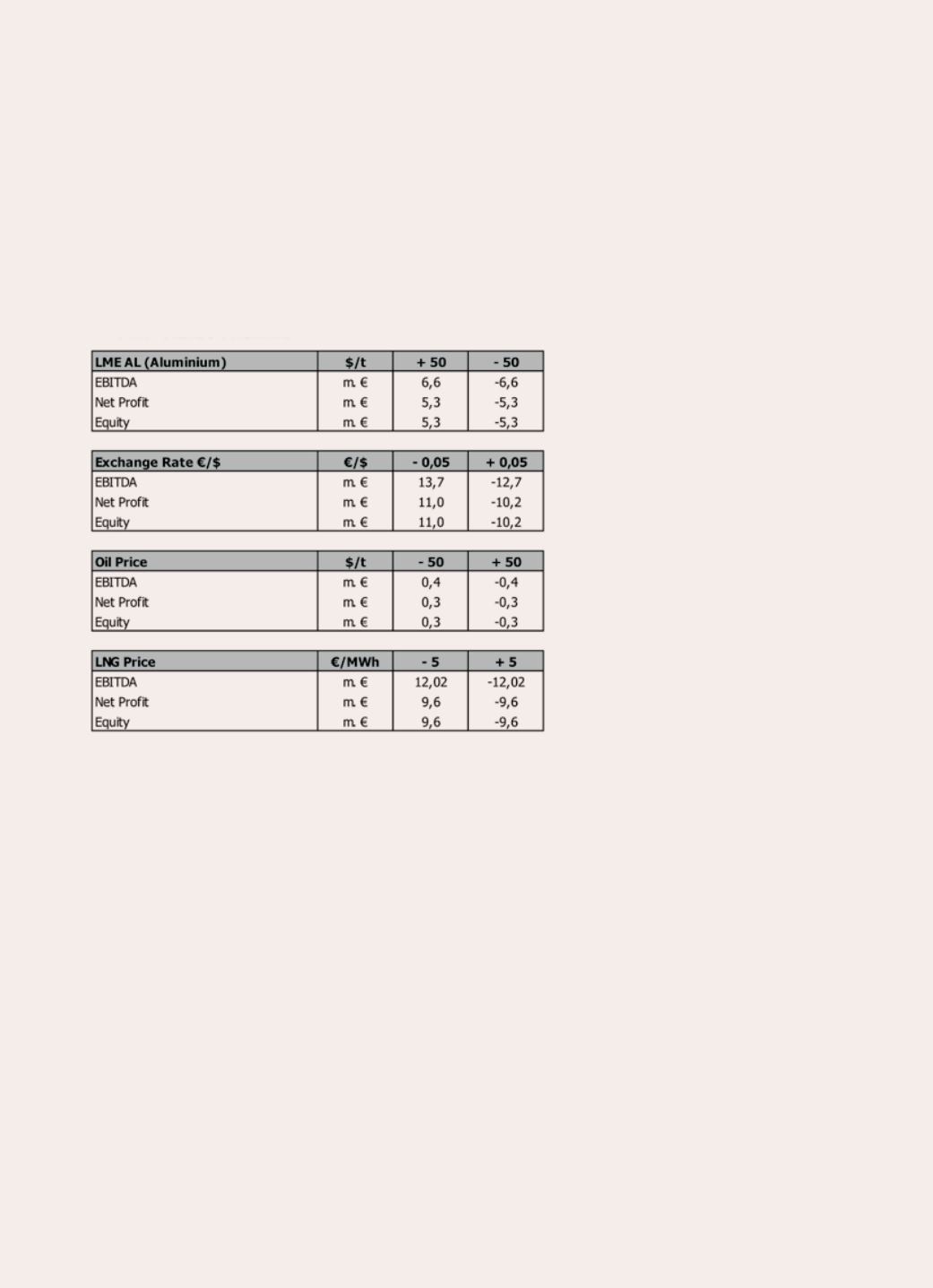

Effects and Sensitivity Analysis

The effects of the above risks at the Group’s operating results, equity, and net profitability are presented in the

table below:

It is noted that an increase of five (5) basis points presume a decrease of 4 mil. € on net results and Equity.

The Group’s exposure in price risk and therefore sensitivity may vary according to the transaction volume and

the price level. However the above sensitivity analysis is representative for the Group exposure in 2012.

4.4 Credit Risk

The Group has no significant concentrations of credit risk with any single counter party. Credit risk arises from

cash and cash equivalents, derivative financial instruments and deposits with banks and financial institutions,

as well as credit exposures to wholesale customers, including outstanding receivables and committed

transactions. Concerning trade accounts receivables, the Group is not exposed to significant credit risks as

they mainly consist of a large, widespread customer base. All Group companies monitor the financial position

of their debtors on an ongoing basis.

The Group also has potential credit risk exposure arising from cash and cash equivalents, investments and

derivative contracts. To minimize this credit risk, the Group operates within an established counterparty policy

approved by the Board of Directors, which limits the amount of credit exposure to any one financial institution.