Annual Financial Report for the period from 1st of January to the 31st of December 2012

95

Also, as regards money market instruments, the Group only deals with well-established financial institutions

of high credit standing.

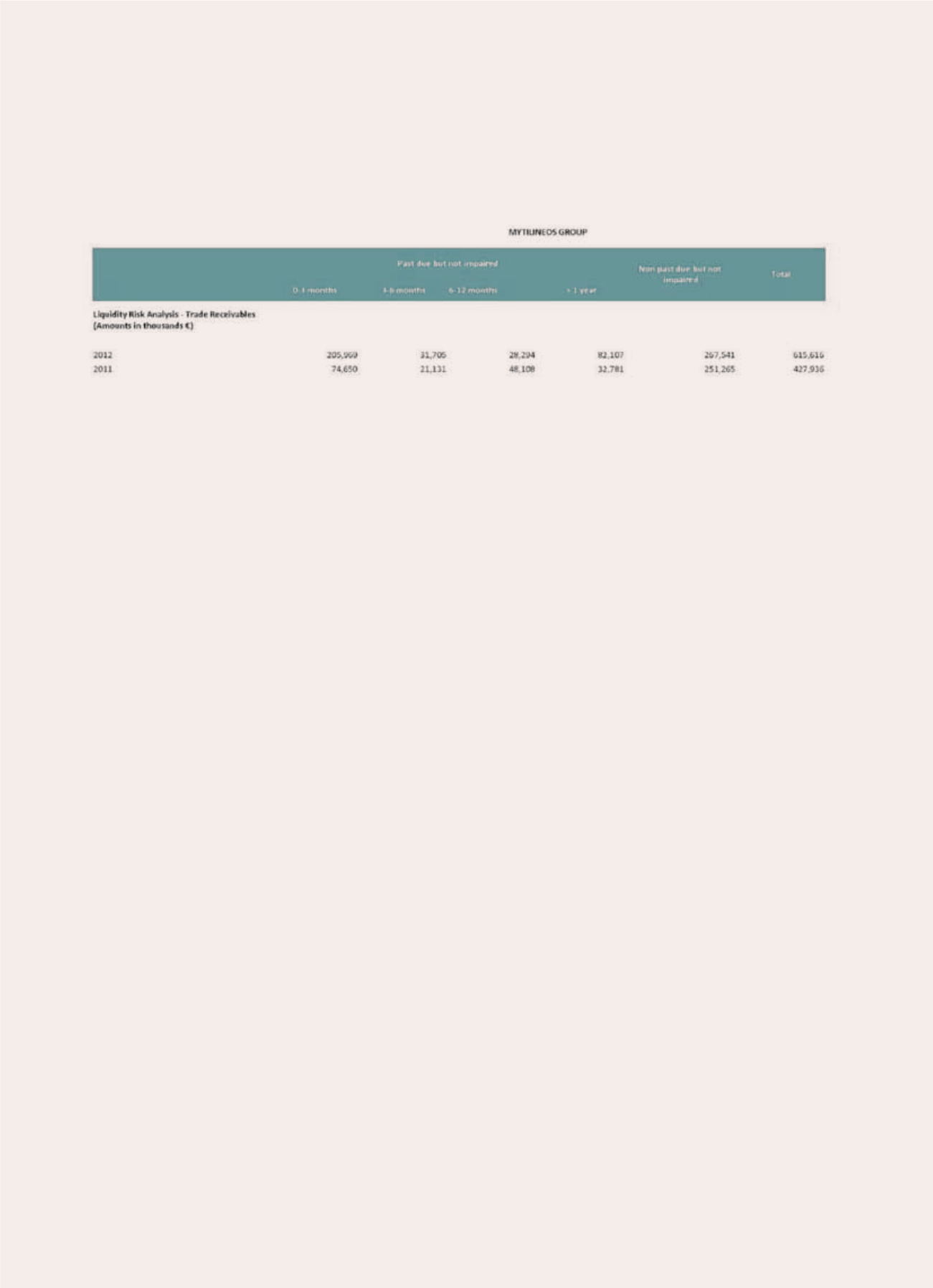

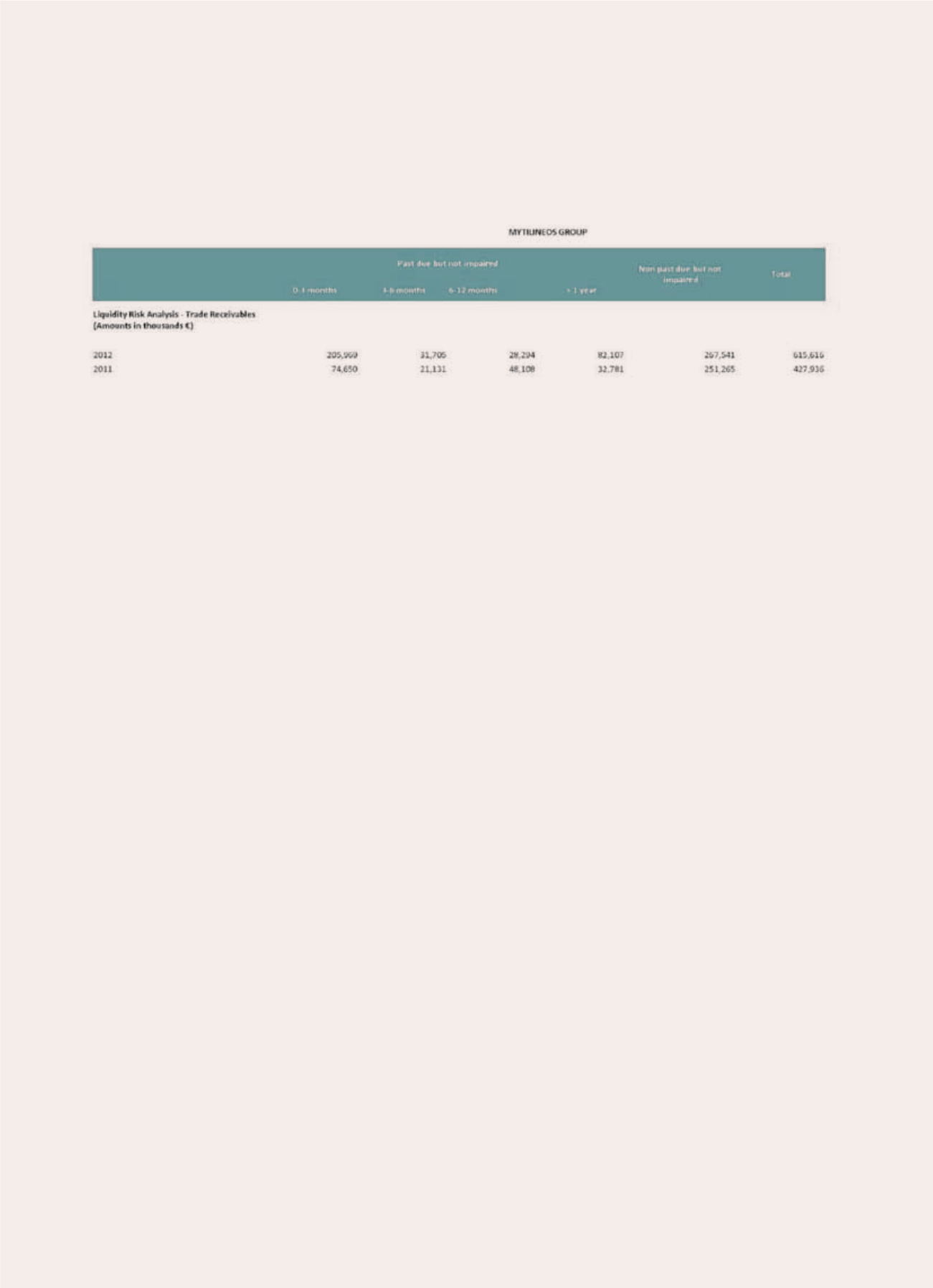

The tables below summarize the maturity profile of the Group’s financial assets as at 31.12.2012 and 31.12.2011

respectively:

4.5 Liquidity Risk

Liquidity risk is related with the Group’s need for the sufficient financing of its operations and development.

The policy of the Group is to minimize interest rate cash flow risk exposures on long-term financing. Liquidity

risk is managed by retaining sufficient cash and immediately liquidated financial assets as well as sufficient

credit lines with Banks and Suppliers in relation to the required financing of operations and investments.

The Group on 31/12/2012 displays a temporary negative difference between current assets and current liabili-

ties amounting to € 361,63 mio. This difference is attributed to loan obligations maturing within the year of

2013 amounting to € 498 mio and short-term loans of € 255mio of which:

•

€46,5 mio€ refer to two equal instalments of the bond loan held by the parent company payable in Febru-

ary and August 2012. •172.5 mio€ refer to the Korinthos Power’s bond loan that is payable in September

2013.

•

105 mio€ refer to short-term loans of subsidiary company PROTERGIA S.A.

•

150 mio€ refer to short-term loans of subsidiary company ALUMINIUM S.A.

Regarding the above requirements the Administration notes that:

Until the approval of the Financial Statements the installment of the Bond Loan of the parent on the February

2013, which amounts to 46.5 million € has been settled up with refinancing of the participating Banks to the

Bond Loan at 87%. Also, according to a letter from the participating Banks to Management of the parent com-

pany, the latter is now in advanced discussions with them on amending the existing Bond Loan of Mytilineos

SA and award the participating Banks issuing new Common Bond Loan from the subsidiary Aluminium SA and

the subsidiary Protergia SA to refinance existing short-term debt of these companies.

Related to the above, as mentioned to the aforementioned letter from the participating Banks, the conditions

under which Banks intend to undertake the organization of above Loans have been discriminated, subject to

be approved by the relevant approval body.

Regarding the Bond Loan of subsidiary Korinthos Power, the company is in advanced discussions with banks

to refinance 100% of the loan, through award of a new long-term financing as typically refers to a letter which

is co-signing by the Participating Bank. According to this letter, the conditions under which banks intend to

undertake the refinancing of these loans have been discriminated in substantial part, subject to be approved

by the appropriate approval body.