92

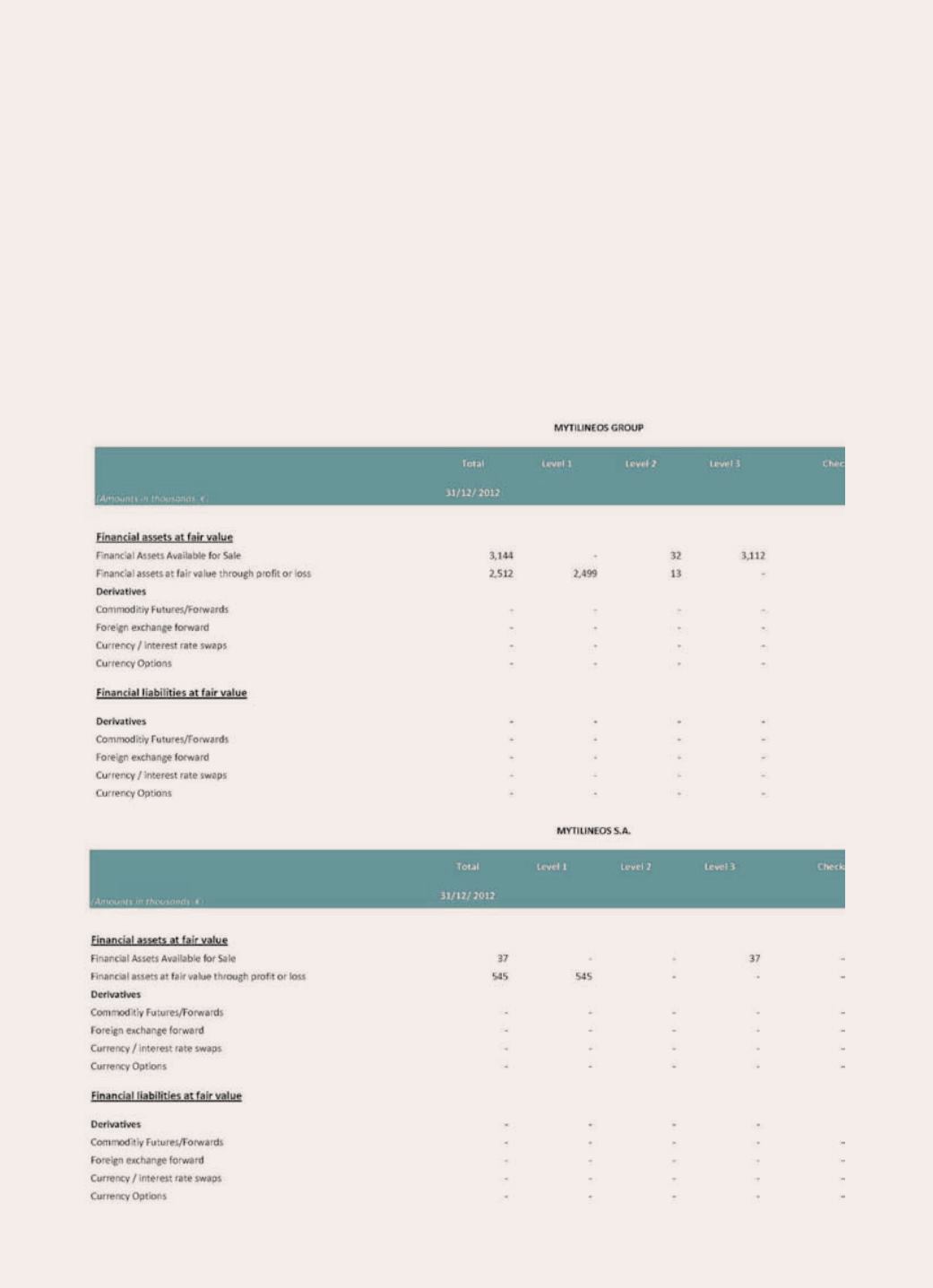

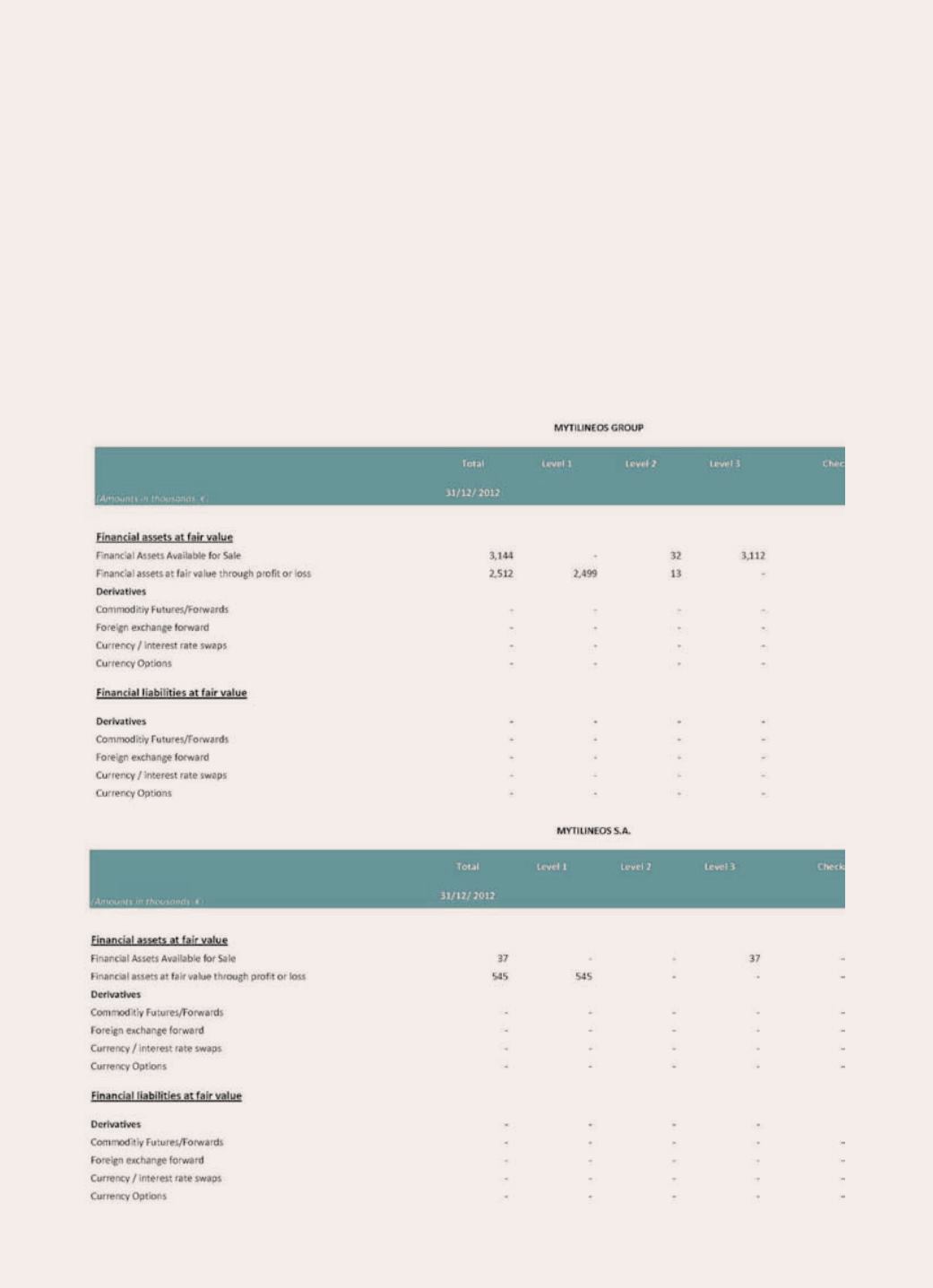

The following table presents financial assets and liabilities measured at fair value in the statement of financial

position in accordance with the fair value hierarchy. This hierarchy groups financial assets and liabilities into

three levels based on the significance of inputs used in measuring the fair value of the financial assets and li-

abilities. The fair value hierarchy has the following levels:

• Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

• Level 2: inputs other than quoted prices included within Level 1 that are observable for the asset or liability,

either directly (i.e. as prices) or indirectly (i.e. derived from prices); and

• Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The level within which the financial asset or liability is classified is determined based on the lowest level of

significant input to the fair value measurement.

The financial assets and liabilities measured at fair value in the statement of financial position are grouped into

the fair value hierarchy as follows: